简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Nervously Eyes ECB Rate Decision, Turmoil in Italy, Trade Wars

Abstract:Euro traders will find themselves hot under the collar as the ECB announces its rate decision and will likely revise its growth outlook downward.

EURO FUNDAMENTAL FORECAST: BEARISH

欧元基本预测:熊势

Euro traders nervously eye ECB rate decision and econ outlook

欧元交易员紧张地关注欧洲央行利率决议和经济前景

Rome-Brussels budget battle may undermine EURUSD strength

罗马 - 布鲁塞尔的预算战可能会削弱欧元兑美元的实力

EU-US trade tensions remain headline risk as global growth slows

欧盟 - 随着全球增长放缓,美国贸易紧张局势仍然是头条风险

The Euro will be under pressure this week ahead of the release of the ECB rate decision and ongoing negotiations between Rome and Brussels over the formers budgetary ambitions. EU officials will also be continuing their talks on who will head major European institutions including the European Commission, European Council and the ECB.

在欧洲央行利率决定公布以及罗马和布鲁塞尔之间关于前期预算野心的持续谈判之前,本周欧元将面临压力。欧盟官员还将继续就如何领导欧洲主要机构,包括欧洲委员会,欧洲理事会和欧洲央行等问题进行谈判。

The ECB is expected to hold rates in negative territory this week as the global and regional outlook for growth continues to sour against the backdrop of unfavorable geopolitical tensions. Internally, inter-European relations in key Eurozone member states continue to threaten sovereign bond markets. The battle of budgets between Rome and Brussels continues (CITE).

预计欧洲央行本周将维持利率在负面区域,因为在地缘政治紧张局势不利的背景下,全球和地区经济增长前景继续恶化。在内部,欧元区主要成员国的欧洲间关系继续威胁着主权债券市场。罗马和布鲁塞尔之间的预算之争仍在继续(CITE)。

This is compounded by the recent release of Italian GDP that saw year-on-year growth shrink 0.1 percent while Italian 10-year bond yields continue to hover at multi-year highs. EU-US trade relations may become a headline concern as cross-Atlantic tensions rise against the backdrop of diverging policy approaches toward Iran.

最近发布的意大利国内生产总值看起来更加复杂一年增长率下降0.1%,而意大利10年期国债收益率继续徘徊在多年高位。欧盟与美国之间的贸易关系可能成为头条问题,因为在对伊朗采取不同政策方针的背景下,跨大西洋的紧张局势升级。

The EU and US narrowly avoided – for the time being – an escalated trade war after US President Donald Trump delayed implementing auto tariffs against Europe which would have put the export-heavy DAX under additional pressure. Deteriorating US-Mexico trade relations also makes European policymakers nervous because of the prospect that Trump may do the same to them without notice. Such an approach has been the Presidents modus operandi.

在美国总统唐纳德特朗普推迟对欧洲实施汽车关税之后,欧盟和美国勉强避免 - 暂时升级的贸易战,这将导致出口重的DAX承受更大的压力。美国与墨西哥之间的贸易关系恶化也使得欧洲政策制定者感到紧张,因为特朗普可能会在没有通知的情况下向他们做同样的事情。这种方法一直是总统的作案手法。

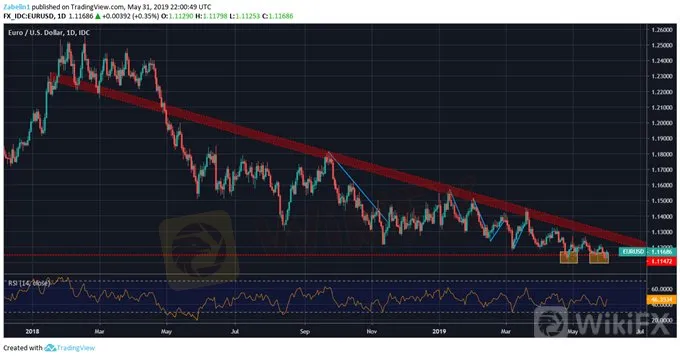

EURUSD CONTINUES TO TRADE BELOW DESCENDING RESISTANCE

欧元兑美元继续下行以防下行NCE

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: Currency Price action at the mercy of the Macro Sentiment

EURUSD Price May Retest $1.1206 Level Before Bullish Reversal Commence

EURUSD is pulling back

EUR/USD Price Analysis: Downside bias remains intact, 1.1250 likely at risk

EUR/USD looks south, with 1.1250 at risks amid firmer USD, yields. Bearish RSI supports the potential move lower towards 1.1200. 1.1300 is the level to beat for the EUR bulls for any meaningful recovery.

CDU's Leadership Election May Affect EUR

The German election will definitely affect the euro's trends.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Currency Calculator