简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Nervously Eyes ECB and EU Data, SEK May Fall on Swedish GDP

Abstract:The Swedish Krona may fall on GDP data and the Euro may struggle to rise if the ECB shows an increasing risk of a Eurozone financial crisis as key economic data is released.

TALKING POINTS – SWEDEN GDP, GERMAN UNEMPLOYMENT RATE, ITALIAN MANUFACTURING CONFIDENCE, ECB HIGHLIGHTS EUROZONE FINANCIAL RISKS

谈话要点 - 瑞典国内生产总值,德国失业率,意大利制造业信心,欧洲央行强调欧元区财务风险

Euro nervously eyes ECB assessment of financial conditions

欧元紧张地关注欧洲央行对金融状况的评估

European markets closely watch German, Italian econ data

欧洲市场密切关注德国,意大利的经济数据

SEK may fall on GDP – risks to financial system are rising

SEK可能会降低GDP - 对金融体系的风险正在上升

ECB HIGHLIGHTS EUROZONE FINANCIAL RISKS, ITALIAN, GERMAN DATA

欧洲央行强调欧元区财政风险,意大利语,德语数据

The Euro may be on its toes ahead of the release of German unemployment data and Italian manufacturing confidence. The former carries significant weight because of Germany‘s role as a powerhouse for local regional economic activity, and the latter because of Italy’s precarious growth prospects. In addition to revising its GDP outlook down, Italy may now incur a fine of up to $4 billion after violating EU budget laws.

Around the same time, the ECB will be publishing its semi-annual Financial Stability Report which will highlight potential vulnerabilities in the Eurozone financial system. This will be supplemented by commentary from ECB Vice President Luis de Guindos. Market participants will be eager to tune into this especially in light of the atmosphere-puncturing rise in Italian 10-year bond yields and fears over solvency issues.

大约在同一时间,欧洲央行将发布其半年度金融稳定报告将突出欧元区金融体系中潜在的脆弱性。欧洲央行副行长路易斯·德金多斯的评论将补充这一点。市场参与者将急于调整这一点,特别是考虑到大气层 - 意大利10年期国债收益率的上涨以及对偿付能力问题的担忧。

{10}

Furthermore, the ongoing debates in the European parliament over who will replace leaders in key EU institutions will continue to be a point of focus for Euro traders. Positions in the European Council, ECB and European Commission are up for grabs, and the uncertainty over who will take over gives plenty of reasons for Euro traders to worry, especially in light of the Eurozones economic performance for the past few months.

{10}

KRONA VOLATILITY AHEAD OF SWEDISH GDP AFTER RIKSBANK PUBLISHES FINANCIAL STABILITY REPORT

在RIKSBANK发布财务稳定报告后瑞典国内生产总值的克朗欧波动率

The Swedish Krona will likely experience higher-than-usual volatility after local GDP data is published. Quarter-on-quarter is expected to show a 0.2 percent growth print – one percent lower than the previous quarter. Year-on-year GDP growth is forecasted to show 1.7 percent growth, a downgrade from the prior report at 2.4 percent.

瑞典克朗将会在公布当地GDP数据后,我们经历了高于平时的波动。预计季度环比增长0.2% - 比上一季度低1个百分点。预计同比GDP增长率将显示增长1.7%,比之前的报告降低2.4%。

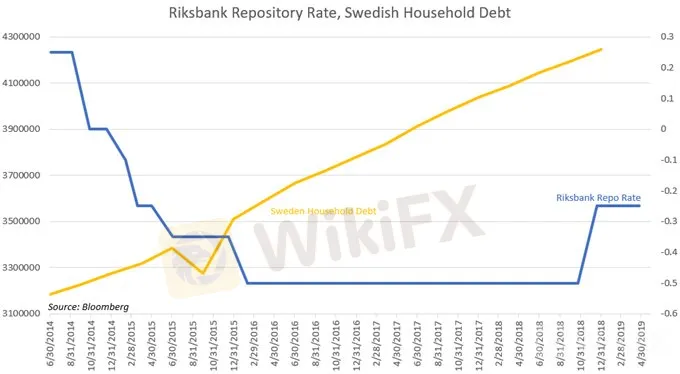

This follows the Riksbanks recent publication of its financial stability report. The paper outlines how “High indebtedness among the households in relation to earnings and assets poses risks to both macroeconomic development and financial stability”. Ultra-low rates are appealing to borrowers because the cost of taking on loans is comparatively small and therefore incentivizes taking on higher levels of debt.

这是继瑞典央行最近公布的金融稳定报告之后。该文件概述了“家庭中与收入和资产相关的高负债对宏观经济发展和金融稳定构成风险”。超低利率对借款人具有吸引力,因为贷款的成本相对较小,因此可以激励承担较高的债务水平。

However, borrowers with mortgages and households in general with larger debts face the risk of having to endure paying higher levels of interest once the Riksbank begins its rate hike cycle. The Swedish financial system in this regard is vulnerable to a sudden change in credit conditions, and with rates already in negative territory, the central bank is limited in its ability to mitigate an economic downturn.

但是,抵押贷款和一般家庭的借款人一旦瑞典央行开始加息周期,债务较大的风险就不得不忍受支付更高利息的风险。瑞典金融体系在这方面很容易受到信贷条件突然变化的影响,而且由于利率已处于负值区域,央行在缓解经济衰退方面的能力有限。

Despite laying out a plan to hike rates in the latter half of the year, it is unclear whether the prevailing economic conditions domestically and in Europe will be sufficiently strong enough to allow the central bank to raise rates. If it does so prematurely, it risks cooling an already-tepid economy and increases the probability of a recession.

尽管计划在今年下半年加息,但目前尚不清楚国内和欧洲的现行经济状况是否足够强大以至于允许央行加息。如果过早这样做,就有可能降低已经不温不火的经济,并增加经济衰退的可能性。

CHART OF THE DAY:ULTRA-LOW RATES MAY POSE RISK TO FINANCIAL STABILITY

当天的情况:超低利率可能会对财务稳定构成风险

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EURUSD May Have Volatile Spikes: Thinner Liquidity on US Holiday

EURUSD may experience volatile spikes as US markets close for the July Independence Day holiday, leaving markets thinner and exposing the pair to potentially violent swings.

NOK Eyes Crude Oil Prices, Norges Bank and FOMC Rate Decisions

The Norwegian Krone will likely experience higher-than-usual volatility alongside crude oil prices ahead of rate decisions by the Norges Bank and Fed.

USDNOK Breaks Critical Support - USDSEK Retreats at Alarming Rate

USDNOK and USDSEK are both experiencing retreats at an alarming rate, potentially opening the door to a short-term break in critical support areas.

EURUSD Regains Some Strength, Bond Yields Signal a Recession

The EURUSD has pushed past the 1.1140 resistance line but traders will be eyeing German CPI and US PCE Core figures to strengthen their position. Worries about a recession have pushed long-term government yields around the world to the lowest level in years

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator