简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: EURUSD in Spotlight Ahead of EZ Inflation, US NFP

Abstract:Tomorrow's economic data from the Eurozone and United States highlights EURUSD with inflation and nonfarm payroll numbers on deck. What might forex traders expect for spot prices?

EURUSD CURRENCY VOLATILITY – TALKING POINTS

Although expected EURUSD price action has fallen slightly with GDP data in the rearview mirror, overnight implied volatility remains elevated with Eurozone inflation and US nonfarm payrolls slated for release tomorrow

Spot EURUSD trades back below the 1.12 handle following a relatively hawkish Fed yesterday, but upcoming data could help the Euro rebound back above this technical level or reinforce the dollars dominance

Take a look at this article for information on the How to Trade the Top 10 Most Volatile Currency Pairs or download the free DailyFX 2Q USD Forecast for comprehensive fundamental and technical insight on the US Dollar over the second quarter

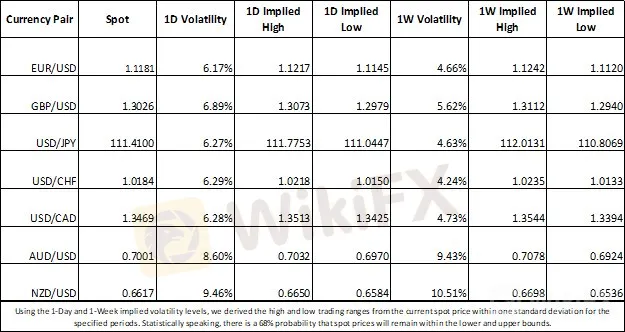

EURUSD overnight implied volatility appears relatively high at 6.17 percent ahead of Eurozone inflation and US nonfarm payroll data due for release tomorrow. This compares to the average of 4.93 percent during April and 5.69 percent year-to-date.

FOREX MARKET IMPLIED VOLATILITY AND TRADING RANGES

Spot EURUSD trades below the 1.12 handle once again after the latest Fed meeting revealed a less-dovish tilt which casted a shadow over bullish prospects for this currency pair. With GDP data, FOMC and Powell presser risk now in the rearview mirror, forex traders will likely turn to high-impact economic indicators expected during Fridays session to reassess positioning biases.

FOREX ECONOMIC CALENDAR – EURUSD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Eurozone year-over-year core CPI for April is forecasted to cross the wires at 1.0 percent. If this inflation measure undershoots estimates, EURUSD could slide further seeing that a soft number would likely underpin the ECBs easing bias. On the other hand, a better than expected reading could help the Euro recover from its recent downside.

As for the greenback, another robust US jobs report has potential of reigniting the long-prevailing EURUSD downtrend. Conversely, a materially worse-than-expected number could jeopardize the dollars recent advance.

{12}

Other economic indicators worth watching out of the US included the change in unemployment rate, average hourly earnings and the ISM Services Index.

{12}

EURUSD PRICE CHART: 4-HOUR TIME FRAME (MARCH 20, 2019 TO MAY 02, 2019)

Judging by EURUSD overnight implied volatility, forex traders might expect the currency pair to trade between 1.1145 and 1.1217 with a 68 percent statistical probability. However, bearish technical indicators could pose headwinds to EURUSD upside.

For example, support-turned-resistance at the 1.12 handle and the 23.6 percent Fibonacci retracement level drawn from the high and low recorded on March 20 and April 26 respectively might hinder spot prices from advancing.

EURUSD TRADER SENTIMENT PRICE CHART: DAILY TIME FRAME (NOVEMBER 05, 2018 TO MAY 02, 2019)

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to client positioning data from IG, 54.9 percent of EURUSD traders are net-long with the ratio of traders long to short at 1.22 to 1. While the number of traders net long is 3.5 percent higher than yesterday and 19.5 percent lower than last week, the number of traders net-short is 6.7 percent higher than yesterday and 45.4 percent higher than last week.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has several free resources available to help you: a comprehensive education center, a proprietary indicator for monitoring trader sentiment; informativetrading guides and forecasts; analyticalwebinars held daily, and much more.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

OFX: Is It Good to Go? Broker Review

Financial Educator “Spark Liang” Involved in an Investment Scam?!

Currency Calculator