Score

Firstrade

United States|5-10 years|

United States|5-10 years| https://www.firstrade.com/content/en-us/welcome

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

United States 8.62

United States 8.62Contact

Licenses

Licenses

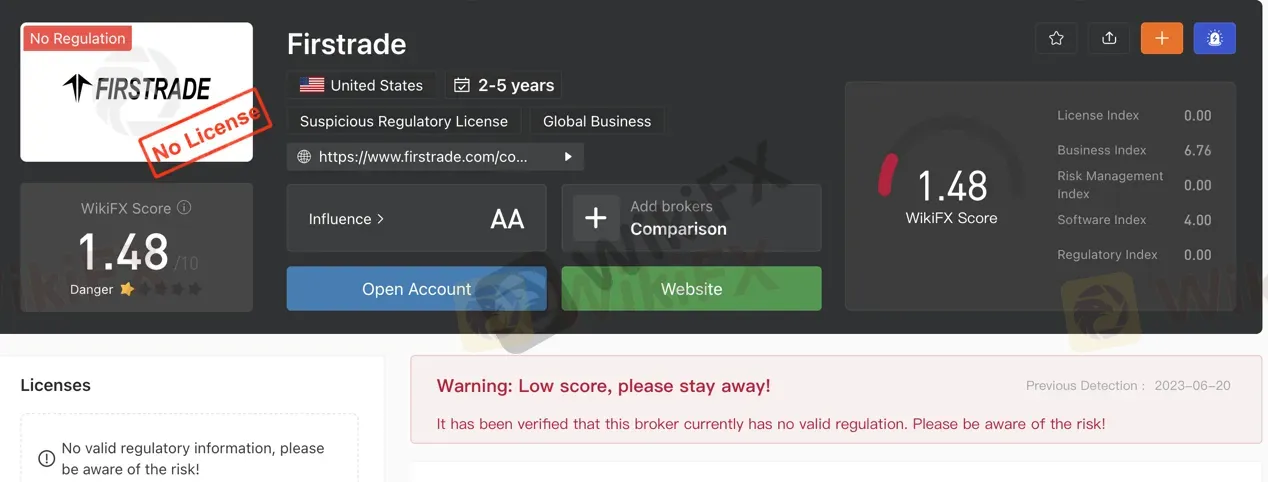

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Firstrade also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Taiwan

United States

Japan

firstrade.com

Server Location

United States

Most visited countries/areas

India

Website Domain Name

firstrade.com

Website

WHOIS.NETWORKSOLUTIONS.COM

Company

NETWORK SOLUTIONS, LLC.

Domain Effective Date

1997-12-28

Server IP

13.33.144.86

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 2-5 years |

| Company Name | Firstrade Securities, Inc |

| Regulation | No Regulation |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | iOS app, Android app, Firstrade Navigator |

| Tradable Assets | Stocks, ETFs, Options, Mutual Funds, Fixed Income |

| Account Types | Brokerage Accounts, Retirement Accounts, International Accounts, Education Planning, Business Planning |

| Demo Account | N/A |

| Islamic Account | N/A |

| Customer Support | Phone: +1 800-869-8800, +1 718-961-6600 (English), +1 888-889-2818 (Chinese), +886 801-856-958 (Chinese) |

| Payment Methods | Electronic Funding, Wire Funds, Account Transfer, Check, ACH Electronic Funds Transfer, Transfer between Firstrade Accounts |

General Information

Firstrade Securities, Inc is a brokerage firm based in the United States. It was founded within the last 2-5 years and currently operates without proper regulation, which poses risks for investors. The company offers a variety of tradable assets, including stocks, ETFs, options, mutual funds, and fixed income products. They provide brokerage accounts for general investing, retirement accounts with no annual fees, international accounts for accessing U.S. financial markets, education planning accounts, and business planning accounts.

Firstrade allows trading of stocks listed on major exchanges and over-the-counter markets, with extended hours trading available. They offer commission-free trading on all ETFs, providing access to a wide range of options. Investors can hedge their portfolios with options at zero commission and zero contract fees. Firstrade also provides a selection of over 11,000 mutual funds and offers fixed income investment options for steady income generation.

The company offers trading platforms for iOS and Android devices, enabling users to trade on the go. They provide research tools, mobile trading capabilities, an options wizard for insights into options trading, Firstrade Navigator for consolidated account management, and information on upcoming IPOs.

Pros and Cons

Firstrade is a brokerage firm that offers a range of investment options for traders and investors. However, it's important to note that Firstrade currently lacks valid regulation, which poses risks for investors. On the positive side, Firstrade provides access to a wide range of market instruments, including stocks, ETFs, options, mutual funds, and fixed income investments. The platform offers trading on major exchanges and extended hours trading. Firstrade also offers commission-free trading on ETFs and zero commission and contract fees on options trading. They provide various account types, including brokerage accounts, retirement accounts, international accounts, education planning, and business planning. Firstrade offers mobile trading platforms for both iOS and Android devices, allowing users to trade on the go. They also provide research tools, mobile trading capabilities, an Options Wizard, Firstrade Navigator platform, and information on upcoming IPOs. However, some drawbacks of Firstrade include the lack of specific payment methods and the absence of information on leverage. Overall, while Firstrade offers a range of investment options and trading tools, its lack of regulation and limitations in payment methods and leverage information may be a concern for some investors.

| Pros | Cons |

| Access to a wide range of market instruments | Lack of valid regulation |

| Commission-free trading on ETFs | Limited payment methods |

| Zero commission and contract fees on options | Lack of information on leverage |

| Various account types for different investment needs | |

| Mobile trading platforms for iOS and Android devices | |

| Research tools and access to market news |

Is Firstrade Legit?

Firstrade, a brokerage firm, does not currently have valid regulation, as confirmed by reliable sources. It is important to note that operating without proper regulation carries inherent risks for investors.

Products & Services

Firstrade provides online and mobile trading of Stocks/ETFs, Options, Mutual Funds, Fixed Income products and more. Firstrade offers extended hours trading from 8am-8pm and stand by its trading tools with a 0.1 second trade execution guarantee.

Stocks

Investors can trade stocks listed on the NYSE, AMEX, Nasdaq, or the Over-the-Counter (OTC) markets through Firstrade. This includes a range of stocks, from large cap companies to penny stocks. Additionally, Firstrade allows trading of both listed and OTC stocks. The platform also offers extended hours trading, allowing eligible stocks to be traded after regular market hours. Traders can place conditional orders and utilize trailing stops to take advantage of market momentum.

ETFs

Firstrade provides access to a wide variety of Exchange Traded Funds (ETFs), allowing investors to replicate the performance of an index. The platform offers a comprehensive set of screeners with more than 30 different screening criteria options to assist users in finding suitable ETFs. Firstrade also offers commission-free trading on all ETFs, providing more opportunities for investors to trade over 2,200 ETFs available in the market.

Options

Investors can hedge their portfolios with options on Firstrade at zero commission and zero contract fees. This feature allows in managing risk and maximizing potential returns.

Mutual Funds

Firstrade offers a selection of over 11,000 Mutual Funds, giving investors the opportunity to create a professionally managed portfolio. This allows for diversification and access to a range of investment strategies.

Fixed Income

Firstrade provides fixed income investment options that offer long-term stability and potentially higher returns compared to traditional savings accounts. These investments can be suitable for investors looking for steady income generation while preserving capital.

| Pros | Cons |

| Wide range of stocks available | Limited information on specific stocks |

| Access to both listed and OTC stocks | Limited research tools for stocks |

| Extended hours trading | No access to IPOs |

| Conditional orders and trailing stops for market momentum | Limited options for short-selling |

| Access to over 2,200 ETFs | Limited options for margin trading |

| Commission-free trading on ETFs | Limited options for futures trading |

| Zero commission and zero contract fees for options | Limited customization options for ETFs |

| Wide selection of Mutual Funds | Limited educational resources on ETFs |

| Diversification and access to various investment strategies | Limited options for complex orders |

| Fixed income investment options for long-term stability | Limited information on fund performance |

Account Types

Brokerage Accounts:

Firstrade offers general investing brokerage accounts that provide a range of investment options. These accounts allow individuals to buy and sell various securities such as stocks, ETFs, options, mutual funds, and more. The brokerage accounts are versatile and do not have any fees for opening or maintaining the account.

Retirement Accounts:

Firstrade offers No-Fee IRAs, providing individuals with opportunities to grow their retirement savings. These IRAs have no annual fee, account set-up fee, or maintenance fee. Investors can trade stocks, options, and mutual funds within their IRA without paying any commissions. Firstrade offers different types of IRAs, including Traditional IRAs, Roth IRAs, and Rollover IRAs. Each type has its own advantages in terms of tax benefits and contribution rules. Firstrade provides tools and resources to help investors make informed decisions and plan for their retirement.

International Accounts:

Firstrade offers international accounts for investors looking to take advantage of opportunities in the U.S. financial markets. Opening an international account is a simple two-step process that can be done online. Firstrade provides a full suite of investment products, including stocks, options, ETFs, mutual funds, bonds, and CDs. Investors can access their accounts and stay updated on market news through Firstrade's online and mobile trading platforms. The company has over 38 years of experience in the industry and offers exceptional customer service in multiple languages.

Education Planning:

Firstrade provides education savings plans to help individuals save for the cost of education. One option is the Coverdell ESA, formerly known as the Education IRA. This account allows non-deductible contributions of up to $2,000 per child under the age of 18. The funds in the account grow tax-free, and withdrawals are also tax-free if used for qualifying educational expenses. Firstrade supports individuals in managing assets on behalf of their beneficiaries, helping them take advantage of tax-advantaged savings for education.

Business Planning:

Firstrade offers business retirement plans for self-employed individuals and small business owners. One such plan is the SEP IRA (Simplified Employee Pension IRA). A SEP IRA allows employers to make contributions to their employees' retirement accounts or their own personal retirement accounts if self-employed. It is a straightforward retirement plan that eliminates administrative complexity and extensive reporting. Contributions are tax-deductible, and the earnings within the account are tax-deferred until retirement.

| Pros | Cons |

| Versatile investment options | No fees mentioned, but potential hidden fees not specified |

| No fees for opening or maintaining brokerage accounts | Limited information on account features and benefits |

| No annual fee, account set-up fee, or maintenance fee for retirement accounts | Limited educational resources or tools for retirement planning |

| Ability to trade stocks, options, and mutual funds within IRAs without commissions | Limited investment research or analysis tools |

| Different types of IRAs with specific advantages | Limited customer support availability or response time |

| Opportunities to invest in U.S. financial markets | Potential limitations on international account access or trading |

| Simple two-step process for opening international accounts | Limited account management features or customization options |

| Education savings plans with tax advantages | Limited trading platform functionality or user experience |

How to Open an Account?

To open an account with Firstrade, you can follow these steps:

Visit the Firstrade website and locate the “Open Account” option. Click on it to begin the account opening process.

2. If you are a citizen or resident of the United States, you will be directed to the appropriate application form. Fill in your First Name, Last Name, and Email Address in the provided fields.

3. For international users who are not citizens or residents of the United States, there will be a separate option to open an international account. Click on it to proceed.

4. In the international account application form, you will need to provide additional information. Enter the Country Code of your country, followed by your Mobile Number.

5. After entering your mobile number, you will receive a verification code via SMS. Enter this code in the designated field to verify your mobile number.

6. Once you have completed the necessary information and verification steps, review the terms and conditions, and submit your application.

7. Firstrade will process your application, and upon approval, you will receive further instructions on how to fund your account and start trading.

Fees & Commissions

Firstrade offers a fee structure that emphasizes affordability and accessibility for investors. They provide commission-free trading for stocks, ETFs, and options, along with no contract fees or exercise and assignment fees for options. Mutual funds are available without charges for both load and no-load funds, as well as no transaction fees for NTF funds. Firstrade operates on a net yield basis for various fixed income products such as treasury bills, municipal bonds, agency bonds, zeros, and strips, allowing investors to calculate their expected yields. While a fee of $30 applies to primary market CDs, secondary market CDs are traded based on the net yield. Overall, Firstrade's fee structure aims to offer cost-effective investment options to its customers.

Deposits and Withdrawals

Electronic Funding:

Firstrade offers various options for depositing and withdrawing funds from your account. One of the methods available is Electronic Funding, which allows you to transfer money electronically.

Wire Funds:

Another option for depositing funds into your Firstrade account is through Wire Funds. This method enables you to transfer money from your bank account directly to your Firstrade account. Whether you have an international bank or a domestic U.S. bank, you can utilize this service to move funds.

Account Transfer:

If you wish to transfer funds from another brokerage or financial institution to your Firstrade account, you can do so through the Account Transfer option. This process allows you to consolidate your investments and manage them in one place. By initiating an account transfer, you can seamlessly move your assets to Firstrade without any hassle.

Check:

For those who prefer traditional methods, Firstrade also accepts deposits and withdrawals via check. You can deposit a check into your Firstrade account by mailing it to the designated address provided by the company. This method is suitable for individuals who are comfortable with physical checks and prefer sending them by mail.

ACH Electronic Funds Transfer:

Firstrade facilitates ACH Electronic Funds Transfer, which enables you to electronically transfer money from your bank account to your Firstrade account. With this service, you have the option to set up periodic deposits or make on-demand transfers without a fixed transfer schedule. The initial setup process involves completing an ACH form or setting up the ACH profile online, which usually takes a couple of business days to complete. During this process, Firstrade will deposit two small amounts into your bank account for verification purposes.

Transfer between Firstrade Accounts - Internal Transfers:

If you have multiple accounts with Firstrade, you can easily transfer funds between them through Internal Transfers. This feature allows you to move money from one Firstrade account to another. Additionally, you can utilize Internal Transfers for making IRA contributions within your Firstrade accounts, simplifying the process of contributing to your retirement savings.

Pros and Cons

| Pros | Cons |

| Electronic Funding helps in managing finances. | Some users may prefer traditional methods like cash or physical checks. |

| Wire Funds allow transfer of money from bank accounts. | There may be fees associated with wire transfers. |

| Account Transfer consolidates investments for easier management. | The process of transferring accounts may take time and effort. |

| Check deposits provide an option for individuals comfortable with physical checks. | Mailing checks may introduce delays in depositing or withdrawing funds. |

| ACH Electronic Funds Transfer allows for bank account transfers. | The initial setup process for ACH transfers may take a couple of business days. |

| Internal Transfers enable easy movement of funds between Firstrade accounts. | Internal transfers may not be applicable for individuals with only one Firstrade account. |

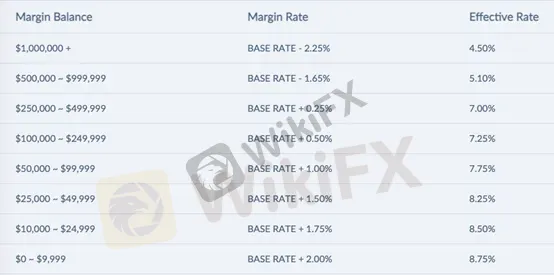

Margin Rates

Firstrade's margin rates are as low as 4.50%.

Minimum account Requirements ( for Options Trading )

While Firstrade does not require a minimum balance to open an account or invest in equity securities, they do require minimum equity in order to place certain option orders. The following table lists the option strategy and the minimum equity required to place option orders:

Trading Platform

Firstrade offers apps for both iOS and Android devices. The Firstrade iOS app allows users to navigate the position page, research stock event news, fund their accounts, transfer funds with just one click, and easily trade directly from the position screen. The app also provides quick access to account information, watchlist overview, and the ability to place stock and options orders.

Similarly, the Firstrade Android app offers a range of features and functionalities for traders. Users can swiftly navigate the position page, access stock event news for research purposes, fund their accounts, transfer funds with just one click, and trade seamlessly from the position screen. The app also provides a comprehensive view of account information, watchlist overview, and the ability to place stock and options orders with ease.

Firstrade's trading platforms introduce several new features designed to help traders make smarter and faster decisions. The smart menus enable faster trades by streamlining the trading process, while the consolidated portfolio dashboard offers a comprehensive overview of all investments in one place. The enhanced trading workflow simplifies the order placement process, reducing the number of clicks required to execute a trade. Users can also take advantage of pre-filled order configurations, which minimize the number of clicks needed while still allowing for customization.

The trading platforms also offer fast options trading with advanced strategies, providing traders with the tools they need to execute complex options trades. Users can create watchlists with pre-defined top lists, making it easier to track and analyze specific stocks or sectors. Additionally, the upgraded research feature includes advanced charts, enabling users to perform in-depth analysis before making trading decisions. Traders can access their order history for reference and easily edit or cancel unfilled orders as needed. Finally, the platforms provide account funding options, making it easy to add funds to your trading account.

| Pros | Cons |

| Mobile trading available | No support for MT4 and MT5 |

| User-friendly interfaces | Limited customization options |

| Watchlist creation for easy tracking | Lack of advanced order types |

| Pre-filled order configurations | Limited research tools |

Trading Tools

1. RESEARCH:

Firstrade offers a range of online stock research tools to assist you in making informed investment decisions. These tools provide comprehensive information for building your investment portfolio. You can access daily, weekly, and quarterly video commentaries from trusted independent analysts, where they discuss the latest earnings reports and significant economic and market events. Additionally, Firstrade provides a Market Heatmap that offers a visual representation of bullish and bearish areas, enabling you to quickly assess stock performance. The Sectors & Industries Stock Research Tool allows you to chart performance data and analyze current industry trends to aid in your investment choices. You can also stay updated with breaking and historical news from renowned investment news providers like Morningstar, Briefing.com, Zacks, Benzinga, and PR Newswire. Furthermore, access to Morningstar's 5-star ratings and comprehensive research reports from experienced analysts is available.

2. MOBILE TRADING:

Firstrade's mobile trading platform allows users to trade on the go. The mobile app enables users to manage their accounts, place and manage orders, view positions and balances, and track the market using their smartphones or tablets. The platform provides real-time streaming account and market data, eliminating the need for manual refreshment of tools for updates.

3. OPTIONS WIZARD:

The Options Wizard provided by Firstrade offers a range of tools and insights designed to assist users in options trading. This feature includes professional analytics and insights, which can be valuable for exploring different options trading strategies. By utilizing the Options Wizard, users have the opportunity to develop a better understanding of the options market, potentially enhancing their decision-making process and improving their trading outcomes. Firstrade also offers webinars that users can register for, allowing them to expand their knowledge and skills in options trading.

4. FIRSTRADE NAVIGATOR:

Firstrade Navigator is a trading platform that aims to enhance your trading experience by consolidating your account information and trading screens into a single interface. It provides features such as order placement and management, viewing positions and balances, and real-time market tracking. The platform also offers customizable widgets for personalizing your trading dashboard and accessing relevant information quickly. Advanced technical charting capabilities are available, enabling analysis and prediction of stock movements using various technical studies. The adjustable layout of the Navigator allows for customization based on individual preferences, whether for a compact or expanded view.

5. UPCOMING IPOs:

Firstrade offers information on upcoming initial public offerings (IPOs) through their May 2023 IPO Calendar. Users can access details such as the company name, symbol, market, price, share, offer amount, and expected IPO date. This information enables users to stay updated on potential investment opportunities and make informed decisions related to IPO investments.

| Pros | Cons |

| Comprehensive research tools | Limited range of research sources |

| Daily, weekly, and quarterly video commentaries | Lack of advanced technical analysis tools |

| Market Heatmap for quick assessment of stock performance | Limited customization options |

| Information on upcoming IPOs for monitoring investment opportunities | Potential issues with mobile app stability |

| Webinars for learning options trading strategies | Inconsistent availability of news providers |

| Real-time streaming account and market data on mobile app | Limited availability of comprehensive research reports |

| Mobile trading platform for trading on the go |

Educational Resources

Educational Resources offered by Firstrade include the following:

Education Center: Firstrade provides an Education Center where users can access various educational materials and resources to enhance their trading and investing knowledge.

Options Guide: Firstrade offers an Options Guide that provides comprehensive information and guidance on trading options.

Margin Guide: Firstrade's Margin Guide offers valuable insights into margin trading, providing users with an understanding of how to use margin accounts effectively.

Webinars: Firstrade conducts webinars to educate users on various trading and investing topics. These webinars cover a wide range of subjects, offering informative sessions for users.

Tax Center: Firstrade's Tax Center provides users with resources and information to help them understand the tax implications of their investments. This section includes tools, articles, and guides related to taxes, empowering users to make informed decisions.

Blog: Firstrade maintains a blog that covers a diverse range of trading and investing topics.

Customer Support

Firstrade provides customer support services to assist users with their online trading needs. They offer multiple channels for customers to reach out and receive assistance. The Help Center is a comprehensive resource where users can find answers to frequently asked questions. In case customers prefer direct communication, they can contact Firstrade through email or phone. The customer service agents are available from Monday to Friday, between 8:00 am and 6:00 pm ET. For toll-free assistance within the United States, customers can dial 1-800-869-8800, while for international inquiries, the number is 1-718-961-6600. If customers need to send any forms or agreements, they can do so via fax at 1-718-961-3919.

Firstrade also provides important links on their support page, allowing customers to search for specific forms, fund their accounts, and access their New York headquarters' address. The physical office is located at 30-50 Whitestone Expwy., Ste. A301, Flushing, NY 11354. The office hours are Monday to Friday, from 10:00 am to 4:00 pm ET.

The support center covers various topics of interest to Firstrade customers. These include Taxes & Documents, Deposits & Transfers, My Account & Login, IRA (Individual Retirement Account), Trading, and Options Trading. Each of these sections aims to address specific inquiries related to the respective topic. If customers require further assistance or have specific questions, they can reach out via the provided contact information, including the toll-free and international phone numbers or through email communication.

Conclusion

In conclusion, Firstrade Securities, Inc. is a brokerage firm based in the United States that offers a range of investment options, including stocks, ETFs, options, mutual funds, and fixed income products. However, it is important to note that Firstrade currently operates without proper regulation, which poses inherent risks for investors. On the positive side, Firstrade provides commission-free trading for stocks, ETFs, and options, making it an affordable option for traders. The brokerage also offers a variety of account types, including brokerage accounts, retirement accounts, international accounts, education planning, and business planning. Firstrade's mobile trading platforms for iOS and Android devices offer access to trading and account management features. Additionally, the brokerage provides various trading tools, such as research resources, mobile trading capabilities, an Options Wizard, Firstrade Navigator platform, and information on upcoming IPOs. However, potential investors should carefully consider the lack of regulation and associated risks before deciding to use Firstrade's services.

FAQs

Q: Is Firstrade a regulated brokerage firm?

A: Firstrade does not currently have valid regulation, which carries risks for investors.

Q: What market instruments can be traded on Firstrade?

A: Firstrade allows trading of stocks, ETFs, options, mutual funds, and fixed income assets.

Q: What types of accounts does Firstrade offer?

A: Firstrade offers brokerage accounts, retirement accounts, international accounts, education planning, and business planning accounts.

Q: How can I open an account with Firstrade?

A: To open an account with Firstrade, visit their website and follow the account opening process.

Q: What are the fees and commissions charged by Firstrade?

A: Firstrade offers commission-free trading for stocks, ETFs, and options, along with no contract fees. Mutual funds are also available without charges.

Q: What are the trading platforms offered by Firstrade?

A: Firstrade offers iOS and Android apps, as well as the Firstrade Navigator platform for trading.

Q: What trading tools are available on Firstrade?

A: Firstrade provides research tools, mobile trading, an Options Wizard, Firstrade Navigator, and information on upcoming IPOs.

Q: What educational resources does Firstrade offer?

A: Firstrade offers an Education Center, webinars, and access to experienced analysts' research reports.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- High potential risk

News

News Firstrade Introduced FirstradeGPT

Firstrade Securities Inc. (Firstrade) launched FirstradeGPT, a research and analysis tool for everyday investors. Firstrade has partnered with Trading Central, a provider of investment decision support tools and research, to help clients make better decisions and trades.

2024-06-20 18:30

News The Easiest Ways to Become Rich in the Stock Market

Investing in the stock market is one of the finest methods to build money around the globe. One of the stock market's key advantages is that there are several methods to benefit from it.

2022-04-21 15:00

News April 2022: Top Options Trading Brokers and Platforms

While the majority of the brokers on our list of the best brokers for stock trading are also excellent options brokers, this list concentrates on brokers that excel in areas that are crucial to options traders. Many of the brokers on this list are also on our list of the best online trading platforms for day trading.

2022-04-18 12:08

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

5487

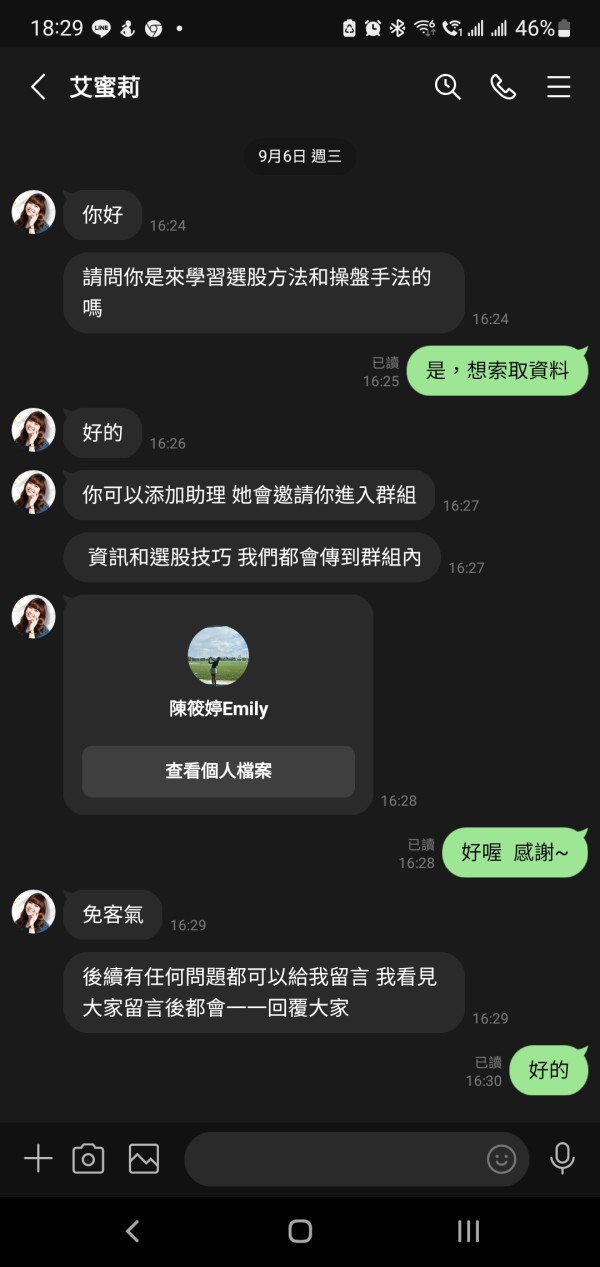

Taiwan

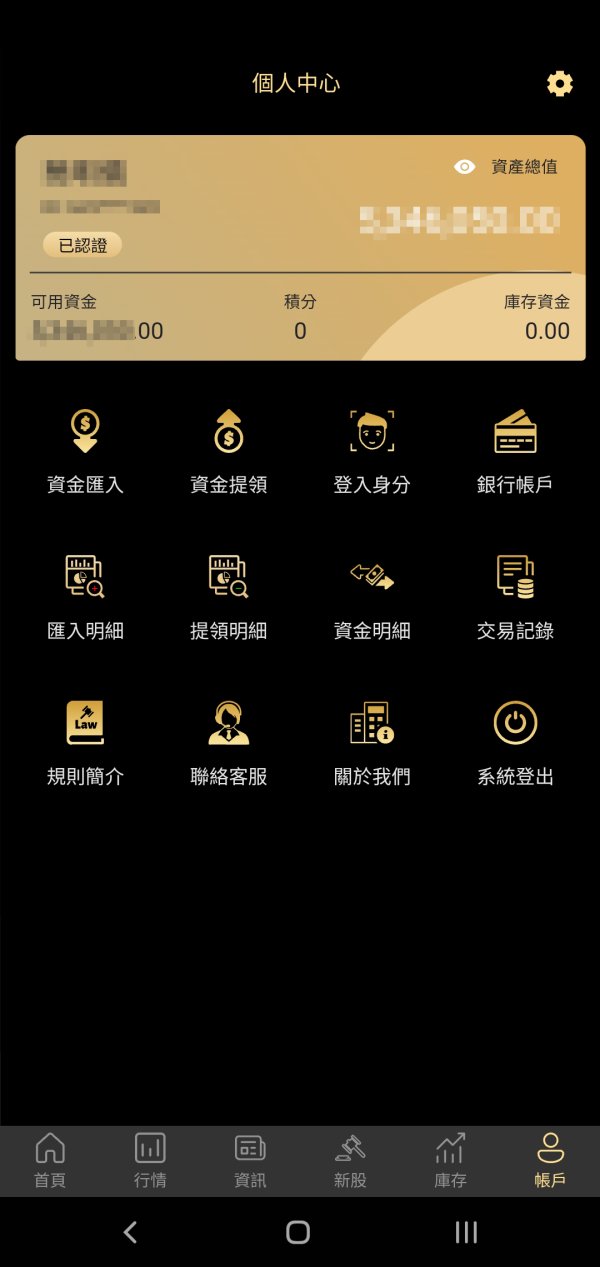

FB asked me to learn stock picking and trading methods. He added me in line and asked me to add an assistant line. The assistant invited me to join the group and follow the operations to make small profits. Later, the teacher told me to cooperate with foreign-funded institutions on a profit plan and gave the First Securities specialist line Inquiry, asking to download the app, store value remittance, reserve chips to transfer, just sell them, quickly accumulate funds through hedging, new stock lottery, huge transactions, but when requesting to withdraw money, I told the assistant that I did not reserve the target, but it was still transferred. As a result, the winning funds were insufficient, and I had to make up the funds before I could withdraw the money. The assistant said that I could apply for over-the-counter funds from the specialist. The specialist only said that I needed to deposit and repay within a time limit, but did not say that I had to deposit and repay before I could withdraw, so I still couldn't withdraw the money. It was obviously a trap. Scam, asking you to keep re-depositing money.

Exposure

02-04

【匿名】

Nigeria

Firstrade is a big cheating brokerage company. Withdrawal is not allowed. Aahana. cheating the account manager... Be careful as in my opinion not worth the hassle.

Neutral

2022-12-19

1998

Indonesia

I believe Firstrade is a good brokerage platform. Their customer support is very professional, providing your customized investment plans, which is definitely what I need. I feel good about this broker.

Positive

2023-02-15

利剑红尘

Taiwan

The whole platform is very professional, I have no problems trading cryptocurrencies on it, and even made some profits with the help of professionals. This is a reliable platform and I recommend it to you.

Positive

2022-12-13