简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Canadian Dollar Price at Risk as Crude Oil Sinks Amidst Trade Wars

Abstract:The USD/CAD eyes resistance breakout as uncertainties over global growth amidst trade wars undermine crude oil prices. Sentiment warns of a bearish NZD/USD bias ahead of the RBNZ.

Asia Pacific Market Open Talking Points

Canadian Dollar sinks with crude oil prices on global demand concerns

USD/CAD on the edge of resistance breakout, eyeing uptrend resumption

NZD/USD IG Client Sentiment warns of bearish bias ahead of the RBNZ

Not sure where Crude Oil is heading next? Check out the third quarter fundamental and technical forecast!

Canadian Dollar Sinks with Crude Oil Prices

The Canadian Dollarunderperformed against its major counterparts over the past 24 hours, sinking alongside sentiment-linked crude oil prices. While Wall Street aimed cautiously higher, reflecting ebbing concerns over US-China trade tensions, uncertainties over the future of demand for oil may have played a part in Tuesdays selloff given the fragile environment for global growth.

The optimism in financial markets appeared to be a result of China taking measures to quell a selloff in the Yuan so that USD/CNY stays under the key 7.00 level. This may avoid further accusations of currency manipulation from the White House and the uptick in sentiment took its toll on the Japanese Yen. However, slowing world GDP is a more medium-term consequence as a result of prolonged trade wars.

Concerns over the future of demand for oil saw energy sector shares underperform in European and North American benchmark stock indexes. This also had spillover effects for Canada as local front-end government bond yields declined, reflecting rising bets of a Bank of Canada rate cut. After all, crude oil is a key source of revenue for the nation.

Unfamiliar with past trade wars? Check out our guide, A Brief History of Trade Wars

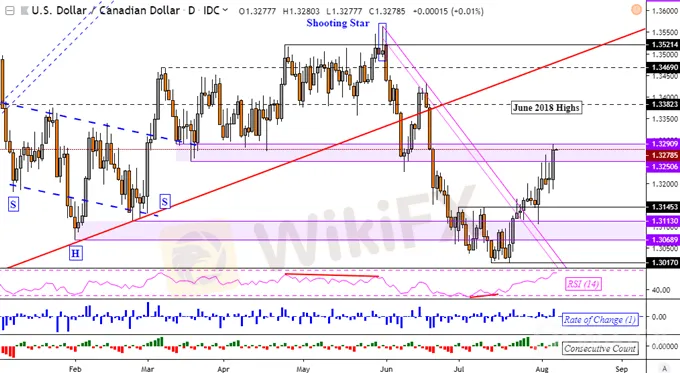

USD/CAD Technical Analysis

The USD/CAD climbed about 0.5% on Tuesday, marking its best performance since the middle of June. Prices pushed into the previous support range between 1.3251 and 1.3291, but failed to breakout to the upside. A close higher opens the door to sustaining the near-term uptrend as the US Dollar targets June 2018 highs against the Canadian Dollar.

USD/CAD Daily Chart

Heading into Wednesdays Asia Pacific trading session, S&P 500 futures are little changed with a slight downside bias. Overall, this may translate into further consolidation after persistent weakness in equities such as the Nikkei 225.

Meanwhile, the New Zealand Dollar awaits a highly-anticipated rate cut to 1.25% from 1.50% from the RBNZ. Since that outcome is widely expected, forward guidance will be what matters most for NZD/USD. Simultaneously, IG Client Sentiment is offering a further bearish contrarian NZD/USD trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Unconfirm Explosion in Middle East Stimulates Commodities Prices

The market was roiled by unconfirmed reports of explosions in Iran, Iraq, and Syria, adding to the already tense atmosphere following Iran's recent attack on Israel over the weekend. Anticipation of potential retaliation from Israel contributed to heightened nervousness in the markets throughout the week. Gold prices surged above the $2400 mark, while oil prices saw a gain of over 4% in the Asia opening session on Friday

The dollar index hit a new two-year high, gold and crude oil rebounded weakly

The dollar index hit a new two-year high, gold and crude oil rebounded weakly

Canadian Dollar Technical Analysis: Short-term CAD Weakness Anticipated–Setups for CAD/JPY, USD/CAD

While the BOC has turned more hawkish, other fundamental factors are working against the Canadian Dollar in the near-term. Volatility and weakness in oil prices coupled with a stretch of disappointing Canadian economic data are weighing on the Loonie. According to the IG Client Sentiment Index, USD/CAD rates have a bullish bias in the near-term.

GBP/USD Downtrend Held as Yen Rose Amid Trump-China Call Dispute

The British Pound soared as “no-deal” Brexit bets cooled, but the GBP/USD dominant downtrend held on chart resistance. Disputes over the Trump-China phone call boosted the Japanese Yen.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator