简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500, DAX Fundamental Forecast: Focus on FOMC, NFP & Apple Earnings

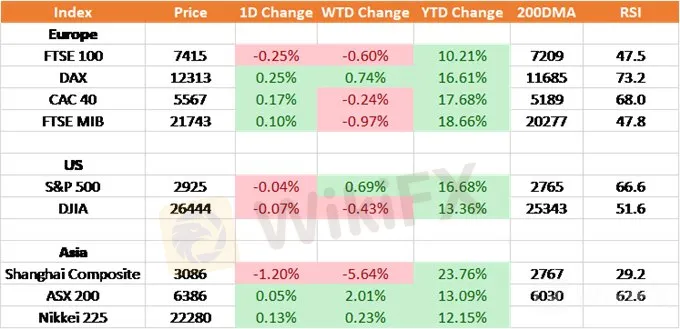

Abstract:The S&P 500 moved within touching distance of its record peak, while the DAX outperformed relative to its major counterparts.

Equity Analysis and News

S&P 500 | Eyes on FOMC, NFP and Apple Earnings

DAX | Firm Chinese Data Needed to Push DAX Higher

Source: Thomson Reuters, DailyFX

S&P 500 | Eyes on FOMC, NFP and Apple Earnings

The S&P 500 continues to march higher with the index adding another 0.7% for the week. The index remains within its uptrend, which in turn saw the S&P move within touching distance from its all-time peak, although, failure to print fresh highs saw the index pullback slightly. Interestingly the risk barometer, which consists of a spread between cyclicals and defensive stocks (XLI vs XLU ETF) has edged lower, which in turn raises the risk of a near-term pullback in the index. Focus next week will be on the Federal Reserve rate decision with questions asked over their take on the Q1 GDP data. Alongside this, eyes will be on the latest US jobs report, while earnings season will see Apple report.

DAX | Firm Chinese Data Needed to Push DAX Higher

While the macro outlook for the Eurozone remains fragile, the DAX continues to go on from strength to strength, with the index outperforming its European counterparts. Among the supportive factors behind this, has been the drop in the Euro to near 2yr lows, consequently, helping German exporters. With many investors looking for a potential recovery in the Eurozone outlook eyes will be on the Eurozone GDP report, while an upside surprise in the Chinese Manufacturing PMI could be enough to push the DAX to better levels.

DAX Price Chart: Daily Time Frame (Dec 2017-Apr 2019)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

S&P 500 Forecast: Stocks Threaten Breakdown as TLT ETF Soars

The S&P 500 fluctuated between losses and gains on Thursday before finishing narrowly higher. Meanwhile, investors continued to clamor for safety in bonds.

Dow Jones, DAX 30, FTSE 100 Forecasts for the Week Ahead

As trade wars and monetary policy look to maintain their position at the helm, markets will be offered insight on another major theme that could rattle fragile sentiment.

S&P 500 Forecast: Stocks Rebound, but will the Recovery Continue?

After plummeting at the open, the S&P 500 mounted a relief effort during Wednesday trading to eventually close in the green. While the rebound was encouraging, can it surmount nearby resistance?

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator