简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Breakout on Hold as Prices Return to Range, Volatility Drops

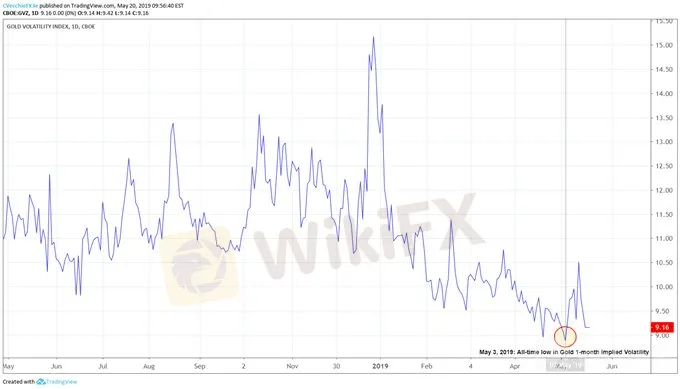

Abstract:After hitting a four-week high in early-May, Gold implied volatility has quickly slumped back towards its all-time low.

Gold Price Talking Points:

The Gold breakout during the first half of May has failed, with price returning back into the 1266.18 to 1288.58 range from April 15 to May 13.

After hitting a four-week high in early-May, Gold implied volatility has quickly slumped back towards its all-time low.

Changes in retail traders positioning suggest that Gold prices could still fall.

{5}

Looking for longer-term forecasts on Gold and Silver prices? Check out the DailyFX Trading Guides.

{5}

The return of uncertainty over the US-China trade war negotiations initially proved bullish for safe haven assets like the Japanese Yen and US Treasuries. But amid a return of US Dollar strength alongside the bid in safe havens, gold prices have been hobbled in recent days, effectively neutralizing bullions appeal during a time of risks seemingly rising everywhere around the globe.

Shortly after hitting an all-time low on May 3, GVZ, the measure of 1-month implied Gold volatility, rebounded to a four-week high as new developments in the US-China trade war spooked investors globally. While rising volatility is usually seen as a disconcerting development for prices, Gold benefits from rising volatility: higher levels of uncertainty increase the safe haven appeal of Gold.

GVZ (Gold Volatility) Technical Analysis: Daily Price Chart (May 2018 to May 2019) (Chart 1)

Keeping this in mind, the past few weeks have seen measures of Gold volatility fall, and in turn, the appeal of Gold wane. GVZ peaked on May 13, and Gold prices hit their monthly high the following day; as Gold volatility has quickly slumped back towards its all-time low, the Gold price breakout from early-May has failed in turn.

But with gold volatility falling against a backdrop of a strengthening US Dollar, gold prices finished last week back within the former range carved out between 1266.18 and 1288.58 from April 15 to May 13. Typically, when false breakouts occur, we see price return to the other side of the consolidation; we thus cant rule out a further drop in gold prices towards the consolidation support.

Gold Price Technical Analysis: Daily Chart (April 2018 to May 2019) (Chart 2)

In early-May, gold prices attempted to climb through four-week consolidation resistance above 1288.58, and for several days, it appeared that a bullish breakout was gathering pace; the downtrend from the February and March swing highs was temporarily broken as well.

Nevertheless, the gold price forecast is still neutral so long as the range is in place; the breakout is on hold for now. Should gold prices move above 1288.58, we would again be looking at topside break of the consolidation as well as the downtrend from the February and March 2019 highs, while, a drop below 1266.18 would constitute a downside break of the consolidation as well as the uptrend from the late-2018 swing lows.

IG Client Sentiment Index: Spot Gold Price Forecast (May 20, 2019) (Chart 3)

Spot gold: Retail trader data shows 79.5% of traders are net-long with the ratio of traders long to short at 3.89 to 1. The number of traders net-long is 10.2% higher than yesterday and 5.0% higher from last week, while the number of traders net-short is 7.0% higher than yesterday and 31.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests spot gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger spot gold-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

{21}

Follow him on Twitter at @CVecchioFX

{21}

View our long-term forecasts with the DailyFX Trading Guides

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Struggle Even as Markets Convulse Amid Omicron Fears

Gold prices seesawed on Omicron variant news as real rates rose. Testimony from Fed Chair Powell now in focus, may offer support. Technically, prices are testing the mettle of a three-month uptrend

Gold Forecast - Gold Looks to Defend Key 1800 Level as PCE Inflation Data Nears

Gold plunges after Biden renominates Powell to Fed Chair. XAU traders eye US inflation data due out this Wednesday. 1800 level key to direction, will bears break below the level?

Gold Prices Rise Post CPI, But US Dollar Strength Outshines. Will XAU/USD Go Higher?

Gold broke higher after eye popping US inflation last week before pausing. Treasury yields continued higher and USD buying eventually dominated gold. Inflation focus has faded but Fed action lingers. Where to for XAU/USD?

Gold Price Forecast: XAU/USD Eyes US Retail Sales for Direction

Gold Forecast - prices look higher after big gain on inflation worries. US retail sales may provide the key for XAU’s direction. XAU/USD eyes psychological 1900 level as prices gain.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator