简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SEK, NOK May Fall on Key Local, Euro Area Economic Data

Abstract:The Swedish Krona and Norwegian Krone are in for a tumultuous 24 hours ahead of local and Eurozone economic data, Brexit and the European elections.

SEK, NOK TALKING POINTS – EUROPEAN ELECTIONS, SWEDEN UNEMPLOYMENT RATE, NORWAY EMPLOYMENT DATA

Swedish Krona and Norwegian Krone eye local unemployment data

ECB meeting minutes, German data and Eurozone PMI in focus too

European elections, Brexit-related talks may induce major volatility

See our free guide to learn how to use economic news in your trading strategy!

The Swedish Krona and Norwegian Krone will find themselves at the mercy of local unemployment data and major European event risk. Eurozone PMI, German IFO business climate surveys and GDP will be market-disrupting data to monitor, particularly for Nordic economies. Between 70 percent-80 percent of all of Sweden‘s and Norway’s exports head to the EU.

GERMAN IFO DATA, EUROZONE PMI, EUROPEAN ELECTIONS

Germany – the so-called “steam engine of Europe” – is a major Eurozone economy Nordic policymakers monitor because of the implications it has on regional growth prospects. Today is also the beginning of the European parliamentary elections, a continent-wide vote where Europeans will cast their ballot and express their true happiness – or discontent – with the 60-year project.

Eurosceptic parties are projected to make unprecedented gains, leading to concerns about whether the functional integrity of the EU will be able to endure such a radical ideological re-alignment. Key regulatory parameters on budget deficits and external trade policy may be at the mercy of a less liberally-minded legislature.

The impact on regional growth may cool economic activity and hurt export-driven economies and sentiment-linked currencies like the Krona and Krone. The latter will be particularly vulnerable if global sentiment wanes because of the Norwegian economys reliance on the petroleum sector. Crude oil prices are at the mercy of oscillations in global sentiment, and the European elections may be a catalyst for global risk aversion.

Souring sentiment may be further compounded by underwhelming Eurozone PMI data. While economic performance out of the EU has been improving, European growth is far from comforting. The ECB meeting minutes will also provide greater insight into how officials feel about the outlook, and what impact Europes changing political landscape will have on monetary policy in the future.

BREXIT

Riksbank officials have repeatedly cited Brexit as a major concern for Swedish growth prospects. The most recent developments offer little comfort to investors and policymakers around the world. Prime Minister Theresa May has come under greater pressure to step down from her post amid dissatisfaction within her own party of her handling of the UK-EU divorce. GBPUSD is teetering on the edge of breaking below key support.

Having May step down would only introduce more uncertainty into an already-complex equation that no policymaker can seem to solve. Having a different Prime Minister with an unknown agenda may only increase the probability of a no-deal Brexit. Were the UK to crash out of the EU, the economic reverberations would not be solely contained to Europe but would ripple across global financial markets.

SWEDEN UNEMPLOYMENT RATE, NORWAY EMPLOYMENT DATA

In Sweden and Norway, unemployment data will likely show weakness after both economies broadly underperformed in April. Crude oil prices broke below major support that month and have since struggled to regain upward momentum. As a sentiment-linked commodity, crude oil prices strongly respond to changes in global risk appetite, and the Norwegian economys reliance on the petroleum sector leaves its currency exposed to this same risk.

For months, Sweden‘s economic performance relative to expectations has been dismal. If the unemployment rate comes in worse than expected, it would fall in line with the country’s broader trend of overall weakness. The Swedish Krona may even fall if the unemployment rate comes in at 6.9 percent, that would still leave it at its highest point since 2018.

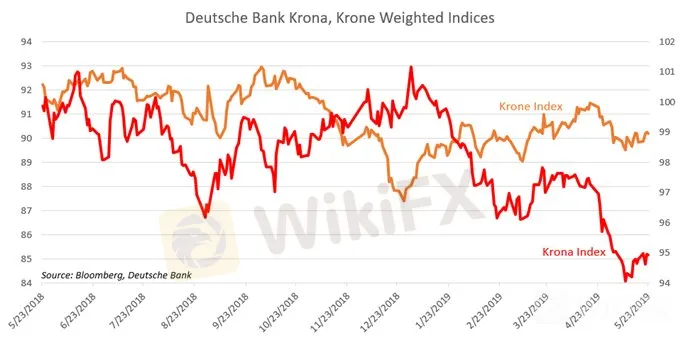

CHART OF THE DAY: KRONA, KRONE INDIXES SHOWING BROAD WEAKNESS

NOK, SEK TRADING RESOURCES

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

Euro May Extend Gains vs NOK and Aim to Re-Test 11-Year High

The Euro may rise vs the Norwegian Krone this week and push EURNOK to retest the 11-year high at 10.0972, a level not reached since the 2008 financial crash.

Crude Oil Prices, NOK May Fall on Norway Sovereign Wealth Fund Data

Crude oil prices and the Norwegian Krone may fall if the world‘s largest petroleum-linked sovereign wealth fund’s earnings amplify global recession fears.

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

WikiFX Broker

Latest News

Japan to Take Action to Stabilize the Yen

Ringgit Remains Flat Amid Holidays, US Debt Concerns Loom

Taurex: Is it Safe to Invest?

Vietnamese Police Bust $1.2 Million Crypto Fraud Case

WikiEXPO Global Expert Interview: Loretta Joseph——Unlock the forefront of digital finance

Malaysia’s Securities Commission Enforces Ban on Bybit & Its CEO

Will Gold Shine Brighter in 2025?

Will Inflation Slow Down in the New Year 2025?

The WikiFX 2024 Annual User Report is here! Come and claim your exclusive identity!

SCAM ON SCAM: New Tactic Used by Scammers

Currency Calculator