简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ASEAN FX at Risk to US Recession Fears & Sentiment on Brexit, ECB

Abstract:The US Dollar may regain ground versus ASEAN currencies if rising concerns about a recession fuel demand for safe havens. Markets eyeing US economic data, Brexit and ECB commentary.

ASEAN Fundamental Outlook

A more dovish Fed sunk US Dollar, lifting ASEAN currencies

Rising concerns about a recession may bolster the Greenback

Declines in USD/IDR, USD/MYR and USD/PHP may not last

Trade all the major global economic data live and interactive at the DailyFX Webinars. Wed love to have you along.

US Dollar and ASEAN FX Recap

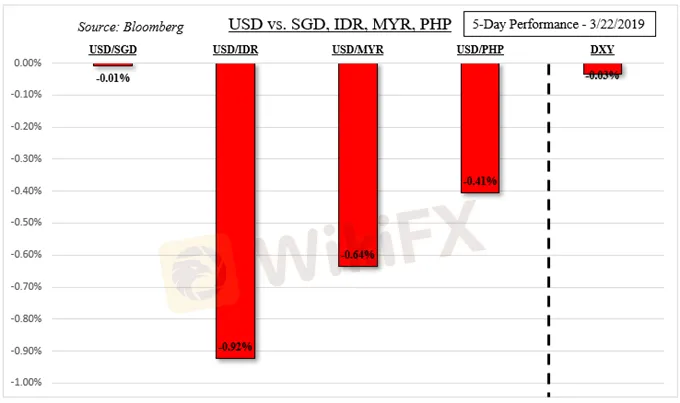

Most ASEAN currencies appreciated against the US dollar this past week, owing to a surprisingly more-dovish-than-expected Fed rate decision. In addition, sentiment generally recovered throughout most the week heading into the FOMC. Most notably, the S&P 500 at one point breached critical resistance before turning back lower on Friday.

USD/IDR saw most of its decline in pre-FOMC trade, with losses pausing after the Bank of Indonesia rate decision afterwards. While benchmark lending rates were left unchanged, the central bank said that it will raise loan-to-funding ratio reserve requirements as it takes on accommodative policies to push for domestic demand. After hiking rates aggressively last year, this was seen as a step away from monetary tightening.

There was a slightly different story from the Philippine central bank last week. Heading into it, USD/PHP rose on more dovish prospects after newly-appointed Governor Benjamin Diokno alluded to cuts in reserve requirement ratios (RRR). However, the Philippine Peso then regained ground after there were no mentions of cutting RRR in the statement, disappointing some dovish bets. USD/SGD was little change by the weekend.

Domestic ASEAN FX Economic Events and Risks

The regional ASEAN economic docket thins out in the week ahead following two central bank rate decisions. Singapore will be releasing February inflation and industrial production data. Regardless, USD/SGDtends to have a close relationship with DXY and its movement in the medium-term may be dictated by the Greenback. For risk trends, do keep an eye on Chinese industrial profits on Wednesday.

External ASEAN FX Event Risk

Speaking of sentiment, ASEAN currencies such as the Malaysian Ringgit could be left vulnerable if global equities turn lower ahead. Lately, there have been rising concerns about a recession in the worlds-largest economy. Looking at the chart below, a closely watched section of the US yield curve, the gap between 3-month and 10-year government bond yields, flipped negative for the first time since 2007.

US Recession Concerns

Chart Created in TradingView

In times of risk aversion, the highly-liquid US Dollar can benefit from haven demand. With that in mind, attention turns to a slew of important domestic data. Next week offers US consumer confidence, GDP and PCE core (the Fed‘s preferred measure of inflation). Lately, economic data has been tending to underperform relative to economists’ expectations. If more of the same fuels risk aversion, USD may rise.

As such, sentiment-linked ASEAN FX may succumb to selling pressure in such circumstances. Another risk for stocks, a wildcard perhaps, is what could happen if UK Prime Minister Theresa May fails to pass her Brexit deal in Parliament for a third time. This may increase the odds of a ‘no-deal’ divorce unless the nation participates in EU parliamentary elections.

There will also be a slew of European Central Bank speakers in the week ahead offering commentary in the aftermath of a more-dovish ECB rate decision. Rhetoric that echoes and builds on a more pessimistic outlook could scare investors. As such, treat losses in USD/IDR, USD/PHP and USD/MYR with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

EUR/USD is mixed to bearish, influenced by resistance levels and upcoming data. GBP/USD is bullish with the pound at four-month highs on positive UK data and hawkish BoE comments. EUR/GBP remains volatile, reflecting diverging economic conditions in the Eurozone and the UK.

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

European trading is subdued due to the U.S. holiday, with the euro benefiting from weak U.S. data. The pound rises ahead of the UK election, supported by market sentiment. ECB President Christine Lagarde's comments on interest rates support the euro. Overall, mixed sentiment prevails with cautious trading expected. Key economic events include Eurozone retail sales, Germany's industrial production, and UK services PMI.

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

GBP/USD Under Pressure as USD Outperforms - Fed, BOE and Brexit Loom

TALKING POINTS:

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Peso Depreciation to 59:$1 Likely Amid Strong Dollar Surge

Currency Calculator