简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Slides to Two-Year Low, Oversold Signal Flashing

Abstract:EURUSD is trading at lows last seen over two years after breaking noted support at 1.1107. While the outlook remains weak for the pair, the market is flashing a short-term oversold signal.

EURUSD Price, Chart and Analysis:

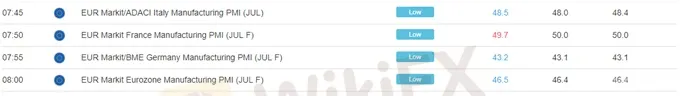

Eurozone Manufacturing PMIs warn of further manufacturing woes.

EURUSD hit by weak euro, strong US dollar combination.

Q3 2019 EUR and USD Forecasts andTop Trading Opportunities

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

The Eurozone manufacturing sector remains in a parlous state, according to Markit PMI data, led by Germany, a traditional source of strength for the single-bloc.

Commenting on the final Manufacturing PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: “The Eurozone PMI dashboard is a sea of red, with all lights warning on the deteriorating health of the regions manufacturers. July saw production and jobs being cut as the fastest rates for over six years as order books continued to decline sharply. Prices fell at the sharpest rate for over three years as firms increasingly competed via discounting to help limit the scale of sales losses.” Williamson also warned that while policymakers have become increasingly alarmed at the deteriorating conditions, “there may be little that monetary policy can do to address these headwinds.”

While economic woes in the Eurozone continue to weigh on the euro, the US dollar continues to rally, despite the FOMC cutting interest rates by 0.25% and halting their quantitative tightening program yesterday. Forward guidance by Fed chair Jerome Powell at the post-decision press conference was deemed by the market as not dovish enough, or even mildly hawkish – “let me be clear, what I said was its not the beginning of a long series of rate cuts” – leaving the US dollar free to hit a fresh 27-month high.

The pair may also come under pressure from Fridays US Labour report (NFP) with any beat of expectations (169k) or an uptick in hourly earnings likely to send the greenback even higher and EURUSD sub-1.1000.

While EURSUD looks weak on the daily chart, the CCI indicator is in extreme overbought territory and this may temper any further fall in the short-term.

EURUSD Daily Price Chart (October 2018 – August 1, 2019)

IG Client Sentiment data shows traders are 74.2% net-long EURUSD, a bearish contrarian bias. However, recent daily and weekly positional changes suggest that EURUSD may soon reverse higher.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.comor via Twitter @nickcawley1.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

Euro (EUR) Price Outlook: No End Yet in Sight for EUR/USD Weakness

EUR/USD continues to tumble, with no sign yet of a rally or even a near-term bounce.. The pair has dropped already beneath the support line of a downward-sloping channel in place since late May this year to its lowest level since July 2020 and there is now little support between here and 1.1170. From a fundamental perspective, the Euro is suffering from a continued insistence by the European Central Bank that much higher Eurozone interest rates are not needed.

Dollar Index (DXY) Soars on Data and Hawkish Fed Lifting Yields. Can USD Fly Higher?

The US Dollar continues to break new ground as momentum gathers. Encouraging economic data and hawkish comments boost yields and USD. Commodities and currencies weaken against the Dollar. Will USD keep going?

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Currency Calculator