简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

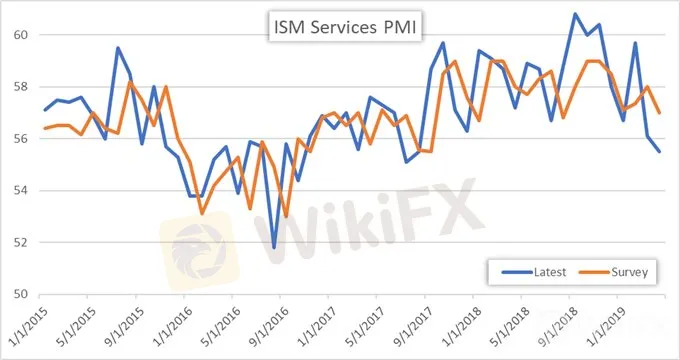

ISM Services Index Falls to Lowest Point Since August 2017

Abstract:The Institute for Supply Managements Non-Manufacturing Index recorded an unexpectedly large dip last month with the gauge reported at 55.5 versus analyst expectations of 57.0 for April.

ISM Services Index Talking Points:

Despite missing estimates, economic activity grew in April for the 111th consecutive month

Growth continues in the non-manufacturing sector with business activity leading the way

Despite business activity growing, new orders, the employment index and the prices index all decreased

The US non-manufacturing sector continued to chug along in April, as the Institute for Supply Management indicated this morning that the Services PMI posted a reading of 55.5 percent. Although this mornings data point missed analyst expectations of 57.0, the reading still signals sector gains seeing that a reading above 50.0 indicates growth. This contrasts to the Markit Services PMI of 52.9 reported earlier last month.

ISM Services Index - April 2019

Todays reading of 55.5 puts the services sector at its 111th month of consecutive growth. Although, there are some concerns behind the numbers, the NMI is a composite index of four underlying indicators of business activity, new orders, employment and supplier deliveries. While business activity increased to 59.5 percent in April, which is 2.1 percentage points higher than March and the 117th straight month of growth, new orders, employment and the prices index all declined from their march reading.

Even with the index missing expectations and 3 of the 4 indicators the ISM uses fell from March, the industry continued to grow. While the headline indicator is data driven, ISM collects comments from business managers. Respondents in the survey noted having to increase wages to comply with mandated minimum wage levels, higher construction traffic due to lower mortgage rates, backlogs in supply chains, and a difficulty in finding qualified workers.

The difficulty in respondents noting a difficulty in finding workers, comes as no surprise, as this mornings job numbers from the BLS show that the labor market remains considerably tight. Other notables from the ISM report are rising fuel and labor prices, along with a short supply of construction subcontractors and labor in general.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator