简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rebound Vulnerable to Strong U.S. Consumer Price Index (CPI)

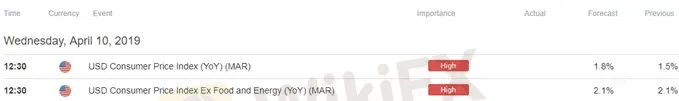

Abstract:Updates to the U.S. Consumer Price Index (CPI) may spur a bullish reaction in the dollar as the headline reading is projected to increase to 1.8% from 1.5% in February.

Trading the News: U.S. Consumer Price Index (CPI)

Updates to the U.S. Consumer Price Index (CPI) may spur a bullish reaction in the dollar as the headline reading for inflation is projected to increase to 1.8% from 1.5% per annum in February.

Indications of sticky price growth may undermine the recent shift in the Federal Reserves forward-guidance for monetary policy as the fresh figures are also expected to show the core reading hold steady at 2.1% in March. In turn, a positive development may curb the recent rebound in EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to deliver a rate-hike in 2019.

However, another unexpected downtick in both the headline and core CPI may drag on the U.S. as it encourages Fed Chairman Jerome Powell & Co. to abandon the hiking-cycle. Keep in mind, EUR/USD may face increased volatility following the U.S. data prints as the European Central Bank (ECB) President Mario Draghi hosts his press conference following the policy meeting.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the U.S. CPI report had on EUR/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change(1 Hour post event ) | Pips Change(End of Day post event) |

| FEB2019 | 03/12/2019 12:30:00 GMT | 1.6% | 1.5% | +10 | +20 |

February 2019 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute Chart

The U.S. Consumer Price Index (CPI) unexpectedly narrowed to 1.5% from 1.6% per annum in January, with the core rate of inflation highlighting a similar dynamic as the index slipped to 2.1% from 2.2% during the same period. A deeper look at the report showed the weakness was led by a 1.0% drop in prescription-drug prices, with the cost for used cars and trucks falling 0.7% in February, while gas prices climbed 1.5% after falling 5.5% the month prior.

The U.S. dollar struggled to hold its ground following the below-forecast prints, with EUR/USD grinding higher throughout the day to close at 1.1286. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

EUR/USD Rate Daily Chart

The failed attempt to test the 2019-low (1.1176) along with the lack of momentum to close below the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) may spur range-bound conditions in EUR/USD, with a break/close back above the 1.1270 (50% expansion) to 1.1290 (61.8% expansion) region raising the risk for a move towards 1.1340 (38.2% expansion).

Next area of interest comes in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion) followed by the 1.1430 (23.6% expansion) to 1.1450 (50% retracement), which largely lines up with the March-high (1.1448).

For more in-depth analysis, check out the 2Q 2019 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Dutch Law Student Arrested for €4.5 Million Crypto Scam

Currency Calculator