简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Mixed Eurozone Data Keeps EURUSD Subdued, Focus on Fed Chair Powells Speech

Abstract:The EURUSD was pushing higher at the end of Mondays session but reversed some of the gains in anticipation of Eurozone inflation and unemployment figures released this morning. A mixed reading kept the pair subdued around the 1.1246 handle.

EURUSD Talking Points:

欧元兑美元谈话要点:

Falling unemployment keeps the Euro from sliding despite falling inflation.

尽管通胀率下降,但失业率下降使欧元不会下滑。 / p>

EURUSD remains subdued ahead of Powells commentary on Fed policy.

在鲍威尔对美联储政策的评论之前,欧元兑美元依然低迷。

TLTROs to be a key point to look out for at the ECBs monetary meeting on Thursday.

TLTRO将成为周四欧洲央行货币会议的关键点。

The EURUSD pushed above the 1.1245 handle at the end of Mondays session as disappointing ISM US data sent the dollar lower, before trading in a 17-pip range during the overnight session. The pair headed higher again at the open of the European session, pushing the it past 1.1270 before it reversed in anticipation of Eurozone inflation and unemployment figures being released today. Mixed data provided a small push for the Euro before EURUSD settled around 1.1246.

欧元兑美元由于令人失望的ISM美国数据令美元走低,然后在隔夜交易时段交易于17点之间,因此在周一交易日结束时突破1.1245区间。该货币对在欧洲时段开盘后再次走高,推动其在1.1270之前反转,因为预期欧元区通胀和今天公布的失业数据。在欧元兑美元收于1.1246附近之前,混合数据为欧元提供了小幅推动。

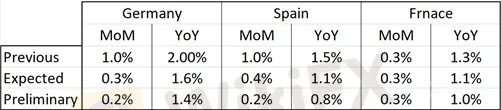

Preliminary Eurozone Headline inflation grew by 1.2% in the month of May (exp. 1.3%) down from 1.7% in the previous month and Eurozone Core inflation grew 0.8% in May (exp. 0.9%), down from 1.3% in the previous month. The figure is in line with other inflation releases seen last week in the Eurozone, with drops in Germany, Spain and France, signalling that underlying price pressures are falling.

初步欧元区5月份整体通胀率从1.7上升1.2%(预期为1.3%)上个月的百分比和欧元区核心通胀在5月份增长0.8%(预期为0.9%),低于上个月的1.3%。这一数字与上周欧元区其他通胀数据一致,德国,西班牙和法国出现下跌,表明潜在的价格压力正在下降。

Despite falling inflation, unemployment figures provided some relief as the unemployment rate fell to 7.6% in the month of May, despite expectations of the rate to remain the same as last month‘s reading of 7.7%. Unemployment has been the key outlier around the globe in the face of a global economic slowdown as many monetary policies setting bodies, including the RBA and the Fed, have focused on improving employment to remain less dovish than markets expectations. But there have been caution signs as last week saw Germany’s unemployment rose for the first time since 2013, as 60,000 more people were considered unemployed in the month of May.

尽管通胀率下降,但失业率数据提供了一些缓解,因为失业率在5月份降至7.6%,尽管预期该比率将保持与上个月的7.7%相同。面对全球经济放缓,失业一直是全球关键的异常因素,因为包括澳大利亚央行和美联储在内的许多货币政策制定机构都把重点放在改善就业,以保持低于市场预期的温和态度。但有一些警告迹象表明,上周德国的失业率自2013年以来首次出现增长,同时增加了60,000人ople在5月份被视为失业。

Key Events to Look Out For

需要注意的重要事项

DailyFX Economic Calendar

DailyFX经济日历

A data-heavy week lies ahead for both the Euro and the US dollar. German, French and Eurozone PMIs will be released on Wednesday. Despite expectations for the figures to be little changed from the previous month, worse than expected numbers could send the Euro lower ahead of the ECB‘s rate meeting on Thursday, the key event for the Euro this week. Even though it is expected that the Central Bank will keep rates unchanged at -0.4%, the focus will be on how dovish they remain and whether the Eurozone needs to consider additional monetary stimulus, especially as the ECB is currently looking for a new President to replace Mario Draghi. A key point to look out for in Thursday’s meeting is for any mention on the terms of the new round of TLTROs for the Eurozone banks.

欧元和美元都将面临数据繁忙的一周。德国,法国和欧元区采购经理人指数将于周三公布。尽管预计这些数字与上个月相比变化不大,但在周四欧洲央行的利率会议之前,糟糕的数据可能使欧元走低,这是本周欧元的关键事件。虽然预计中央银行将维持利率在-0.4%不变,但重点将放在它们保持多么温和以及欧元区是否需要考虑额外的货币刺激措施上,特别是因为欧洲央行目前正在寻找新的总统。取代马里奥德拉吉。在周四的会议上要注意的一个关键点是提及欧元区银行新一轮TLTRO的条款。

On the US dollar side, Federal Reserve Chairman Jerome Powell is expected to give his outlook on the Fed policy in an event taking place today in Chicago, where a more dovish stance could push the USD lower against other major currencies, as markets are now pricing in at least two 0.25% US interest rate cuts by the end of the year. Part of the downgrade in expectations on the future of the US economy is that yield curves have inverted signalling that a recession may be nearing. Of key importance to the Feds decision on rates will be non-farm payrolls and wages figures to be released on Friday.

美元方面,美联储主席预计杰罗姆鲍威尔将在今天芝加哥举行的一场活动中展示他对美联储政策的展望,由于市场现在定价至少两个0.25%的美国利率,更加温和的立场可能会推动美元兑其他主要货币走低。到年底削减。对美国经济未来预期下调的部分原因是,收益率曲线反映出经济衰退可能已接近尾声。对联邦政府关于利率的决定至关重要的是非农就业人数和工资数据将于周五公布。

--- Written by Daniela Sabin Hathorn, Junior Analyst

---由Daniela Sabin Hathorn撰写,初级分析师

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 26 August: Bitcoin (BTC) Breaks Out Above $60,000, Faces Resistance at $72,000

Bitcoin traded above $60,000 on Friday, gaining over 4% this week but staying within a $57,000 to $62,000 range for the past 15 days. On-chain data reveals mixed signals, with institutions accumulating while some large holders are selling. Inflows into US spot Bitcoin ETFs and potential volatility from ongoing Mt.Gox fund movements could impact Bitcoin's price in the coming days.

KVB Market Analysis | 5 August: Gold Declines in Early Asian Session Amid Profit-Taking and Market Uncertainty

Gold declined in the early Asian session due to profit-taking after hitting a record high on Friday. The US NFP report showed only 117K new jobs in July, below the expected 175K, signaling a potential increase for XAU/USD. Annual wage growth slowed to 3.7%, easing inflation fears and boosting Fed rate-cut prospects. Rising tensions between Iran and Israel have also increased gold’s safe-haven appeal.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Standard Chartered Secures EU Crypto License in Luxembourg

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator