简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: Euro and Mexican Peso Ripe for Price Action

Abstract:Eurozone and Mexico GDP puts EURUSD and USDMXN in forex traders' crosshairs for currencies to watch ahead of tomorrow's potentially market-moving data.

CURRENCY VOLATILITY – TALKING POINTS:

Implied volatility measures remain subdued, but signs continue to emerge that currency volatility could soon return to forex markets and aligns with risks from high-impact economic data and events this week that could trigger price action

Traders will likely examine tomorrows slew of GDP data which is expected to primarily impact the Euro, Mexican Peso and Canadian Dollar

Take a look at How to Trade the Top 10 Most Volatile Currency Pairsor read up on Market Cycle Phases, Stages and Common Characteristics for additional insight

Unsurprisingly, EURUSD overnight implied volatility spiked ahead of tomorrows economic growth data from the Eurozone and now sits at 5.78 percent, slightly above its 2019 average. EURUSD 1-Day expected price action has drifted lower, however, from a reading of 7.23 percent before the US GDP report release last Friday.

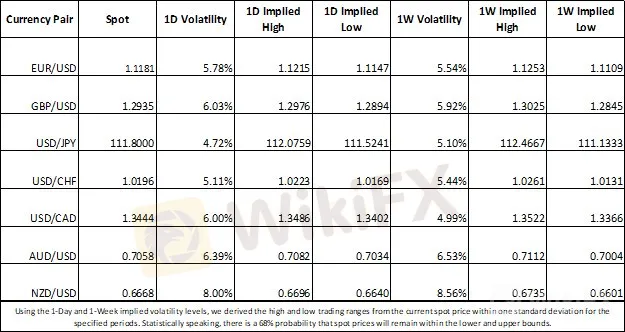

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

This could indicate that currency traders are expecting Eurozone GDP (1Q19 YoY) to fall relatively in line with the 1.1 percent forecast whereas more uncertainty clouded expectations for US GDP data.

Yet, tepid expectations have only grown bleaker for EU economic growth following a series of downward GDP revisions for 4Q18 GDP – the final reading of 1.1 percent drastically halved initial estimates of 2.2 percent.

More recently, several economic indicators out of the EU have painted a dreary picture of Eurozone fundamentals and could potentially suggest that the blocs GDP data may disappoint once again.

EURUSD PRICE CHART: 4-HOUR TIME FRAME (MARCH 13, 2019 TO APRIL 29, 2019)

As such, EURUSD traders could witness a swing in spot prices greater than the implied move of 34 pipsif tomorrows high-impact GDP data surprises to the downside. On the contrary, if Eurozone economic growth prints an upbeat report, spot EURUSD may quickly reclaim the 1.2000 handle.

Although, the 61.8 percent Fibonacci retracement line drawn from the low on January 1, 2017 and high on February 11, 2018 could pose a significant headwind to Euro upside against the US Dollar. That being said, EURUSD trader sentiment data from IG still shows a mixed trading bias despite net-short positions increasing by 20.4 percent relative to last week.

FOREX ECONOMIC CALENDAR – EUR, MXN, USD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Shifting to the Mexican Peso, one of the most actively traded emerging market currencies, USDMXN has potential to gyrate tomorrow in response to Mexicos GDP release. Trade between Mexico and the United States has grown into a somewhat touchy subject as the two countries approach final stages of ratifying the new-NAFTA, USMCA trade agreement along with Canada.

Friction over President Trumps unwillingness to alleviate tariffs on steel and aluminum imports while concerns voiced among politicians remain material hurdles to signing the deal into law. The lack of clarity over trade policies have potential of weighing negatively on business decisions and consumption which could drag economic activity lower as a result.

USDMXN PRICE CHART: 4-HOUR TIME FRAME (MARCH 20, 2019 TO APRIL 29, 2019)

Moreover, Fridays US GDP report detailed that imports dropped a sizable 3.7 percent over the first quarter – a negative sign for Mexico seeing that the country relies on the US for roughly 80 percent of its exports. Judging by USDMXN overnight implied volatility, spot prices are estimated to trade between 18.893 and 19.096 with a 68 percent statistical probability.

If Mexicos GDP misses to the downside, USDMXN could continue its recent ascent. However, the 61.8 percent and 50.0 percent retracement lines drawn from the low on March 20 and high on March 29 of this year might serve as technical resistance. Conversely, if Mexico inks a solid GDP report above the 1.4 percent estimate, USDMXN has potential of targeting downtrend support formed by the lows on April 22 and April 29, which also comes into alignment with the 76.4 Fib level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator