简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

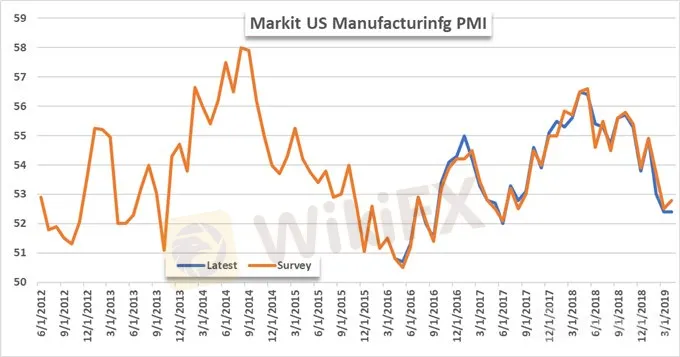

US Manufacturing and Services PMI Miss Estimates, Reveals Slow Growth

Abstract:Surveyed US services and manufacturing managers indicated a continued slowdown in growth for the start of the second quarter as the economy struggles to match its growth from the previous year.

Markit Economics released their monthly Purchasing Managers Index readings this morning for the service and manufacturing sectors. The Services PMI came in at 52.9 which missed analyst estimates of 55.0, which are largely attributed to purchasing managers revising their output expectations lower for the year and slower growth in employment. New business was also lower with it being the softest increase since March 2017.

The soft marks in the service sector follow weak numbers in consumer spending to start the year which coupled with continued weakness in the Service PMI could stoke fears that consumers are losing their appetite to spend, however some fears could be eased by this mornings stronger than expected retail sales - mainly attributed to strength in the auto sector.

The manufacturing PMI reading was 52.4 which missed estimates and went unchanged from last months reading. This was the weakest improvement in the manufacturing sector since June 2017. Improved indicators for output and new orders were offset from slowing increases in employment and pre-production inventories according to purchasing managers.

There was also an increase in new business, with the best reading in three months. However, compared to the same period last year, the increase is somewhat underwhelming. Inflation pressure eased across the sector with input prices declining for the sixth consecutive month, but survey participants noted that small increases in cost are generally being passed on to their clients.

The data from Markit puts the U.S. economy at its weakest growth since 2016 in relation to manufacturing and services, with hiring and output being the main sources for the slowdown. It appears weak manufacturing in the first quarter has started to bleed into April. The easing of inflation pressure on prices for manufactures has reduced pricing power which, coupled with weaker demand, could cause continued downward pressure into the rest of the second quarter.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

What Are The Top 5 Cryptocurrency Predictions For 2025?

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

Currency Calculator