简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/MXN: Peso Eyes Mexico Central Bank Interest Rate Decision

Abstract:The Mexican Peso is at risk with the country's central bank slated to release its latest monetary policy update which could reveal an interest rate cut. Where might USDMXN head next?

USDMXN, MEXICAN PESO, BANXICO RATE DECISION

USDMXN overnight implied volatility spikes to a multi-month high ahead of the interest rate decision from Banco de Mexico

The Mexican Peso could extend its downside against the US Dollar if Mexicos central bank cuts interest rates

Check out this free educational guide on Forex Trading for Beginners

Spot USDMXN has soared well over 3% so far this month with the Mexican Peso – alongside other Emerging Market currencies – sinking in response to widespread risk aversion recently exhibited by market participants.

In fact, we highlighted our bullish outlook on spot USDMXN citing a series of sharp downward revisions to Mexico GDP forecasts amid rising political uncertainty with the abrupt resignation of Mexico‘s Minister of Finance. Now, forex traders will shift attention to Banco de Mexico (Banxico) – Mexico’s central bank – for its latest monetary policy update slated for release Thursday at 18:00 GMT.

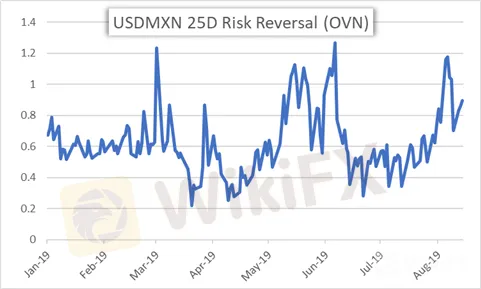

USDMXN RISK REVERSAL SUGGESTS UPSIDE BIAS AHEAD OF BANXICO RATE REVIEW

According to Bloomberg‘s survey of economists, less than half of the 23 respondents are expecting Banxico to cut its key overnight interest rate from the current 8.25% level. Although, President Andres Manuel Lopez Obrador (AMLO) has recently stated that the country’s interest rates are too high for Mexicos slowing economy and would like to see Banxico cut rates to boost growth.

If Mexico‘s central bank shocks markets with a surprise rate cut, it will be the first time Banco de Mexico lowers interest rates since June 2014. Currency option traders are positioning ahead of Banxico’s rate decision with a bullish bias on spot USDMXN judging by the latest 25-delta overnight risk reversal data which was last clocked at 0.895.

USDMXN PRICE CHART: DAILY TIME FRAME (JANUARY 2019 TO AUGUST 2019)

USDMXN has already begun to stage a bullish breakout above its downtrend line extended from the December 2018 and June 2019 swing highs. Yet, spot USDMXN has struggled to reclaim the 19.800 price level with hopes that legislators will soon approve the USMCA trade deal which has largely kept the Mexican Peso afloat. That said, USDMXN overnight implied volatility of 14.31% can be used to calculate its estimated 1-standard deviation trading range of 19.509-19.804 which, statistically speaking, encompasses spot price action with a 68% probability.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator