简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Norwegian Krone, Swedish Krona Eyeing Brexit, ECB, FOMC

Abstract:NOK, SEK – along with global markets – will be eyeing tomorrow‘s release of the FOMC meeting minutes, the ECB rate decision and the EU’s verdict on whether the UK will get an extension.

TALKING POINTS – BREXIT DEAL, MONETARY POLICY, ECB RATE DECISION, FOMC

ECB, FOMC, Brexit main focus for NOK, SEK, global markets

How will slower European growth impact Nordic economies?

Norway CPI could be overshadowed by external event risks

See our free guide to learn how to use economic news in your trading strategy!

Global markets are in for a volatile day over the remaining 24 hours. The FOMC is preparing to release its meeting minutes, the ECB is announcing its next rate decision with commentary by Mario Draghi, and the EUs verdict on granting the UK government a Brexit extension is due. Because of the global impact from all of these potential market-disrupting factors, local Nordic data may as a result be overshadowed due to the focus on external event risks.

The release of the FOMC meeting minutes will reveal the Fed‘s outlook for monetary policy going forward, and what some of the board members’ outlook is for global growth and how the central bank intends to respond. As outlined in my weekly Nordic fundamental outlook, if policymakers forecasts are adequately pessimistic enough for them to believe a cut is warranted, it could result in a substantial amount of volatility.

The ECB will be releasing its interest rate decision with policymakers anticipating a hold, though commentary from Mario Draghi will likely be the market-moving event. At the last meeting it sent USD higher against all its major counterparts amid a heightened sense of risk aversion after the central bank cut inflation forecasts. Given the IMFs recent global growth forecast, it is likely the ECB will deliver a similar outlook.

Today the 27 EU member states decide on whether to grant the UK government a Brexit extension. The emergency summit was called by European Council President Donald Tusk who has also proposed allowing a one-year flexible exit date, permitting the UK to leave on or before the one-year mark. Were this to occur, the UK would likely have to participate in the upcoming European parliamentary elections.

In the Nordics, Sweden‘s Prospera inflation report is expected to be released with expectations that inflation will be lower than what Riksbank policymakers are hoping for. In Norway, CPI data will be published and is looking to outperform relative to economists’ expectations. This may largely be due to part the recent recovery in crude oil prices.

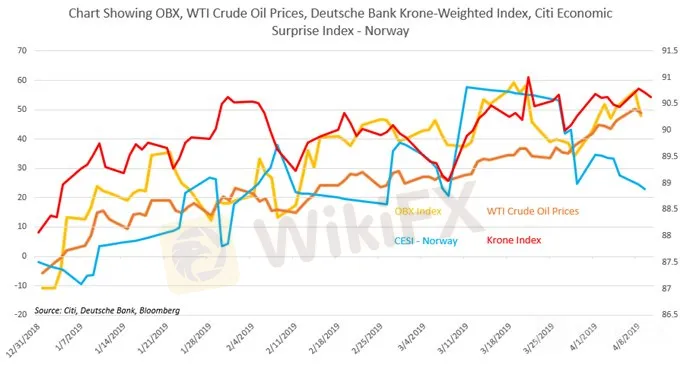

Because of the Norwegian economys heavy reliance on the petroleum sector, key benchmark assets – like the Krone and OBX equity index – closely track the movement in crude. This also leaves the country vulnerable to changes in global sentiment, a particularly important theme for Krone traders to keep in mind given the growing concern about waning global demand.

CHART OF THE DAY:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

Crude Oil Prices, NOK May Fall on Norway Sovereign Wealth Fund Data

Crude oil prices and the Norwegian Krone may fall if the world‘s largest petroleum-linked sovereign wealth fund’s earnings amplify global recession fears.

USDNOK Plunges, Breaks 15-Month Support on Hawkish Norges Bank

USDNOK fell over one percent after the Norges Bank chose to raise its benchmark interest rate and provided a hawkish outlook for monetary policy.

NOK Eyes Crude Oil Prices, Norges Bank and FOMC Rate Decisions

The Norwegian Krone will likely experience higher-than-usual volatility alongside crude oil prices ahead of rate decisions by the Norges Bank and Fed.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator