简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Central Bank Weekly: Fed and BOE Shape Currency and Growth Forecasts

Abstract:This week weve seen the Federal Reserve surprise markets while the Bank of England remains sidelined thanks to Brexit.

Talking Points

谈话要点

{1}

- After Fed Chair Powells press conference, a pullback inFederal Reserve rate cut expectationshelped spur a reversal in the US Dollar.

{1}

- Even though the Bank of England produced a new Quarterly Inflation Report (QIR) at its May meeting, policy remained and will remain on hold until Brexit is resolved.

- 尽管英格兰银行在5月份的会议上制定了新的季度通胀报告(QIR),但政策仍然存在并将一直搁置,直到英国退欧解决。

- Retreating Fed funds cut odds for 2019, particularly if they feed into higher US Treasury yields, will help the US Dollar and hurt gold prices.

- 撤回联邦基金削减2019年的赔率,特别是如果他们提高美国国债收益率,将有助于美元并损害金价。

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

寻找更长期关于美元的预测?查看DailyFX交易指南。

The Federal Reserve‘s and Bank of England’s May policy meetings could not have produced more divergent results for their local currencies. The US Dollar saw considerable volatility on May 1 after Fed Chair Jerome Powell said that low inflation was “transitory” and not “persistent,” taken as a sign that the likelihood of the Fed lower rates this year is smaller than otherwise anticipated. The British Pound can't say it experienced anything meaningful after the May BOE meeting.

美联储和英格兰银行5月份的政策会议不可能为其本地货币产生更多不同的结果。在美联储主席杰罗姆鲍威尔表示低通胀是“暂时的”而不是“持久性”之后,美元在5月1日出现了相当大的波动,这表明美联储今年降息的可能性小于预期。在5月份的英国央行会议之后,英镑不能说它经历了任何有意义的事情。

Bank of England Remains Sidelined by Brexit

英国央行仍然受英国脱欧的支持

The BOE‘s May meeting brought about a new Quarterly Inflation Report (QIR), the Monetary Policy Committee’s equivalent to the Feds Summary of Economic Projections (SEP). While the QIR release would constitute a significant event in any given month, recently, and for the foreseeable future, the QIR has been a non-event.

英国央行5月会议带来了新的季度通胀报告(QIR),货币政策委员会相当于美联储经济预测摘要(SEP)。虽然QIR发布将在任何特定月份,最近和可预见的未来构成重大事件,但QIR一直是非事件。

The fact of the matter is that in an effort to appear apolitical, the BOE will stay on the sidelines of the UK economy until the Brexit talks are resolved. Look no further than the bland reaction in GBPUSD around the BOE meeting today for confirmation that this is a lifeless market without Brexit headlines: a neutral doji candle formed during the hour around the QIR release.

事实是在英国脱欧谈判得到解决之前,英国央行将继续保持英国经济的观望态度。英国退欧今日会议围绕英镑兑美元的温和反应,确认这是一个没有英国脱欧头条新闻的无生命市场:在QIR发布时间内形成的中性十字架蜡烛。

Fed Funds No Longer Confident About a Rate Cut

联邦基金对降息不再有信心

Rates markets have been more active in recent days, slowly pricing out the likelihood of a Fed rate cut in 2019; much of this was spurred on in the past 24-hours. At their apex at the end of March, markets were pricing in a 58% chance of a 25-bps rate cut in September; now, odds of a September cut are only 32%.

最近几天利率市场变得更加活跃,缓慢定价美联储的可能性te切入2019年;其中大部分都是在过去的24小时内激发的。在3月底的顶点,市场定价9月份降息25个基点的可能性为58%;现在,九月份降息的可能性仅为32%。

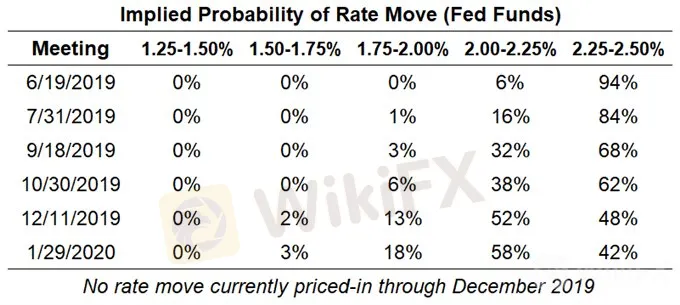

Federal Reserve Rate Hike Expectations (May 2, 2019) (Table 1)

美联储加息预期(2019年5月2日)(表1)

The probability of a rate cut in 2019 has been diminished meaningfully over the past week. Ahead of the May Fed meeting, there was a 68% chance of a 25-bps rate cut by the end of the year; now those odds have fallen down to 52%. A continued retracement in Fed cut expectations for 2019 will serve to benefit the US Dollar, just as it did during Fed Chair Powells press conference on May 1.

2019年降息的可能性在过去一周有意义地减弱。在5月美联储会议召开之前,到年底降息25个基点的可能性为68%;现在这些可能性已降至52%。美联储削减2019年预期的持续回撤将有利于美元,正如5月1日美联储主席鲍威尔新闻发布会期间所做的那样。

We can measure whether or not a rate cut is being priced-in for 2020 by examining the difference in borrowing costs for commercial banks over a one-year time horizon in the future. Over the past two weeks, rate expectations have been slowly pricing out a cut, with rates markets discounting -24-bps by the end of 2020; this is a 4-bps increase from this time last week.

我们可以衡量是否通过研究未来一年时间内商业银行的借贷成本差异,降息将在2020年定价。在过去的两周里,利率预期一直在缓慢降价,到2020年底利率市场的折扣为-24-bps;这比上周这个时间增加了4个基点。

Eurodollar December 2019/2020 Spread: Daily Timeframe (October 2018 to May 2019) (Chart 1)

Eurodollar 2019/2020/2020点差:每日时间表(2018年10月至2019年5月)(图1)

Readings have oscillated around one cut being priced-in for most of April. Receding 2020 rate cut expectations have provided the spark that the US Dollar has needed to retain its bullish breakout attempt following a six-month consolidation dating back to November 2018.

4月份的大部分时间里,读数大约在一次降价。在2018年11月进行的为期六个月的整合之后,2020年降息预期提供了美元需要保持其看涨突破尝试的火花。

DXY INDEX TECHNICAL ANALYSIS: DAILY PRICE CHART (JUNE 2018 TO APRIL 2019) (CHART 2)

DXY指数技术分析:每日价格表(2018年6月至2019年4月)(图2)

After the May Fed meeting, the US Dollar‘s (via the DXY Index) bullish daily hammer reestablished price above the daily 8-, 13-, and 21-EMA envelope. While it initially appeared that the US Dollar’s breakout attempt after a six-month consolidation may have been a failure – price fell back below former resistance at 97.72 – we must conclude that it is too soon to write-off a bullish outcome. Indeed, the DXY Index is back above 97.72 at the time of writing.

5月美联储会议后,美元(通过看跌每日锤子重新建立的价格高于每日8,13和21-EMA信封。虽然最初似乎美元在六个月合并后的突破尝试可能是失败的 - 价格回落至低于前者阻力位在97.72 - 我们必须得出结论认为,现在还不能撇开看涨结果。事实上,在撰写本文时,DXY指数已回到97.72以上。

Consider the fact that prior to the May Fed meeting, rates markets were pricing in a 68% chance of a 25-bps rate cut by the end of 2019; after Fed Chair Powells press conference, there is only a 52% chance. A further retrenchment in rate cut expectations should prove supportive for the US Dollar and disruptive for gold prices.

考虑到事实上,在5月美联储会议之前,利率市场估计到2019年底降息25个基点的可能性为68%;在美联储主席鲍威尔新闻发布会之后,只有52%的可能性。进一步裁员降息预期应该证明对美元的支持和对金价的破坏。

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 26 August: Bitcoin (BTC) Breaks Out Above $60,000, Faces Resistance at $72,000

Bitcoin traded above $60,000 on Friday, gaining over 4% this week but staying within a $57,000 to $62,000 range for the past 15 days. On-chain data reveals mixed signals, with institutions accumulating while some large holders are selling. Inflows into US spot Bitcoin ETFs and potential volatility from ongoing Mt.Gox fund movements could impact Bitcoin's price in the coming days.

Gold Price Tops $2500 For the First Time

Gold prices soared above the $2,500 mark for the first time, driven by expectations of potential interest rate cuts, which have weakened the dollar to its recent low levels. Market participants are now focused on Wednesday’s FOMC meeting minutes for insights into the Fed’s next monetary policy moves.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator