简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CAD Soars, Crude Oil Pushes Higher, GBPUSD Eyes 1.30 Support - US Market Open

Abstract:CAD Soars, Crude Oil Pushes Higher, GBPUSD Eyes 1.30 Support - US Market Open

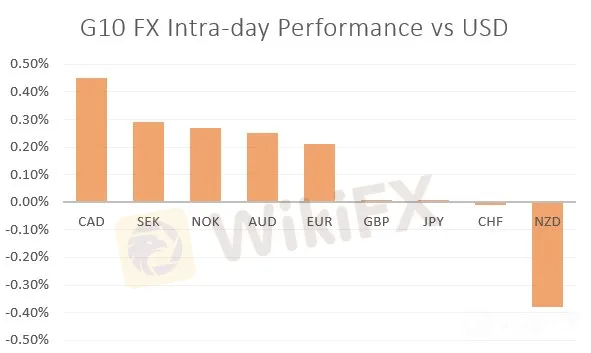

CAD: The Loonie soared following an encouraging set of inflation figures, while the headline figures printed in line with estimates, the Bank of Canadas preferred measure of inflation jumped to 1.96% from 1.9% which in turn may see the BoC refrain from making a full 180 pivot and keep the option of a rate hike open, albeit, not to take place for some time. In reaction to the CPI report, USDCAD dropped to lows of 1.3270, however, the 1.3250-1.3465 range that has been place for over a month remains in tact for now. Alongside this, the push higher in oil prices also provided underlying support for the Loonie.

NZD: The New Zealand Dollar came under significant selling pressure overnight after Q1 CPI figures disappointed forecasts with the headline reading at 1.5% (Exp. 1.7%). Consequently, money markets priced in greater likelihood that the RBNZ will ease policy at the next meeting (May 8th), jumping to a near 50/50 possibility from 25%. However, NZDUSD soon reclaimed the 0.67 handle with the RBNZs Sectoral Factor model showing inflation remained at 1.7%, while encouraging Chinese GDP and production data lifted risk appetite. Nonetheless, with the RBNZ Governor Orr maintaining his easing bias, the risk of a rate cut at the May meeting, could see upside limited, which in turn favours moves higher in AUD and CAD vs NZD.

GBP: Softer than expected CPI data saw the Pound back under pressure with GBPUSD making a move towards 1.30 support. However, given the wind down in Brexit headlines, price action in the Pound has been relatively tame with implied volatility dropping to multi month lows.

Oil: Brent and WTI crude futures continued to march higher as yesterday‘s API inventory report showed a surprise 3.1mln barrel drawdown, which in turn sees WTI edging towards $65/bbl. Elsewhere, with the fighting within Libya continuing to escalate, the geopolitical premium continues to keep oil prices supported, while the risk tone had also been improved by China’s encouraging GDP figures for Q1 with signs growing that Q2 may begin to see a rebound in growth.

Source: Thomson Reuters, DailyFX

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

NZD/USD Grapples 0.7000 With RBNZ’s Inflation Expectations Survey on Deck

New Zealand Dollar holds firm while risk-sensitive Australian Dollar falls overnight. RBNZ's inflation expectations survey in focus as the central bank’s rate decision nears. NZD/USD looks to retake the 0.7000 psychological level after bouncing from support

New Zealand Dollar Forecast: NZD/USD Falls as Traders Eye Chinese Inflation Data

NEW ZEALAND DOLLAR, NZD/USD, WESTPAC CONSUMER CONFIDENCE, CHINA INFLATION - TALKING POINTS

British Pound Technical Analysis - GBP/USD, EUR/GBP

BRITISH POUND, GBP/USD, EUR/GBP - TALKING POINTS

US Dollar Flexes Against British Pound Ahead of the Fed and BoE. Where to for GBP/USD?

US DOLLAR, BRITISH POUND, GBP/USD, BOE, FED,CHINA, AUD/USD - TALKING POINTS

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Dutch Law Student Arrested for €4.5 Million Crypto Scam

Currency Calculator