简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WTO Slashes Global GDP Growth Estimates, Risk Assets Unfazed

Abstract:The World Trade Organization released its latest outlook on the global economy, cutting 2019 growth forecasts from 3.7 percent to 2.6 percent.

LATEST WTO ECONOMIC GROWTH OUTLOOK – TALKING POINTS

The World Trade Organization lowered its estimate for 2019 merchandise trade volume by a staggering 1.1 percent in the latest downward revision to global growth estimates

The report stated that “world trade will continue to face strong headwinds” this year and next, adding how it is “increasingly urgent that we resolve tensions and focus on charting a positive path forward for global trade”

Looking for comprehensive equity market outlook? Download the DailyFX Q2 Equity Forecastfor free

New to forex trading? No problem – this free educational guide on Forex for Beginners has you covered

The WTO announced its latest global trade statistics and outlook yesterday which painted a melancholic picture of global growth in 2019. In its press release, the WTO published a stunning downward revision of GDP growth this year, cutting its forecast to 2.6 percent from its previous estimate of 3.7 percent. The report highlighted escalating trade tensions, waning fiscal and monetary stimulus in North America and Europe, in addition to structural changes to the Chinese economy as the primary factors leading to the WTOs lower GDP projections.

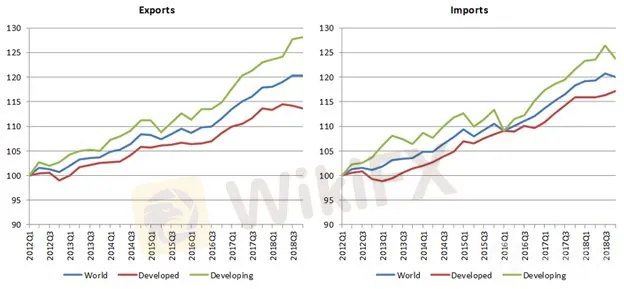

WTO WORLD MERCHANDISE EXPORTS AND IMPORTS VOLUME INDEX: QUARTERLY TIME FRAME (JANUARY 2012 TO DECEMBER 2018)

Source: World Trade Organization

The WTO report labeled the economic slowdown in Europe and Asia as the main culprits to the downturn in trade considering the significant weight the two regions have as a proportion of the global economy. As such, dismal PMI data released out of the Eurozone recently could have contributed to the WTOs downward revision to global outlook.

The global deceleration now appears to be spilling over into the US. The ISM Non-Manufacturing/Services PMI just touched its lowest level since August 2017 with the data print also coming in below Bloombergs median consensus. Plummeting sovereign yields can be viewed as another sign that the world economy is slowing, especially when considering the latest US Treasury yield curve inversion.

Despite economic data and numerous GDP estimates progressively pointing to slower and slower global growth, risk assets like stocks appear completely unfazed by deteriorating fundamentals. In fact, the MSCI World Equity Index has gained over 13 percent so far this year and is roughly 300 basis points away from its all-time high.

MSCI WORLD EQUITY INDEX PRICE CHART: 30-MINUTE TIME FRAME (MARCH 03, 2019 TO APRIL 03, 2019)

The surge higher in global stocks has been primarily driven by the dovish pivot in central bank policy from the Fed and ECB along with monetary stimulus from the BOJ and PBOC. Most recently, the ECB announced another round of TLTROs while the Fed cut its projection for future rate hikes in addition to stating the end of its balance sheet normalization.

As such, the MSCI World Equity Index was largely unchanged by the WTOs press release announcing its downward revision to world trade forecasts. Although central banks around the globe will likely keep responding to economic weakness with dovish monetary policies that ease financial conditions, there may soon come a tipping point were gloomy fundamentals overwhelm investor sentiment and consequently push risk assets lower.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar ticks lower with Fed policy decision in focus

The dollar eased versus its main rivals on Monday, after posting its biggest daily rise in more than four months in the previous session, as traders position themselves ahead of this week's highly anticipated U.S. Federal Reserve policy meeting.

EURUSD May Have Volatile Spikes: Thinner Liquidity on US Holiday

EURUSD may experience volatile spikes as US markets close for the July Independence Day holiday, leaving markets thinner and exposing the pair to potentially violent swings.

EURUSD Regains Some Strength, Bond Yields Signal a Recession

The EURUSD has pushed past the 1.1140 resistance line but traders will be eyeing German CPI and US PCE Core figures to strengthen their position. Worries about a recession have pushed long-term government yields around the world to the lowest level in years

Euro Nervously Eyes ECB and EU Data, SEK May Fall on Swedish GDP

The Swedish Krona may fall on GDP data and the Euro may struggle to rise if the ECB shows an increasing risk of a Eurozone financial crisis as key economic data is released.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator