简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

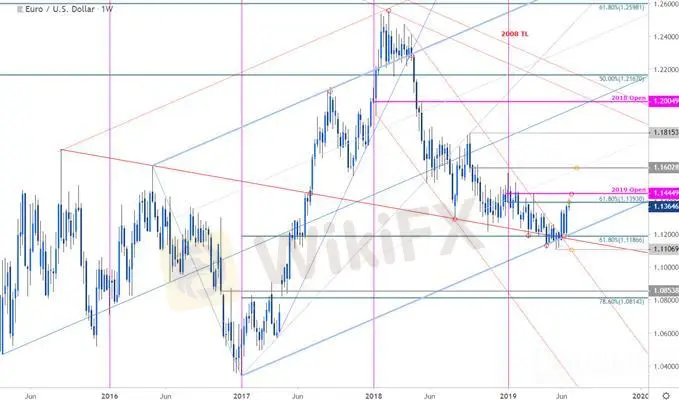

Euro Weekly Price Outlook: EUR/USD Breakout Eyes Yearly Open into Q3

Abstract:Euro has rallied more than 2.7% off the yearly lows with the advance now testing initial resistance targets. Here are the levels that matter on the EUR/USD weekly chart.

Weekly technicals on EUR/USD- Breakout testing key resistance targets into close of June / 2Q

每周技术面欧元/美元 - 突破测试6月/ 2季度关键阻力目标

The Euro is virtually unchanged against the US Dollar since the start of the week with price holding just below yearly Fibonacci resistance into the close of the month / quarter. These are the updated targets and invalidation levels that matter on the EUR/USD weekly chart. Review this weeks Strategy Webinar for an in-depth breakdown of this Euro setup and more.

欧元兑美元自此基本未变本周初,价格保持在年度斐波纳契阻力位于月/季度收盘价之前。这些是欧元/美元周线图上重要的更新目标和失效水平。回顾本周的战略网络研讨会,深入了解欧元设置等。

New to Forex Trading? Get started with this Free Beginners Guide

Forex Trading新手入门?开始使用此免费入门指南

EUR/USD Price Chart – Euro Weekly

欧元/美元价格走势图 - 欧元周报

Notes: In my last EUR/USD Weekly Price Outlook our ‘bottom line’ noted that, “Euro held long-term slope support for over two months with the breach above channel resistance this week shifting the focus back to the long-side as we head deeper into June trade.” The rally extended into initial weekly resistance targets this week at the 61.8% retracement of the yearly range at 1.1393 with more significant resistance is eyed just higher at the 2019 open at 1.1445- risk for near-term exhaustion heading into these levels. Critical support remains at 1.1187 with a break / close below 1.1107 needed to suggest a larger breakdown is underway.

注意:在我上一次欧元/美元每周价格展望中我们的'底线'指出,“欧元持有超过两个月的长期斜坡支撑位,本周突破通道阻力突破将焦点重新转移到长边,随着我们进一步深入6月交易。”反弹延伸至初始周线本周抵抗目标位于年度区间1.1393的61.8%回撤位,2019年开盘时的阻力位在1.1445附近,而近期疲惫的风险将进入这些水平。关键支撑位维持在1.1187,突破/收盘价低于1.1107需要表明正在进行更大的细分。

Bottom line: The Euro breakout is testing initial resistance targets here around 1.14 and while the broader focus remains higher, the advance is vulnerable near-term heading into the yearly open- Watch the weekly / monthly close tomorrow. From a trading standpoint, a good place to reduce long-exposure / raise protective stops. Be on the lookout for topside exhaustion here if price fails to close above- ultimately, well favor fading weakness while above 1.1270 targeting a test of 1.1445.Review my latest EUR/USD Technical Outlook for a closer look at the near-term Loonie trading levels.

底线:欧元突破正在测试1.14附近的初始阻力目标,而更广泛的焦点仍然更高,这一进展在短期内是脆弱的进入年度开放 - 观看明天的每周/每月收盘。从交易的角度来看,这是一个减少长时间曝光/提高保护性止损的好地方。如果价格未能收于上方,那么请关注上行疲惫 - 最终有利于消退弱势,同时高于1.1270,目标是测试1.1445。回顾我的近期欧元/美元技术展望,仔细研究近期Loonie交易水平。

EUR/USD Trader Sentiment

EUR / USD Trader情绪

A summary of IG Client Sentiment shows traders are net-short EUR/USD - the ratio stands at -1.5 (40.1% of traders are long) – bullish reading

IG Client Sentiment的摘要显示交易者是网络空头欧元/美元 - 该比率为-1.5(交易者持有多头的40.1%) - 看涨读数

Traders have remained net-short since June 20th; price has moved 0.6% higher since then

交易商自6月以来一直保持净空头20;此后价格已上涨0.6%

Long positions are 0.9% lower than yesterday and 9.2% lower from last week

多头头寸比昨天低0.9%,比上周下降9.2%

Short positions are 1.9% higher than yesterday and 39.4% higher from last week

空头头寸比昨天增加1.9%,比上周增加39.4%

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias from a sentiment standpoint.

我们通常采取逆向观点来看待人群情绪,而交易商净空头表明欧元/美元价格可能继续上涨。交易商的净空头比昨天和上周还要短,目前的定位和最近的变化相结合,使我们从情绪的角度看待欧元兑美元看涨的逆势交易偏差。

{21}

Key Euro / US Data Releases

{21}

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide!

Economic Caendar - 最新的经济发展和即将发生的事件风险。了解我们如何在我们的免费指南中交易新闻!

Previous Weekly Technical Charts

以前的每周技术图表

Canadian Dollar (USD/CAD)

加拿大元(美元/加元)

Crude Oil (WTI)

原油(WTI)

US Dollar (DXY)

美元(DXY)

Gold (XAU/USD)

黄金(XAU / USD)

{28}

Kiwi (NZD/USD)

{28}{29}

Japanese Yen (USD/JPY)

{29}

Aussie (AUD/USD)

澳元(澳元/美元)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

WikiFX Broker

Latest News

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

5 Questions to Ask Yourself Before Taking a Trade

Quadcode Markets: Trustworthy or Risky?

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator