简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Swedish Krona, Norwegian Krone Eyeing Key Global Growth Data

Abstract:The Swedish Krona and Norwegian Krone will be watching a cascade of key growth indicators out of the US and Europe, potentially stoking volatility in SEK and NOK.

NORDIC FX, NOK, SEK WEEKLY OUTLOOK

Swedish Krona, Norwegian Krone at risk from higher-than-usual volatility

Growth-sensitive event risk out of Europe, China, US to impact NOK, SEK

Nordic data docket: Sweden unemployment rate and Norway trade balance

See our free guide to learn how to use economic news in your trading strategy!

The first week of April had a hefty data docket for the Swedish Krona and Norwegian Krone. Traders were eyeing what were potentially global market-moving event risk. The ECB announced its rate decision, the FOMC released the March meeting minutes and an extension to the Brexit deadline was granted. Looking ahead, NOK and SEK may yet have another potentially tumultuous week driven primarily by external-event risk.

EUROPEAN-BASED EVENT RISK:

Germany

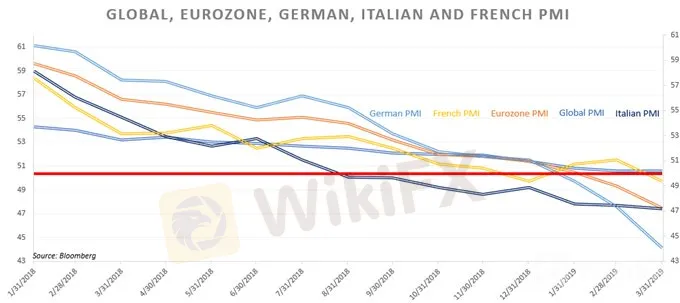

In Europe, several key growth indicators and announcements will be released from core Eurozone economies. Germany will be releasing its Zew Survey – a measure used to gauge sentiment – which will be particularly important to monitor given the region-wide slowdown. This follows a presentation by Germanys Finance Minister on the latest economic forecasts.

Italy

In Italy, the lower house will be debating on the governments most recent economic growth forecasts. Last week, the report showed a dismal outlook for the Italian economy in 2019 along with an update that the budget deficit will now be wider than previously agreed. The latter point in particular is a source of concern given the rising risk of another – and potentially more disruptive – Eurozone debt crisis.

France

In France, President Emmanuel Macron will be delivering a speech which will contain new policy measures as a response to the Yellow Vest protests. Since their start last year, it has severely impacted France‘s economic performance and undercut the President’s ratings. The new policies may rattle the Euro and regional bond markets because of the potentially dangerous fiscal example it may set for other Eurozone governments.

This comes as the continent may now be re-entering another trade war with the US, putting further pressure on the already-battered economy. ECB President Mario Draghi reinforced the negative growth outlook at the last two meetings, signaling – along with the IMF – that the downside risks appear to be greater. Political risks are also rising as the European Parliamentary elections approach.

In Sweden, Riksbank Deputy Governor Martin Floden expressed concern on Friday over Germany‘s lackluster performance. This in large part has to do with Germany’s status as the “steam engine of Europe”. Why this is of concern to Swedish policymakers is because the Scandinavian countrys economic performance is closely linked to European demand.

US-BASED EVENT RISK

A slew of key US economic indicators will be released which traders will be likely be monitoring closely because of the potential impact it may have on Fed monetary policy. Below are some key indicators to watch out for:

Tuesday – Industrial Production

Wednesday – Trade Balance, MBA Mortgage Applications, Fed Publishes Beige Book

Thursday – Retail Sales, Initial Jobless Claims

For a more extensive list, check out DailyFXs economic calendar!

Japanese Economy Minister Toshimitsu Motegi will also be visiting the White House from April 15-18. The two powers will discus trade agreements in an effort to avert another trade conflict on a third front as US economic performance wanes. On Friday, the Easter holiday will begin and may cause additional volatility due to thinner liquidity.

NORWAY, SWEDEN EVENT RISK

In the Nordics, the economic docket remains relatively light, which could mean NOK and SEK traders will likely be keeping their attention more on external risks. On Thursday, Sweden will be releasing its unemployment rate. While broadly the indicator has been falling, there was a spike in November from 5.50 to 6.00 percent. The Swedish Krona promptly fell and cooled rate hike bets from the Riksbank.

In Norway, the data docket is very light with trade balance data due later today. For this reason, NOKs price movement will be especially watchful for external event risk. The Krone last week was given a boost following better-than-expected CPI data. This was in large part due to the strong recovery in crude oil prices in 2019, although the Norwegian economy and CPI may be at risk if global and European demand wanes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator