简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Eye Monthly-High as US Delays China Tariffs

Abstract:The price of oil extends the rebound from the monthly-low ($50.52) as the US delays the next tranche of China tariffs to December 15.

Oil Price Talking Points

The price of oil extends the rebound from the monthly-low ($50.52) as the US delays a portion of the next tranche of China tariffs to December 15, and recent price action raises the risk for a larger correction as crude extends the series of higher highs and lows from earlier this week.

Crude Oil Prices Eye Monthly-High as US Delays China Tariffs

Crude prices may continue to catch a bid as China pledge to hold talks with US representatives in two weeks, and fresh details of an imminent trade agreement should keep oil afloat as it instills an improved outlook for consumption.

It remains to be seen if a resolution will be reached ahead of the new deadline as the Peoples Bank of China (PBOC) weakens the Yuan reference rate, and Chinese officials may take additional steps to insulate the economy as the 2Q Gross Domestic Product (GDP) report shows the growth rate slipping to a fresh record low of 6.2%.

At the same time, the US may continue to adjust its trade policy as President Donald Trump tweets that “the tens of billions of dollars that the U.S. is receiving is a gift from China,” and little indications of a looming trade deal may continue to drag on oil prices amid the weakening outlook for global growth.

In turn, the Organization of the Petroleum Exporting Countries (OPEC) and its allies may take additional steps to balance the energy market, and the group may curb production throughout 2019 in response to the pickup in US output.

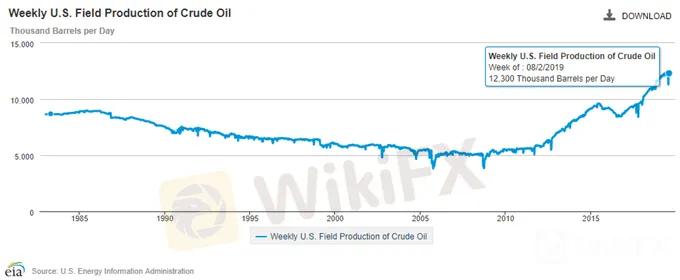

The latest update from the US Energy Information Administration (EIA) showed crude inventories unexpectedly increasing for the first time in eight weeks, with stockpiles climbing 2385K in the week ending August 2, while oil production increased to 12,300K from 12,200K during the same period.

The rise in US crude output may become a growing concern for OPEC and its allies, but the group appears to be in no rush to announce additional measures to balance the energy market as the most recent Monthly Oil Market Report (MOMR) states that “in 2019, the global oil demand growth forecast remains at 1.14mb/d, with expectations for global oil demand to reach 99.87 mb/d.”

With that said, OPEC and its allies may stick to the status quo ahead of the next meeting on December 5, but the lack of response may continue to drag on crude prices amid the lingering threat of a US-China trade war.

As a result, oil prices remain at risk of facing a bear market especially as a ‘death-cross’ formation takes shape in July.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups.

Crude Oil Daily Chart

Keep in mind, the broader outlook for crude oil is no longer constructive as both price and the Relative Strength Index (RSI) snap the bullish trends from earlier this year.

At the same time, a ‘death cross’ formation has taken shape in July as the 50-Day SMA ($55.97) crosses below the 200-Day SMA ($56.53), with both moving averages tracking a negative slope.

However, the price of oil appears to be making a run at the August-high ($57.99) following the failed attempt to test the Fibonacci overlap around $48.80 (38.2% expansion) to $49.80 (78.6% retracement), with a break of the monthly opening range raising the risk for a move towards $59.00 (61.8% retracement) to $59.70 (50% retracement).

Nevertheless, failure to test the August-high ($57.99) may bring the downside targets back on the radar as the RSI continues to track the bearish formation from earlier this year, with the first area of interest coming in around $54.90 (61.8% expansion) to $55.60 (61.8% retracement) followed by the $51.40 (50% retracement) to $51.80 (50% expansion) region.

For more in-depth analysis, check out the 3Q 2019 Forecast for Oil

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

Crude Oil Prices Stuck in Monthly Range Despite Waning US Inventories

The price of oil may continue to track the monthly range amid the string of failed attempts to test the August-high ($57.99).

WikiFX Broker

Latest News

Trading is an Endless Journey

Japan to Take Action to Stabilize the Yen

Ringgit Remains Flat Amid Holidays, US Debt Concerns Loom

Taurex: Is it Safe to Invest?

Malaysia’s Securities Commission Enforces Ban on Bybit & Its CEO

New Zealand's FMA Warns Against "YouTube Crypto Investment Scam"

The WikiFX 2024 Annual User Report is here! Come and claim your exclusive identity!

Will Inflation Slow Down in the New Year 2025?

SCAM ON SCAM: New Tactic Used by Scammers

Crypto Fraud: MBBS Student Linked to Rs.8 Lakh Scam

Currency Calculator