简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BRL, Ibovespa at Risk From Brazil-China Investment Negotiations

Abstract:The Brazilian Real and Ibovespa equity index will be watching Brazil-China negotiations as officials discuss Beijing‘s investment into Latin America’s largest economy.

TALKING POINTS – BRL, IBOVESPA FUTURES, BOLSONARO, GLOBAL GROWTH

-

Brazil Vice President Hamilton Mourao to meet with high-level officials, Xi Jinping

This is part of a diplomatic effort to fortify relationship after Bolsonaros comments

Weaker demand out of China, slow pension reform progress weighs on Brazil econ

See our free guide to learn how to use economic news in your trading strategy!

BRAZIL-CHINA RELATIONS

BRL and the benchmark Ibovespa equity index will be closely watching the five-day negotiations between Brazilian Vice President Hamilton Mourao and high-level Chinese officials. Hamilton is expected to meet with General Secretary of the Communist Party of China Xi Jinping. Brazil-China relations have somewhat deteriorated ever since Jair Bolsonaro became President.

“The Chinese can buy in Brazil, but they cant buy Brazil”, said Bolsonaro. Most of his appointees have a military background, and as such, are hesitant to have close ties with a country that potentially poses a security threat. This comes against the backdrop of greater scrutiny over potential security threats posed by Chinese tech giant Huawei.

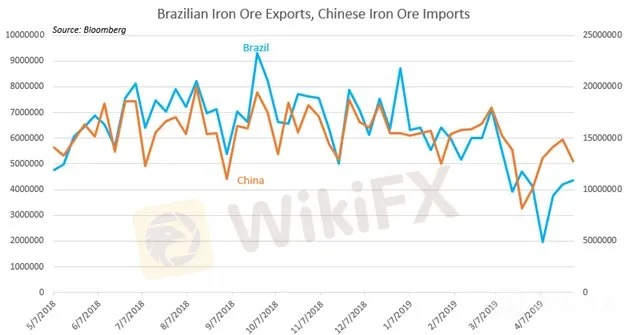

Both China and Brazil are major players in the emerging market association known as BRICS – Brazil, Russia, India, China and South Africa. China is also Brazil‘s largest trading partner and the biggest consumer of Brazilian iron ore. Brazil may also soon replace the US as China’s biggest client of imported soybean products due to Beijings tariff imposition on US-based soybean crops.

Brazil-China tensions have already somewhat softened after officials in Sao Paulo stated that they will no longer seek WTO intervention on China‘s policies on sugar tariffs. The concession was likely a gesture of good faith ahead of this week’s talks and may provide a more favorable backdrop to investment negotiations.

However, the small boon granted from the US-China trade war is outweighed by the cost associated with the economic conflict. As an emerging market economy, Brazilian assets are particularly sensitive to changes in global risk appetite. This reaction will only be amplified as the government attempts to open up Brazils economy to the world, making it more in sync – or vulnerable – to changes in global demand.

BRAZIL ECONOMY OUTLOOK

A few days ago, the Brazilian Economy Ministry cut the country‘s GDP forecast for 2019 from 1.6 percent to 2.2 percent. Some of this has to do with the slow progress and uncertain outlook on Bolsonaro’s market-disrupting pension reforms and the implications they have domestic growth prospects. Pessimism over the outcome has led to slower economic activity and reduced the appeal of the Brazilian Real.

USDBRL at its Highest Point Since October 2018 – Daily Chart

The Ibovespa has been showing some improvement, with futures retesting support after previously breaking through it. While Brazilian markets have been primarily driven by the progress on pension reforms, this market move may have less to do with the structural plans and more with the central bank. If economic data continues to underperform, it may prompt monetary authorities to adjust to a more dovish stance.

Ibovespa Futures Retesting Support

The prospect of cheaper credit may therefore be the leading cause behind the rally in the Ibovespa. Looking ahead, US-China trade relations will persist as a global fundamental headwind and will continue to pressure Brazilian exports. Looking ahead, negotiations between China and Brazil will be crucial to see if a stronger relationship will lead to greater investment that could help lift up Brazilian economic activity.

FX TRADING RESOURCES

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Brazilian Real, Ibovespa Index Forecast: Major Breakout Ahead?

USDBRL and the benchmark Ibovespa equity index are teetering on the edge of major price levels. If breached with follow-through, a selloff or rally may ensue.

USD/BRL Eyeing Brazil GDP, Manufacturing PMI and Fed Testimony

USD/BRL traders will be closely watching Brazilian GDP and manufacturing PMI amid the ongoing pension negotiations along with the Fed Chairmans congressional testimony.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator