简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD Dips, EUR/USD Eyes Italian Politics, AUD/USD Bounces on RBA - US Market Open

Abstract:GBP/USD Dips, EUR/USD Eyes Italian Politics, AUD/USD Bounces on RBA - US Market Open

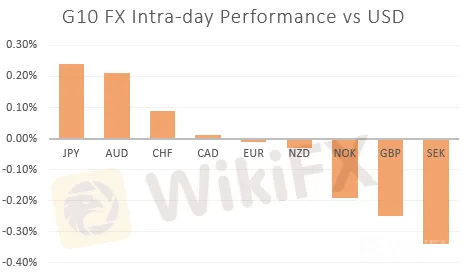

MARKET DEVELOPMENT – GBP/USD Dips, EUR/USD Eyes Italy, AUD/USD Bounces on RBA

DailyFX 2019 FX Trading Forecasts

GBP: A lack of compromise between the UK and the EU provides another reminder that corrective moves higher in the Pound will be faded. The Pound dipped below 1.21 against the greenback as UK PM Johnsons letter demanding the reopenining of the withdrawal agreement had been rebuffed by the EU, in which they stated that Boris Johnson had not provided a viable proposal in regard to an alternative to the Irish backstop.

EUR: Italian politics will take center stage for the Euro with Prime Minister Conte set to face a no-confidence after he addresses the Senate from 1400BST.If PM Conte loses the no-confidence or resigns before the vote takes place, President Matttarella will have two options. Either gather party leaders in order to form a technocratic government with the sole purpose of passing the 2020 budget (due October 15th) or call for snap elections, which could take place as soon as the Autumn (most bearish scenario). (Full analysis)

AUD: Latest RBA meeting minutes offered a slightly more balanced approach with rate setters stating that developments in regard to the domestic and global economy would need to be assessed before mulling further easing. Consequently, the Australian Dollar is slightly firmer with expecations of near-term easing receeding. As it stands, money markets attach an 88% likelihood that interest rates will be left on hold at 1% at the September meeting.

Source: DailyFX

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Gold Price and Silver Outlook Remains Constructive So Far” by Paul Robinson, Currency Strategist

“GBPUSD Price Outlook Fragile as Boris Johnson Heads to Europe” by Nick Cawley, Market Analyst

“EUR/CHF Outlook: SNB Steps up Currency Intervention” by Justin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GemForex - weekly analysis

The Week Ahead: Will the FED pivot to the emerging dynamics?

GemForex - weekly analysis

European Central Bank under enormous pressure ahead of Fed rates

GemForex - EUR/USD

EURUSD Forecast: Vulnerability ahead of fresh EZ economic data, FOMC

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator