简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD at Risk of Breakout, AUDUSD Drops as Soft CPI Fuels RBA Rate Cut Bets - US Market Open

Abstract:EURUSD at Risk of Breakout, AUDUSD Drops as Soft CPI Fuels RBA Rate Cut Bets - US Market Open

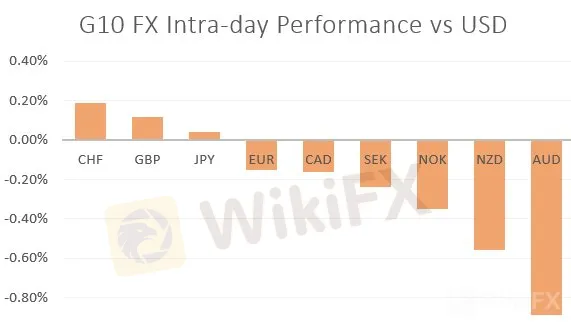

MARKET DEVELOPMENT – Euro Breakout in Focus, AUDUSD Plummets as Soft CPI Fuels Rate Cut Talk

AUD: The Australian Dollar is the notable underperformer, having dropped to session lows following the softer than expected inflation report overnight. The RBA‘s preferred measure of inflation (trimmed mean) continues to reside below the RBA’s 2-3% target band and has done since Q4 2015. In light of the CPI inflation report, rate cut expectations jumped to 65% at the upcoming May meeting with a flurry of banks also joining the rate cut party. However, as a reminder, the recent jobs report continues to shine a bright torch in the dim domestic outlook for Australia, which may be enough to see the RBA postpone on a rate cut.

EUR: As the greenback continues to edge higher, the Euro is back towards critical support, with the pair hovering slightly above the 2019 lows (1.1176), in which a break below could pave the way for deeper losses in EURUSD with a 1.10 handle in sight. Data in the Eurozone remains weak as evidenced by the latest German IFO survey missing economic forecasts. German 10yr bund yields are back into negative territory, while the spread against the US 10yr has widened once again, consequently, this does not bode well for Euro buyers.

Source: Thomson Reuters, DailyFX

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

US Dollar Holds Gains as Japan Boosts and China PMI Weighs. USD Volatility Ahead?

US DOLLAR, JAPAN ELECTION, USD/JPY, CHINA PMI, AUD/USD - TALKING POINTS

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator