简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Price Declines May Accelerate on Fed, Soft US Econ Data

Abstract:After crude oil prices fell by the most in two months this past week, the commodity may find itself at risk if the Fed doesnt hint at cutting soon. US data may put OPEC supply fundamentals on the sidelines.

Oil Fundamental Forecast: Bearish

石油基本面预测:看跌

Crude oil prices suffered their worst week in two months despite Iran supply disruption fears

原油价格在两个月内遭遇最糟糕的一周尽管伊朗供应中断恐惧

The commodity and equities may be vulnerable to a Fed that doesnt hint at cutting soon

商品和股票可能很容易受到美联储的影响,而美联储并未暗示即将减产

Oil Weekly Wrap

石油周刊包装

Crude oil prices started off the week on a high note after reports crossed the wires that the US is going to end Iran sanction waivers for imports of the commodity come May 2. This created supply disruption concerns which bolstered petroleum prices. The sentiment-linked commodity then started losing upside momentum on overall mixed US earnings, particularly from industrials as 3M Company announced job cuts.

原油价格在本周开始后高位回落据报道,5月2日美国即将结束对美国进口商品的制裁豁免。这引发了供应中断问题,从而加剧了石油价格。随着3M公司宣布裁员,情绪相关的商品随后开始失去上涨势头,特别是来自工业公司。

By Friday, oil suffered its worst week in two months as US President Donald Trump took another jab at OPECs efforts to uphold prices. This also followed a mixed US GDP report. The 3.2% q/q growth in the first quarter was undermined by weakness in personal consumption which is the largest portion of GDP (almost 70%). Moreover, volatile inventories and trade contributed to most of the sunny surprise.

周五,石油遭遇两个月来最糟糕的一周美国总统唐纳德特朗普再次对石油输出国组织维持价格的努力进行了抨击。美国国内生产总值报告也是如此。第一季度3.2%的季度环比增长受到个人消费疲软的影响,个人消费是GDP的最大部分(接近70%)。此外,波动较大的库存和贸易促成了大部分阳光普照。

Oil Week Ahead, The Fed

未来石油周,美联储

Pro-risk crude oil prices have the upcoming Fed rate decision to look to for direction. Fed funds futures are showing a roughly 66% probability that the central bank may cut once by the end of this year. This means that with each passing monetary policy announcement that the Federal Reserve does not support expectations of an impending rate cut, risk-leveraging dovish bets could falter and send assets tied to speculative sentiment, like equities, tumbling.

风险较高的原油油价有即将到来的美联储利率决定寻求方向。联邦基金期货显示出央行可能在今年年底前削减一次的可能性约为66%。这意味着随着每一次通过货币政策宣布美联储不支持即将降息的预期,风险杠杆温和的赌注可能会动摇,并将资产与投机情绪挂钩,如股票,跌跌撞撞。

This is a clear downside vulnerability for the commodity because of how closely it has been following the S&P 500 since bottoming in late December. Fed Chair Jerome Powell stressed on multiple occasions that they are closely watching external risks such as a European slowdown and Brexit. On top of this, he added that ‘rates are in a right place’. In short, the risks for crude oil and equities seem tilted to the downside.

这是该商品明显的下行漏洞,因为自机器人以来它一直跟随标准普尔500指数的紧密程度12月下旬。美联储主席杰罗姆·鲍威尔多次强调,他们正在密切关注欧洲经济放缓和英国退欧等外部风险。除此之外,他补充说“利率处于正确的位置”。简而言之,原油和股票的风险似乎倾向于下行。

US Economic Data

美国经济数据

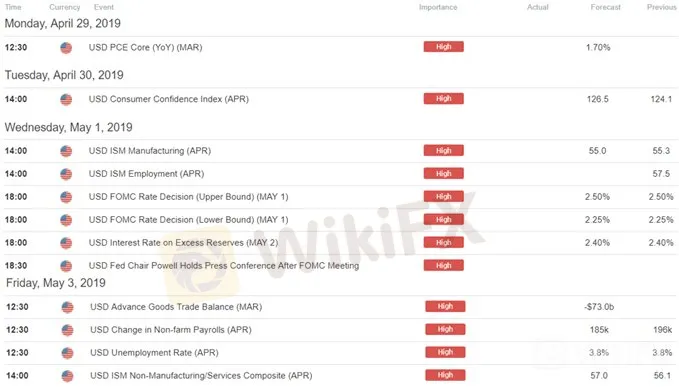

In the context of their data-dependent approach and last week‘s first quarter GDP report, the week ahead contains a plethora of domestic economic statistics. We have the core PCEdeflator (the central bank’s favored measure of inflation), consumer confidence, ISM manufacturing and a jobs report. These can impact the US Dollar and thus crude oil prices since the latter is typically priced in the former.

在他们的背景下数据依赖型方法和上周的第一季度GDP报告,未来一周包含了大量的国内经济统计数据。我们拥有核心PCEdeflator(中央银行青睐的通胀指标),消费者信心,ISM制造业和就业报告。这些可能会影响美元,从而影响原油价格,因为后者通常以前者定价。

{13}

*All times listed in GMT

{13}

On the chart below, the Citi Surprise Economic Index still shows that data outcomes have tended to disappoint relative to expectations. Despite increasingly softer-than-expected economic results, the S&P 500 continued rising along with the commodity as markets focused on a more dovish Fed. Though, last week we did start seeing a divergence between the two.

在下图中,花旗惊喜经济指数仍显示数据结果相对于预期趋于失望。尽管经济结果比预期的要软得多,但标准普尔500指数随着市场关注美联储更加温和而继续上涨。尽管如此,上周我们确实开始看到两者之间的分歧。

The Citi index hints that economists may be overestimating the health and vigor of the economy, opening the door to further disappointing outcomes. The counterargument is that it could further fuel Fed rate cut bets, but last Friday showed a lackluster response. It may come down to what Jerome Powell has to say on Wednesday which just leaves the jobs report on the docket afterwards.

花旗指数暗示经济学家可能过高估计经济的健康和活力,为进一步令人失望打开了大门结果。反驳的是,它可能进一步推动美联储降息,但上周五反应乏力。这可能归结为杰罗姆鲍威尔周三所说的事情,之后就将工作报告留在了案卷中。

With that in mind, the density of the US economic calendar and the prominence of monetary policy may put OPEC output fundamentals on the sidelines. Trade negotiations between the US and Japan are another wildcard for market mood.

考虑到这一点,密度为美国经济日历和货币政策的重要性cy可能会将欧佩克产量基本面置于观望之列。美国和日本之间的贸易谈判是市场情绪的另一个通配符。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

BoJ Holds Firm on Tightening Path Fuels Yen

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House.

Eye on Today’s FOMC Meeting Minutes

Wall Street took a pause in the last session, with all three major indexes remaining relatively flat as investors awaited the highly anticipated FOMC meeting minutes.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator