简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NZDUSD Rate to Eye November-Low on RBNZ Rate-Cut, Dovish Guidance

Abstract:The Reserve Bank of New Zealand (RBNZ) interest rate decision may trigger a selloff in NZD/USD as the central bank is expected to deliver a 25bp rate-cut.

Trading the News: Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

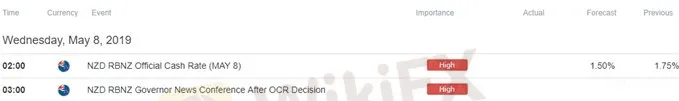

The Reserve Bank of New Zealand (RBNZ) interest rate decision may trigger a selloff in the NZD/USD exchange rate as the central bank is expected to cut the official cash rate (OCR) to a fresh record-low of 1.50%.

The recent shift in the forward-guidance for monetary policy have spurred bets for lower interest rates as Governor Adrian Orr & Co. warn that ‘the more likely direction of our next OCR move is down,’ and it seems as though the central bank will take additional steps to insulate the economy as ‘the risk of a more pronounced global downturn has increased.’ In turn, NZD/USD stands at risk of giving back the rebound from the November-low (0.6514) should the RBNZ deliver a 25bp rate-cut paired with a dovish forward-guidance for monetary policy.

However, the RBNZ may merely attempt to buy more time as officials expect ‘low interest rates, and increased government spending and investment, to support economic growth over 2019,’ and more of the same from the central bank may spark a short-term pop in the New Zealand dollar as market participants scale back bets for an imminent rate-cut.

Sign up and join DailyFX Analyst David Cottle LIVE to cover the RBNZ interest rate decision

Impact that the RBNZ rate decision had on NZD/USD during the previous meeting

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

| MAR 2019 | 03/27/2019 01:00:00 GMT | 1.75% | 1.75% | -110 | -114 |

March 2019Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

NZD/USD 10-Minute Chart

As expected, the Reserve Bank of New Zealand (RBNZ) kept the official cash rate (OCR) at the record-low of 1.75% in March, but altered the forward-guidance for monetary policy, with Governor Orr & Co. warning that ‘the more likely direction of our next OCR move is down.’

It seems as though the RBNZ will continue to change its tune over the coming months as ‘the risk of a more pronounced global downturn has increased,’ and the central bank may prepare New Zealand households and businesses for an imminent rate-cut as officials abandon the wait-and-see approach for monetary policy.

The New Zealand dollar sold off as the RBNZ endorsed a dovish outlook, with NZD/USD quickly tumbling below the 0.6900 handle to close the day at 0.6797. Learn more with the DailyFX Advanced Guide for Trading the News.

NZD/USD Rate Daily Chart

Keep in mind, the broader outlook for NZD/USD is no longer constructive as both price and the Relative Strength Index (RSI) fail to retain the upward trends from earlier this year, with the exchange rate breaking down from a long-term wedge/triangle formation following the series of failed attempts to break/close above the 0.6930 (23.6% expansion) to 0.6960 (38.2% retracement) region.

Will keep a close eye on the monthly opening range as NZD/USD comes up against the Fibonacci overlap around 0.6600 (23.6% retracement) to 0.6630 (78.6% expansion), but the exchange rate stands at risk for range-bound conditions as it holds above the April-low (0.6580).

However, the rebound from the November-low (0.6514) may continue to unravel as the RSI falls back towards oversold territory, with a break/close below the 0.6520 (100% expansion) raising the risk for a move towards the overlap around 0.6400 (61.8% retracement) to 0.6430 (78.6% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator