简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD, JPY Could Rise as IMF Global GDP Outlook Gets Cut Again

Abstract:Anti-risk currencies like the US Dollar and Japanese Yen could catch a bid after the IMF's updated World Economic Outlook report revealed another cut to its global GDP forecasts for 2019 and 2020.

IMF WORLD ECONOMIC OUTLOOK REPORT REVEALS GDP GROWTH STILL SLUGGISH

国际货币基金组织世界经济展望报告揭示国内生产总值增长仍然令人沮丧

The International Monetary Fund (IMF) released its July 2019 World Economic Outlook report and noted that global GDP growth remains subdued

国际货币基金组织(IMF) )发布了2019年7月的“世界经济展望”报告并指出全球GDP增长仍然低迷

Global GDP growth forecasts for 2019 and 2020 were both lowered by 0.1%

2019年和2020年全球GDP增长预测均下调0.1 %

Safe-haven currencies like the US Dollar and Japanese Yen could benefit if market sentiment deteriorates in response

如果市场情绪恶化,美元和日元等避险货币可能会受益

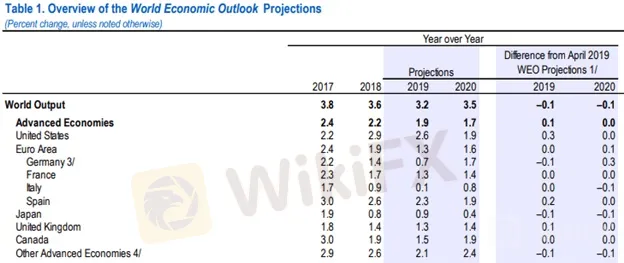

Another IMF World Economic Outlook Report, another downgrade to global GDP growth. The IMF revealed a cut to its global GDP forecasts once again as the trend of slower economic activity continues to bite. Projections for 2019 and 2020 were both lowered by 0.1%, down to 3.2% and 3.5% respectively. The July 2019 update listed sluggish GDP growth across the board with economic activity being weighed down broadly by lingering risks surrounding trade policy uncertainty, Brexit and geopolitical tensions. World trade volume for 2019 is also expected keep drifting lower with the 2019 forecast cut by another 0.9% to 2.5%.

另一份国际货币基金组织“世界经济展望报告”,又一次降级为全球GDP增长。随着经济活动放缓的趋势持续下滑,国际货币基金组织再次下调其全球GDP预测。 2019年和2020年的预测均下调0.1%,分别下降至3.2%和3.5%。 2019年7月的最新消息显示,全面的GDP增长缓慢,经济活动受到贸易政策不确定性,英国退欧和地缘政治紧张局势的挥之不去的风险的影响。预计2019年世界贸易量将继续下滑,2019年的预测下调0.9%至2.5%。

{6}

IMF WORLD ECONOMIC OUTLOOK JULY 2019 GDP PROJECTIONS

{6}

Source: IMF

资料来源:国际货币基金组织

Yet, consumer confidence has held firm which could be largely attributable to resilience in performance of the services sector and robust employment growth. Notable changes in advanced economies detailed upward revisions for US and Eurozone GDP growth estimates to the tune of 0.3%. On the contrary, Asia is expected to grow 6.2% this year which is 0.1% lower than previously estimated with the economic outlook downgrade driven primarily by the adverse impact of tariffs on trade and investment. Also, Latin America is expected to see the largest slowdown in GDP growth with the region now expected to show 0.6% growth this year and is 0.8% lower than the IMFs prior 2019 GDP forecast.

然而,消费者信心保持坚挺,这主要归功于业绩的弹性服务业和强劲的就业增长。发达经济体的显着变化将美国和欧元区GDP增长预测的上调修正为0.3%。相反,由于关税对贸易和投资的不利影响,亚洲预计今年将增长6.2%,比先前估计的低0.1%,因为经济前景下调。此外,预计拉丁美洲的GDP增长将出现最大幅度放缓,而该地区目前预计会出现这种情况今年增长0.6%,比国际货币基金组织2019年预测的国内生产总值预测低0.8%。

SAFE-HAVEN CURRENCIES US DOLLAR & JAPANESE YEN COULD BENEFIT

安全 - 美国货币美元和日元可能带来好处

The IMFs July 2019 World Economic Outlook report also detailed that risks to the forecast are mainly to the downside with the estimated rebound in growth later this year and into 2020 is underscored as “precarious,” adding that “downside risks have intensified” since the April 2019 report. Furthermore, the IMF stated that “business sentiment and surveys of purchasing managers for example point to a weak outlook for manufacturing and trade, with particularly pessimistic views on new orders.” That said, in consideration of slower GDP growth forecasts, lingering uncertainty and heightened risks, there could be potential for safe-haven currencies like the US Dollar and Japanese Yen to rise if market sentiment takes a turn for the worse.

国际货币基金组织2019年7月世界经济展望报告还详细说明,预测的风险主要是下行风险,预计今年晚些时候的增长将出现反弹,并且到2020年被强调为“不稳定”,并补充说自2019年4月报告以来,“下行风险加剧”。此外,国际货币基金组织表示,“商业情绪和采购经理人调查显示,制造业和贸易前景疲弱,对新订单的看法尤为悲观。”尽管如此,考虑到GDP增长预测放缓,不确定性持续存在且增强风险方面,如果市场情绪转向恶化,美元和日元等避险货币可能会上涨。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

BoJ Holds Firm on Tightening Path Fuels Yen

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House.

Eye on Today’s FOMC Meeting Minutes

Wall Street took a pause in the last session, with all three major indexes remaining relatively flat as investors awaited the highly anticipated FOMC meeting minutes.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

OFX: Is It Good to Go? Broker Review

Financial Educator “Spark Liang” Involved in an Investment Scam?!

Currency Calculator