简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BoE Cuts Growth Outlook, Sterling (GBP) Unmoved

Abstract:BoE unanimously keeps rates at 0.75% as Brexit uncertainty continues to devaluate the pound and adjusts forward guidance to acknowledge the slump in global growth.

Talking Points:

BoE leaves rates unchanged as the increasing likelihood of a no-deal has led to a marked depreciation of the sterling exchange rate

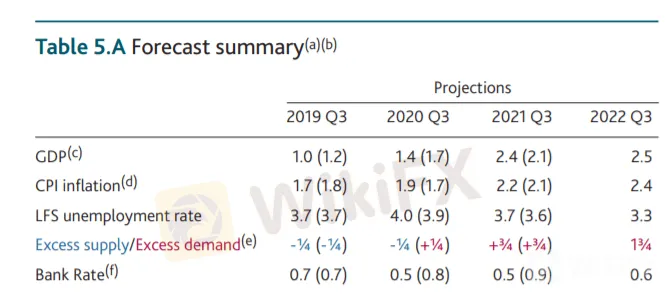

GDP in Q2 expected to be flat as underlying growth slows, growth projections revised downward

GBPUSD remained mostly unchanged as MPC minutes provide no guidance into the future of the economy

********** UPDATE ************

Below are some of the headlines from Mark Carney's press conference:

Monetary response to Brexit will not be automatic but the BoE will always try to keep in line with the 2% inflation target

A no-deal scenario would not only bring a shock for the economy in terms of disruption to demand, but supply capacity will also suffer, despite no-deal preparations, making policy reponse difficult to predict

Already there are signs of trade wars causing more disruption than expected, with global manufacturing PMI at its lowest level since October 2012

UK growth forecasts are more volatile as a result of Brexit uncertainty as hopes of researching a withdrawal agreement are diminishing, which has led to a weakness in business sentiment and investment

The labour market has remained resilient but GDP growth is expected to slow as consumer spending will remain on the prudent side

UK economy could follow a wide range of paths, which will be mostly dependent on the outcome of Brexit. BoE is expecting sterling to fall and risk premiums to spike higher if a no-deal Brexit takes place, and businesses expect their output and earnings to fall between 1% to 3% in such event

******************

The Bank of Englands Monetary Policy Committee (MPC) has decided to leave rates unchanged at 0.75% in its August meeting as Brexit and global growth uncertainties continue to loom. They also voted to keep bond and asset purchase targets unchanged at 10b and 435b respectively.

The decision saw a small spike in GBPUSD as recent dollar strength coupled with increasing Brexit uncertainty has kept the pair trading near two-year lows. But the pair remained mostly unchanged as the meeting minutes failed to provide any further guidance into the next coming months, keeping Q2 growth expectations flat at 0% and a revision downward for the subsequent quarters.

Up until now MPC projections have been based on a smooth Brexit taking place, where gradual hikes would be needed in the months after the withdrawal is completed. Their stance has remained mostly unchanged as they stated that rate hikes would be appropriate, but they did add that they will need to see a recovery in global growth before interest rates are adjusted.

BoE Governor Carney is due to give a press conference at 1130 GMT.

GBP Q3 Forecast

UK inflation started to fall in August 2018 from year highs of 2.7%, led mainly by a drop in fuel and clothing prices. The steady fall in prices pushed back the need for the Bank of England to hike rates in early 2019, as global economies were experiencing slowing growth and other Central Banks embarked on a cycle of monetary easing. But the need to cut rates in the UK may be pushed back as a weakening pound will likely lead to a push higher in inflation, as imports become more expensive and the demand for domestic exports increases. This will leave the BoE with the difficult task of balancing Brexit and economic uncertainty with a potential increase in inflation as a result of a weakening pound.

GBP Forecast Trading Guide

Yields on UK gilts have continued to fall reaching their lowest level since August 2016. Current gilts offer a return of just 0.62%, down from 1.38% a year ago. The fall in yields coupled with increasing odds that a rate cut will happen before the end of the year continue to put downward pressure on sterling as pessimist sentiment in the future of the British economy takes over.

Recommended Reading

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 16 August: USD/JPY Forecast: Short-Term Bearish Trend Amid Dollar Consolidation

This year's arbitrage gains have been erased, with 65%-75% of these positions closed. The dollar's reaction has been as expected but slightly disappointing, with a significant 100 basis point rise in U.S. short-term interest rates impacting it. JPMorgan has reduced its dollar forecasts, now predicting USD/JPY at $146 in Q4 2024 and $144 in Q2 2025, down from $147. Despite a weakening job market, other economic data remains strong.

KVB Market Analysis | 5 August: Gold Declines in Early Asian Session Amid Profit-Taking and Market Uncertainty

Gold declined in the early Asian session due to profit-taking after hitting a record high on Friday. The US NFP report showed only 117K new jobs in July, below the expected 175K, signaling a potential increase for XAU/USD. Annual wage growth slowed to 3.7%, easing inflation fears and boosting Fed rate-cut prospects. Rising tensions between Iran and Israel have also increased gold’s safe-haven appeal.

XAU/USD Post-CPI Data Analysis

Gold prices surged post-CPI data, hitting a third consecutive weekly gain and surpassing $2,400, driven by expectations of Fed rate cuts. Positive sentiment and global economic uncertainty boost gold's appeal as a safe haven. Despite minor pullbacks, the overall trend remains bullish with short-term volatility anticipated.

【MACRO Insight】The Crossroads of the American Economy——Inflation, Employment, and the Fed’s Policy Choices

The dynamics of the U.S. economy and labor market, as well as changes in inflation expectations, have profound implications for Federal Reserve policy decisions. Market participants are closely monitoring upcoming economic data releases and statements from Fed officials to capture signals of policy direction. Against this backdrop, investors need to prepare for potential market fluctuations and closely watch the Fed's next steps. Meanwhile, trends in housing prices, changes in core CPI, and the

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Currency Calculator