简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar May Extend Drop as Yen Gains on OECD Outlook

Abstract:The Australian Dollar may continue to fall after a bruising Asia Pacific trading session as a downbeat OECD economic forecast update spooks risk appetite.

AUD, NZD, RBA, LOWE, RBNZ, US-CHINA TRADE WAR, OECD, USD – TALKING POINTS:

Australian Dollar down after RBA meeting minutes, Lowe speech

New Zealand Dollar dragged lower alongside Aussie counterpart

US Dollar to rise with Yen if markets risk appetite deteriorates

The Australian Dollar underperformed in Asia Pacific trade after minutes from Mays RBA policy meeting signaled that the central bank may be ready for a rate cut as soon as next month. A subsequent speech from the central banks Governor Philip Lowe seemed to make the case for easing even more explicit. He went so far as to confirm that policymakers have an “easing bias”.

The New Zealand Dollar followed its Aussie cousin downward. That might have reflected investors extrapolating the two economies‘ broadly analogous profiles to mean that the RBA’s defensive stance might portend RBNZ rate cuts too. Both countries are cycle-sensitive commodity exporters on the front lines of a slowdown in global growth and an escalating US-China trade war.

AUD, NZD MAY EXTEND DROP AS YEN GAINS ON OECD OUTLOOK

Looking ahead, commodity bloc currencies might face further pressure as the OECD issues an updated set of economic forecasts. A raft of downgrades seems likely. Timely PMI survey data puts the pace of worldwide manufacturing- and service-sector growth near a three-year low. Meanwhile, a measure of overall macro data flow reveals it has tended to undershoot baseline forecasts by meaningful margin.

A downbeat revision might weigh on market-wide risk appetite, inspiring another round of systemic de-risking. The Yen is likely to gain in this scenario as carry trades funded in terms of the perennially low-yielding Japanese unit are unwound. Meanwhile, the US Dollar might rise as liquidation puts a premium on the benchmark currencys unmatched liquidity.

Did we get it right with our latest FX market forecasts? Get them free to find out!

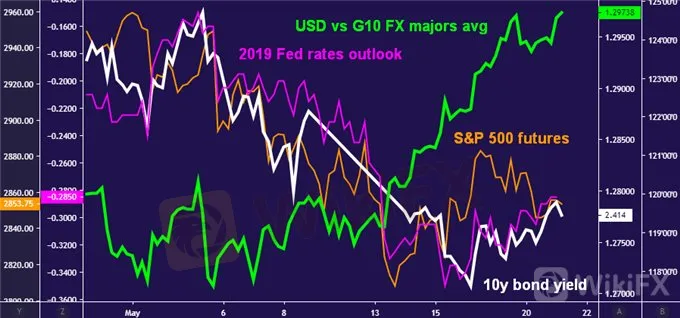

CHART OF THE DAY – US DOLLAR GAINS REFLECT HAVEN DEMAND

Currencies are typically expected to fall when their central banks are seen pivoting to a more dovish policy stance. The US Dollar has marked a clear exception to the rule. It has jumped to a seven-year high against an average of its major counterparts even as the priced-in policy outlook implied in Fed Funds futures flounders alongside benchmark 10-year Treasury bond yields.

The bellwether S&P 500 fell in tandem, implying a backdrop of risk aversion. In this scenario, it is not unusual to see lending rates decline as haven flows lift Treasuries while tightening prospects – such as they are – fizzle. That the Greenback has managed to thrive in this environment seems to clearly mark it out as a haven asset. If investors mood counties to sour, it may have scope to probe headier highsstill.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

<Part 2> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

<Part 1> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator