简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

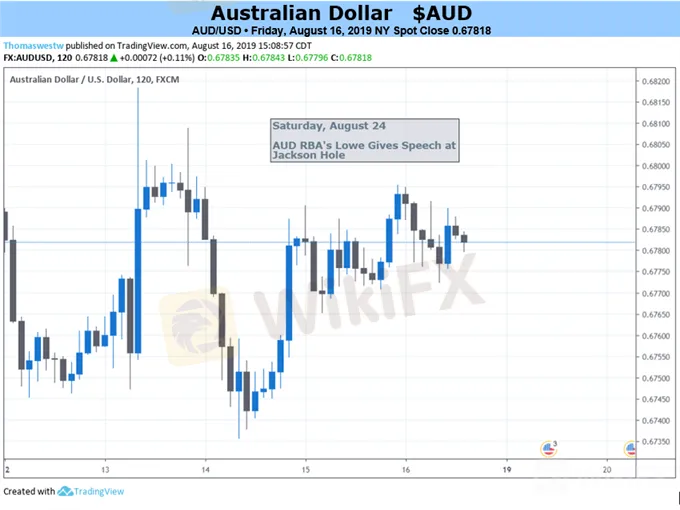

Australian Dollar Bears Rule But May Not Turn Up Heat This Week

Abstract:The Australian Dollar remains close to notable lows against its US counterpart and the market is still betting on aggressive rate cuts from the RBA

Fundamental Australian Dollar Forecast: Neutral

AUDUSD remains close to 11-year lows

Two further interest rate cuts are now fully priced

Still, the market may lack cause to hammer the Aussie much harder in the week ahead

Find out what retail foreign exchange traders make of the Australian Dollars prospects right now, in real time, at the DailyFX Sentiment Page

The Australian Dollar remains close to this months eleven-year lows against its US cousin with overall global risk appetite continuing to drive sentiment towards this most pro-cyclical currency.

Strong Labor Numbers Havent Changed Interest Rate Forecasts

On the domestic front, it was clear that Australias extraordinary job-creation record remained unblemished. Julys official labor-market figures made a mockery of forecasters with 41,00 new jobs on the books rather than the 14,000 expected. There was a solid rise in full-time employment to boot.

However, it is notable that those strong labor numbers did absolutely nothing to market expectations that the record-low 1% Official Cash Rate will slide to just 0.5% by the start of next year. That was the futures curves position before the data, it remained so after.

That surprise half-point rate cut from the Reserve Bank of New Zealand this month has seen a solid re-pricing lower of OCR expectations that it is clearly going to take a lot to shift.

No such shift is likely this week, which is a quiet one for economic data. Central bank meeting minutes are due from both the RBA and the US Federal Reserve, but they are unlikely to alter the overwhelming view that rates are headed down in both countries. Australian Purchasing Managers Index figures are coming up too. They‘ll attract plenty of investor attention but, again, won’t change the backdrop.

Keep an Eye on Jackson Hole

The Australian Dollar will be left as usual then to the ebb and flow of the risk trade. The risk trade in turn will depend on hard-to-predict headline news. There will also no doubt be plenty of focus on the Kansas City Fed‘s annual Jackson Hole central bankers’ fest. That kicks off on Thursday with RBA Governor Philip Lowe saving his speech until Saturday.

In short then it‘s hard to get bullish about an Australian Dollar so bereft of domestic monetary policy support, but the risk trade could yet lend it some support for as long as there are clear signs that Beijing and Washington intend to keep talking on trade. Therefore, it’s a neutral call this week.

Resources for Traders

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RBA and BoE Take Center Stage Amidst U.S. Light Week

During the March meeting, Australia's central bank kept its interest rates steady at 4.35% and adopted a more relaxed approach towards tightening, suggesting growing confidence in inflation reaching its target despite economic deceleration. During the last meeting, the Bank of England maintained its interest rate at 5.25%. Governor Andrew Bailey emphasized the importance of ensuring that inflation returns to the 2% target and remains there, stating that the current situation does not warrant

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

AUD/USD Clings to Support After Chinese CPI and PPI Surge Higher

AUSTRALIAN DOLLAR, AUD/USD, CHINESE INFLATION – TALKING POINTS

AUD/JPY snaps five-day uptrend above 81.00 as covid woes renew in Australia

● AUD/JPY bounces off intraday low but prints daily loss for the first time in six days. ● NSW refreshes highest covid infections since March 2020, Victoria ends lockdown. ● Bears also cheer US Senators’ jostling over President Joe Biden’s infrastructure spending proposal, cautious mood ahead of the key data/events. ● BOJ’s Kuroda, RBA’s Debelle and risk catalysts will be crucial for fresh impulse.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator