简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Steadies as May FOMC Minutes Detail “Patient” Approach

Abstract:The May FOMC minutes detailed a reserved conversation among policymakers who believed that patience on rates would be appropriate for the foreseeable future.

FOMC Minutes Talking Points

The May FOMC minutes detailed a reserved conversation among policymakers who believed that patience on rates would be appropriate for the foreseeable future.

Many FOMC members saw the early-2019 dip in inflation readings as “transitory.”

Rates markets show a small dip in 2019 rate cut odds relative to where they stood prior to the May FOMC minutes release.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The May Fed meeting minutes suggest that policymakers will be keeping interest rates at their current level for the foreseeable future. The May FOMC minutes echoed Fed Chair Jerome Powell‘s remark at the May Fed meeting press conference that the slowdown in inflation was “transitory” and not “persistent.” It’s worth noting that US inflation expectations have subsided in the weeks since the May Fed meeting.

In accordance with the FOMC‘s neutral view, the minutes noted that “members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time.” Earlier this year, the March Summary of Economic Projections’ dot plot suggested that FOMC members did not believe rates would move for the rest of 2019, before one 25-bps rate hike in 2020.

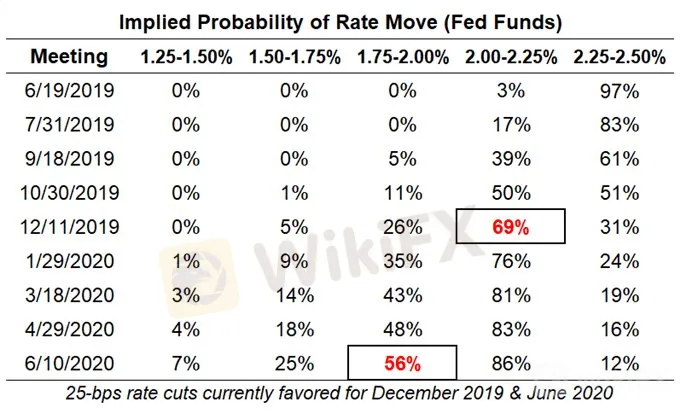

Fed Funds Futures Rate Expectations (May 22, 2019) (Table 1)

Following the May FOMC minutes, Fed funds futures were pricing in 69% chance of a 25-bps rate cut by the end of 2019 – barely lower than the 70% odds seen prior to the release.

DXY Index Technical Analysis: 1-minute Price Chart (May 22, 2019 Intraday) (Chart 1)

Following the release of the May FOMC minutes, the US Dollar (via the DXY Index) gyrated higher and lower, but ultimately steadied around levels seen prior to 14 EDT/18 GMT. Ahead of the release, the DXY Index was trading at 98.02, which is where it was last seen at the time this note was written.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

Global Economic and Financial Highlights: July 18, 2024

Today's news covers significant developments in global markets and politics. President Biden's campaign faces challenges due to a COVID-19 diagnosis, while China's economic strategies and tech advancements remain in focus. Key updates include the impact of US semiconductor restrictions, rising tensions in global trade, and significant shifts in corporate strategies and financial markets. The news reflects the dynamic and interconnected nature of the global economy.

Special Article: Analysis of FOMC Minutes

The FOMC minutes highlighted financial strains on low-to-moderate-income households, the Fed's data-dependent approach, and the impact of geopolitical risks. Discussions included immigration's positive impact on the labor force and modest progress toward disinflation. Potential rate cuts were mentioned if the job market deteriorates significantly. This cautious outlook emphasizes balancing inflation control and economic support.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator