简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Rips & USD Dips Sharply as Fed Rate Cut Bets Surge

Abstract:Gold price, US Dollar, DXY, USD, Fed, Fed Rate cut, Fed Williams, Fed Clarida

US DOLLAR & GOLD PRICE REACT TO LATEST DOVISH FED COMMENTS

The US Dollar just dropped to its lowest level in a month while spot gold prices soared to a fresh 6-year high

Federal Reserve rate cut bets skyrocket in anticipation of the upcoming July FOMC meeting after the latest dovish commentary from Fed Vice Chair Richard Clarida and NY Fed President John Williams

Download the DailyFX Q3 Forecasts on the US Dollar and Gold for comprehensive outlook

More dovish commentary from the Federal Reserve have been crossing the wires during afternoon trading on Thursday and has so far caused a dramatic reaction in the dollar and gold prices. The latest calls to ease monetary policy are coming from Fed Vice Chair Clarida and NY Fed President Williams who are both FOMC voting members this year.

FED VICE CHAIR CLARIDA COMMENTS 18 JULY 2019

Uncertainty on trade policy is hitting confidence

Research shows that the Fed should act preemptively when possible

Limit on how far US rates can diverge from global rates

Inflation data on the soft side

NY FED PRESIDENT WILLIAMS COMMENTS 18 JULY 2019

Fed has space to react to ‘run of the mill’ negative shock

You want to attack factors weighing on the neutral rate

Inflation weakness somewhat worrisome

Act quickly with monetary policy when you see signs of distress

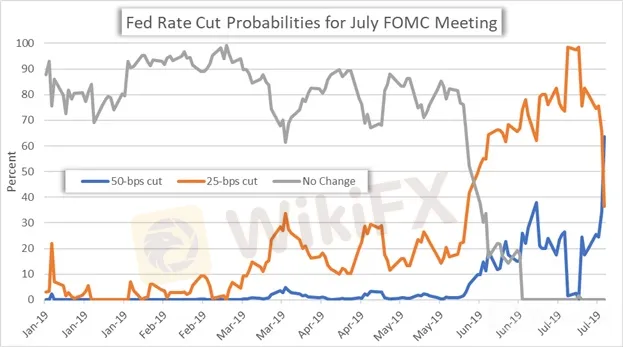

FED RATE CUT PROBABILITIES BY JULY FOMC MEETING

These increasingly dovish comments from Fed officials has sent the probability that the FOMC cuts rates at its next meeting by 50-basis points soaring to 63.5%, which is up from 34.5% yesterday and 0% on July 9.

Stock Market Outlook: S&P 500 Returns When the Fed Cuts Rates

SPOT GOLD PRICE CHART: DAILY TIME FRAME (DECEMBER 14, 2018 TO JULY 18, 2019)

Unsurprisingly, the prospect of lower interest rates as sent spot gold prices continuing along its parabolic climb to a fresh 6-year high. Spot gold could keep climbing and possibly target the $1,460 price level next where uptrend resistance might come into play so long as yields remain compressed by lofty Fed rate cut bets.

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (NOVEMBER 29, 2018 TO JULY 18, 2019)

The US Dollar, measured by the DXY Index, correspondingly dropped to a 1-month low where technical support from the 50% retracement of the greenbacks year-to-date trading range aims to stymie some of the downside in USD. The US Dollar Index now trades below its 200-day simple moving average which will be an important level for USD bulls to overcome going forward.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator