简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Outlook: Investors Flee Risky Corporate Debt Amid Rout

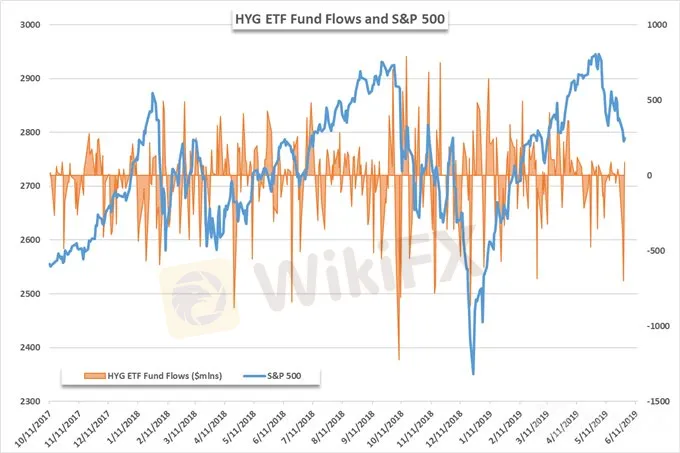

Abstract:The HYG ETF registered its largest outflow in 2019 thus far, suggesting investors are becoming increasingly concerned with the state of the S&P 500.

S&P 500 Outlook:

标准普尔500指数展望:

The HYG ETF registered an intraday outflow of -$700 million on Wednesday – the largest in 2019

HYG ETF在盘中流出了7亿美元的资金周三 - 2019年最大

In the year-to-date, broad-market tracking funds have now seen assets under management shrink

在今年迄今为止,大盘跟踪基金现已看到管理资产缩水

{3}

Retail traders are overwhelmingly short the Dow Jones and S&P 500, find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

{3}

S&P 500 Outlook: Investors Flee Risky Corporate Debt Amid Rout

标准普尔500指数展望:投资者在经历中逃离风险企业债务

The risk appetite of investors is waning as the S&P 500 and Dow Jones continue to slide. On Wednesday, the HYG ETF – which grants exposure to high yield corporate debt – registered its largest daily net outflow in 2019. The outflows effectively double down on the same theme that has sparked an unwillingness for many market participants to maintain exposure in riskier trades like Tesla and Uber.

随着标准普尔500指数和道琼斯指数继续下滑,投资者的风险偏好正在减弱。周三,HYG ETF(其为高收益公司债务提供风险敞口)在2019年实现了其最大的每日净流出。同一主题的流出量实际上翻了一番,导致许多市场参与者不愿意维持风险较高的交易,如特斯拉和优步。

Investors Shed High Yield Corporate Debt Exposure

投资者棚高收益公司债务风险

Data source: Bloomberg

数据来源:Bloomberg

Wednesdays outflow of -$700 million was the largest on a single-day basis since December 21, when traders reduced their exposure to HYG by -$864 million. In the year-to-date, the HYG ETF has returned 5.11% - compared to roughly 10% for the S&P 500. During this period, HYG has seen its net flows total $884 million, despite shedding -$1.06 billion this week alone. Interestingly, investor allocation to the largest broad-market tracking funds has shrunk in the year-to-date.

周三流出的7亿美元是自12月21日以来单日最大的一次,当时交易员将他们的HYG风险减少了8.64亿美元。今年迄今为止,HYG ETF的回报率为5.11%,而标准普尔500指数的回报率为10%左右。在此期间,HYG的净流量总额为8.84亿美元,尽管本周仅下降了10.6亿美元。有趣的是,今年迄今为止,投资者对最大的广告市场追踪基金的配置已经缩减。

Broad Market Exposure Cast Aside

广泛的市场曝光除此之外/>

Data source: Bloomberg

数据来源:Bloomberg

While investors have expressed demand for the riskier HYG fund for the year, net capital flows for the largest Index-tracking funds have dwindled in 2019. SPY, IVV and VOO, which boast a collective $536 billion in assets under management, have seen a total of -$6.3 billion leave their coffers in the first five months of 2019. Prior to May, the funds registered inflows nearing $10 billion – but a total net outflow of -$16.3 billion in the last month has shattered the capital allocation trend.

虽然投资者已表示对年度风险较高的HYG基金的需求,但最大的指数跟踪基金的净资本流量在2019年已经减少.SPY,IVV和VOO拥有管理资产总额5360亿美元的集合,在2019年的前五个月共有63亿美元的资金。在5月之前,资金流入的资金接近100亿美元 - 但净流出总额为 - 上个月的163亿美元破坏了资本配置趋势。

{15}

The lack of demand - despite an overall market gain of roughly 10% - highlights the shift in the perceived risk-reward ratio of the stock market at current valuations. With trade wars and slowing global growth, yield curve inversions and surprise tariffs, the optimism of many investors has been battered. Until some of these headwinds are resolved or there are newfound reasons for optimism, the “Sell in May and Go Away” theme is poised trickle into June.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

HFM Adds More Popular Stocks On MT4

The award-winning broker's new CFD stocks have flexible leverage, low spreads and competitive commission.

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

S&P 500 Forecast: Stocks Threaten Breakdown as TLT ETF Soars

The S&P 500 fluctuated between losses and gains on Thursday before finishing narrowly higher. Meanwhile, investors continued to clamor for safety in bonds.

Dow Jones, DAX 30, FTSE 100 Forecasts for the Week Ahead

As trade wars and monetary policy look to maintain their position at the helm, markets will be offered insight on another major theme that could rattle fragile sentiment.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator