简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK Credit Impulse Contracts for Seven Consecutive Quarters

Abstract:There has been a handful of good data released in the United Kingdom in recent weeks but it would be misleading to see this as a sign that growth is on the verge of a prolonged rebound.

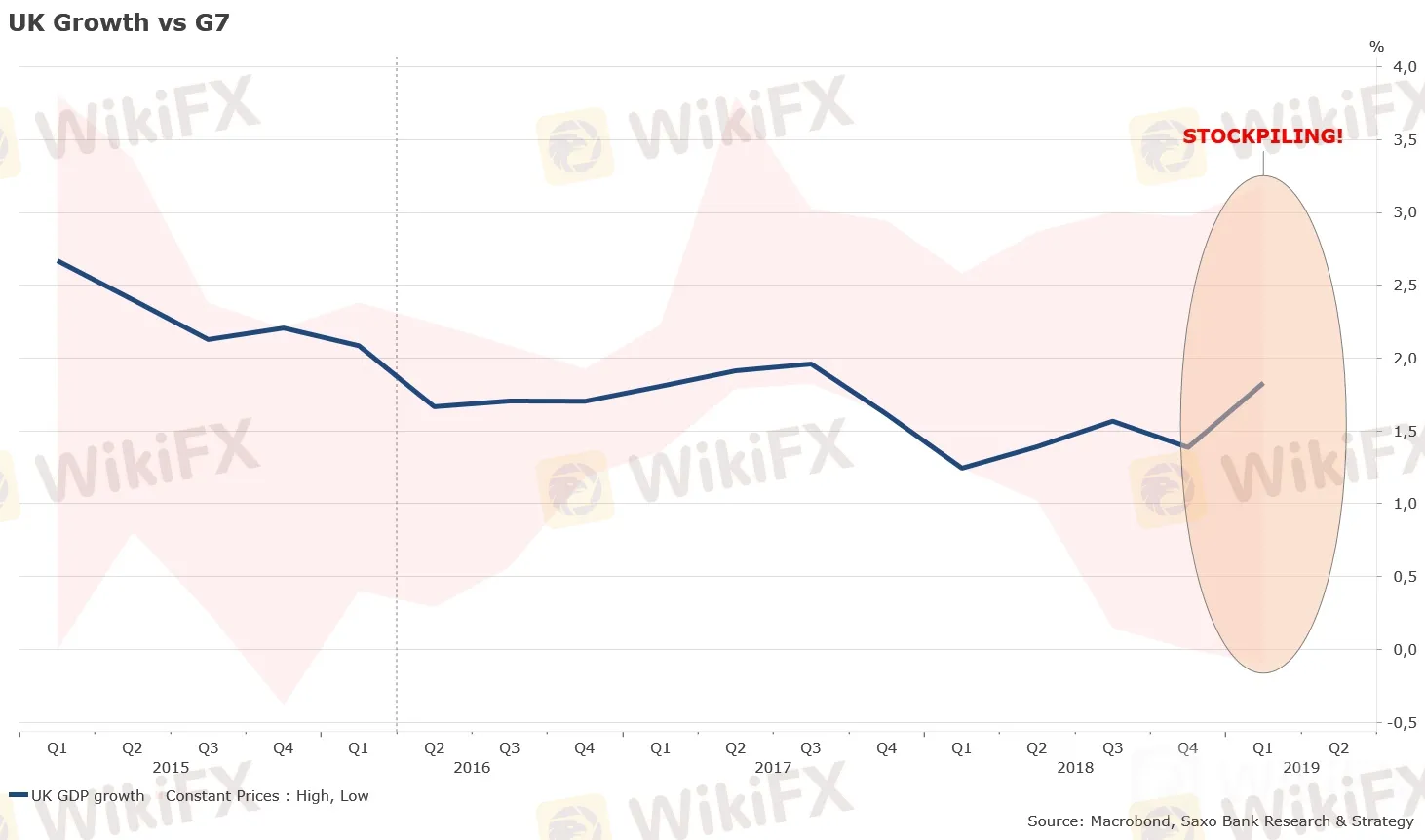

In fact, the UK economy is going through a false stabilisation that wont last long. Q1 UK growth has returned to the average of the G7 countries, but this is mostly due to stockpiling ahead of March 31, the initial Brexit deadline. This is not the sign of a very dynamic economy in our view. It also primarily reflects lower growth momentum in the G7, not real stronger momentum in the UK. In addition, consumer surveys are rebounding but this is mostly caused by higher wages (+3.4% YoY in Q1 2019 according to the latest OECD update) and postponed Brexit.

事实上,英国经济正在经历一场不会持续多久的虚假稳定。英国第一季度的增长已恢复到G7国家的平均水平,但这主要是由于英国脱欧最初截止日期3月31日之前的库存增加。在我们看来,这并不是一个充满活力的经济的标志。它也主要反映了七国集团的增长势头较低,而不是英国真正强劲的势头。此外,消费者调查正在反弹,但这主要是由于工资上涨(根据经合组织最新的更新,2019年第一季同比增长3.4%)和推迟英国脱欧。

We identify a bunch of risks that could derail growth in coming quarters:

我们确定了在未来几个季度可能会破坏增长的一系列风险:

The likelihood of no-deal Brexit at the end of October 2019.

在交易结束时没有交易的英国退欧的可能性2019年10月。

Deterioration in the trade war front that could impact more negatively the global supply chain.

贸易战前线的恶化可能会对全球供应链产生更大的负面影响。

The lack of money supply growth in main economies is leading to low growth until at least mid-end of 2020.

主要经济体货币供应增长不足导致至少在2020年中期之前出现低增长。

The risk of recession in the US has significantly increased for 2020. Based on leading indicators, the probability is now comparable to the probability measure in advance of the last 3 recessions.

美国经济衰退的风险在2020年显着增加。根据领先指标,现在的可能性与过去3次衰退之前的概率指标相当。

Rising tensions between the United States and Iran in the oil-strategic routes of the Strait of Hormuz that could lead to disruptions in the global oil market.

美国和伊朗之间在霍尔木兹海峡石油战略路线上的紧张关系可能导致全球石油公司的破坏arket。

More fundamentally, even if none of these events materialises, which is rather unlikely, the UK economy is condemned to a prolonged period of low growth. The number one issue of the British economy is not really Brexit but the lack of new credit growth which is essential in a highly leveraged economy.

更重要的是,即使这些事件都没有实现,这是不太可能的,英国经济也会受到长期低迷的谴责生长。英国经济的头号问题不是真正的英国脱欧,而是缺乏新的信贷增长,这对高杠杆经济至关重要。

Our leading indicator, the credit impulse, is tracking the flow of new credit in the economy and explains economic activity nine to twelve months forward with an “R2” of .60. As of now, UK credit impulse has been in contraction for seven consecutive quarters and is currently running at minus 4.4% of GDP. The length of the contraction is similar to that of the GFC but with a smaller amplitude. The lowest point reached in the post-referendum area was minus 7.4% of GDP versus a drop up to minus 20% of GDP in 2009.

我们的领先指标,信贷冲动,是追踪经济中新信贷的流动并解释经济活动九o前十二个月,“R2”为.60。截至目前,英国信贷冲动已经连续七个季度出现萎缩,目前正在占GDP的4.4%。收缩的长度类似于GFC的长度,但幅度较小。公投后领域达到的最低点是GDP的7.4%,而2009年则下降到GDP的负20%。

Prolonged contraction in UK credit impulse marks the end of the massive credit boom that started in 2015 and lasted until 2017 and will ultimately constraint in the long run private consumption, which contributes to roughly 60% of GDP.

英国信贷冲动的长期收缩标志着2015年开始的大规模信贷繁荣期结束,持续到2017年,最终将限制长期私人消费,占GDP的60%左右。

In the chart below, we have plotted the evolution of the flow of new personal loans and overdrafts since 2002 as a proxy of UK household financial stress. It has been in contraction since April 2018 and is currently back to where it was in 2011, at minus 1.8% of GDP.

在图表中下面,我们绘制了自2002年以来新的个人贷款和透支流动的演变,作为英国家庭财务压力的代表。它自2018年4月以来一直处于收缩状态,目前已恢复到2011年的水平,为GDP的负1.8%。

Real higher wages are bringing some relief to UK consumers at the moment, pushing a bit up the saving rate from historically low level of 3% reached after the referendum, but it is likely to be short-lived as Brexit – no matter which trade and political agreements will prevail with the EU – will undoubtedly have negative ripple effects on businesses, labor market and growth due to higher uncertainty. In a more constrained economic environment, companies will be more reluctant than now to keep lifting pay by cutting their margins, even in a context of full employment.

真正的高工资为英国消费者带来了一些缓解在公投之后,将储蓄率从3%的历史最低水平推高一点,但由于英国脱欧 - 无论哪种贸易和政治协议将在欧盟取得胜利 - 毫无疑问,它可能会昙花一现。由于不确定性较高,对企业,劳动力市场和增长的负面影响。在一个更加有限的经济环境中,即使在充分就业的背景下,公司也会比现在更不愿意通过削减利润来提高工资。

On the top of that, the risk of policy error has significantly increased. In 2010, the credit cycle has rebounded very fast and strongly after recession due to the Bank of England lowering interest rates and the massive injections of liquidity in the financial system. In post-Brexit UK, such a stimulus is unlikely. The BoE has lately sent very mixed messages about the next move of monetary policy, pointing out risks to growth at its latest Monetary Policy Committee meeting but also expressing concerns about household inflation expectations that keep increasing above 3% up to 5 years.

最重要的是,政策错误的风险显着增加。 2010年,由于E银行的衰退,信贷周期在经济衰退后迅速而强劲地反弹腺体降低了利率,并在金融体系中大量注入流动性。在英国脱欧后,这种刺激措施不太可能。英国央行最近发出了关于下一步货币政策的非常复杂的消息,指出了其最新货币政策委员会会议上的增长风险,但也表达了对家庭通胀预期的担忧,这些预期持续增长至3年以上3%。

Though it is getting more or more likely that the next move will be an interest cut rather than a hike, the UK central bank has less room than the Fed and the European Central Bank to stimulate growth in a context of high inflation expectations. This monetary policy dilemma makes a move in terms of fiscal policy even more urgent than before to mitigate the Brexit impact.

尽管下一步行动将会更有可能降息而不是加息,但英国央行的空间要小于美联储和欧洲央行刺激经济增长的空间在高通胀预期的背景下。这种货币政策困境使得财政政策方面的举措比以往更加紧迫,以减轻英国脱欧的影响。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator