简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

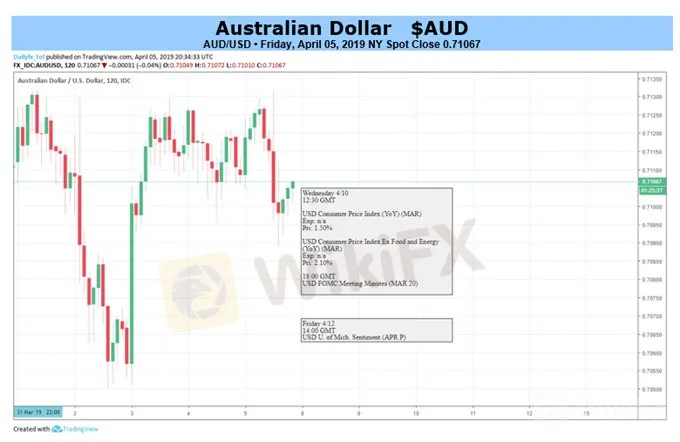

Australian Dollar Could Ride US-China Trade Hopes Higher Again

Abstract:The Australian Dollar still completely lacks domestic monetary policy support, and that will weigh on it more heavily in time. However, for now trade is running the table.

Fundamental Australian Dollar Forecast: Bullish

The Australian Dollars long fall against its US cousin has halted somewhat

Trade-deal hopes have underpinned it, an actual deal will probably lift it considerably

The Aussies longer-term prospects are much cloudier, however

Find out what retail foreign exchange traders make of the Australian Dollars prospects right now, in real time, at the DailyFX Sentiment Page

The Australian Dollar faces a week of scant domestic economic clues but is in any case likely to spend the next few sessions in thrall rather to global risk appetite.

Despite plentiful weak economic numbers from around the world of late, that appetite has been buoyed by persistent hopes that China and the US will come to a durable trade settlement, possibly quite soon. US President Donald Trump fueled those hopes last Thursday. Then he suggested that a ‘monumental’ agreement could be announced as soon as some time in the next four weeks, even as he acknowledged that differences remain between the two countries.

Given the feebleness of much economic data, it will remain to be seen whether any pact can truly be the magic cure for the world economy that many investors seem so sure it will be. But, for now, any signs that talks are on track are likely to buoy growth-linked assets such as the Australian Dollar.

AUD/USD remains well within the long downtrend which has endured since the start of 2018, but a combination of trade hopes and a rethink about the likely pace of US interest rate rises has seen it effectively rangebound for this year.

Its worth noting that the Aussie still utterly lacks interest rate support of its own, and that futures markets are now moving to price-in not just one but nearly two quarter-point cuts to the 1.50% Official Cash Rate over the next eighteen months.

With that in mind the currency still doesn‘t look like one to get too excited about over the medium or long term, but it may still reap the benefit of trade’s feelgood factor in the sessions ahead.

Investors will however get domestic consumer confidence data to chew over this week, while Reserve Bank of Australia Deputy Governor Guy Debelle will speak on the State of the Economy in Adelaide on Wednesday. While either event could see the Aussie move, neither is likely to give it the impetus to escape the broader gravity of overall risk appetite.

So, its a cautiously bullish call this week.

Looking for a technical perspective on the AUD Dollar? Check out the Weekly AUD Technical Forecast.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUD/USD Eyes Upside on Potential Loan Prime Rate Cut in China

Australian Dollar eyes China’s monthly 1- and 5-year Loan Prime Rate fixing. Traders await news over US/China oil inventory releases and Biden’s Fed pick. AUD/USD downside may continue as bearish SMA crossover nears.

FX Week Ahead - Top 5 Events: August RBA Meeting Minutes & AUD/USD Rate Forecast

The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

AUD/USD: Australian Dollar at Risk Ahead of China Trade Balance

Spot AUDUSD remains at risk with looming China trade balance data due for release during Thursday's trading session.

Top 5 Events: June RBA Rate Decision & AUDUSD Price Forecast

The Reserve Bank of Australia meets on Tuesday, June 4 at 04:30 GMT; rates markets are pricing in a 93% chance of a 25-bps rate cut.

WikiFX Broker

Latest News

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

Currency Calculator