简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

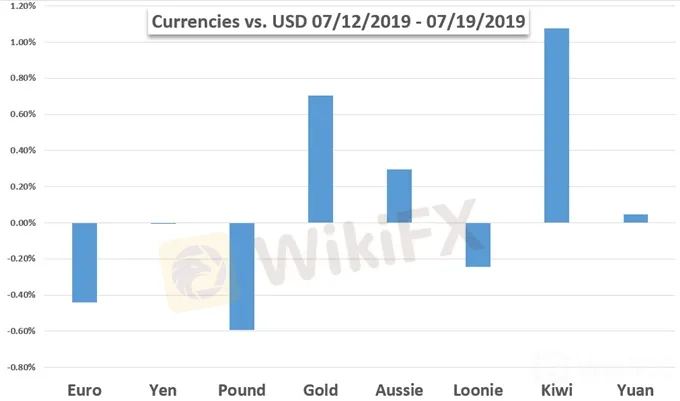

Weekly Trading Forecasts: EURUSD Top Fundamental Candidate on Fed Speculation, ECB Decision Approaches

Abstract:We may find the top scheduled event risk next week displaced for market moving potential by an increasingly volatile theme. Key event risk ahead includes Fridays US 2Q GDP update and the global PMIs for July which would seem to put the focus on growth and recession concerns. Yet, the

US Dollar May Gain if IMF Report, US GDP Data Fuels Haven Demand

如果国际货币基金组织报告显示美元可能上涨,美国国内生产总值数据加剧黑客需求

The US Dollar may find itself propelled higher if the IMFs updated assessment of the world economy and an underwhelming US GDP data report stoke demand for liquidity.

美元可能会发现自己如果国际货币基金组织更新对世界经济的评估,并且美国国内生产总值数据报告不足,则会推高对流动性的需求。

Australian Dollar Gains Should Hold As Markets Still Think Fed Will Cut

随着市场仍认为美联储将削减澳元兑美元应该保持增长 p>

The Australian Dollar has shared fully in the broad US Dollar weakness seen as markets become more certain that US rates are going lower.

由于市场越来越确定美国利率正在走低,澳元兑美元在广泛的美元疲软中完全分享。

Gold Price Weekly Forecast: Fed Drives Next Leg Higher

黄金价格每周预测:美联储推动下一步走高

The price of gold made a fresh six-year high Thursday, fueled by dovish Fed commentary. This stimulus comes on the back of recent, heavy, central bank buying of the precious metal alongside large gold ETF inflows.

黄金价格上涨温和的美联储评论推动周四新的六年高点。这一刺激措施是在近期大量央行购买贵金属以及大量黄金ETF流入的背后发起的。

DAX & FTSE MIB Fundamental Forecast: Eyes on ECB Rate Decision

DAX&富时MIB基本面预测:关注欧洲央行利率决议

{11}

DAX focus centered around ECB rate decision and heavyweight earnings, while Italian political risks weigh on the FTSE MIB.

{11}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator