简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Gets Bid Following FOMC Meeting Amid Bets for December Rate-Cut

Abstract:Gold prices have reversed course ahead of the 2019-low ($1277), with the price of bullion climbing to a fresh monthly-high ($1320) following the FOMC meeting.

Gold Price Talking Points

Gold climbs to a fresh monthly-high ($1320) following the Federal Open Market Committee (FOMC) interest rate decision, and the precious metal may exhibit a more bullish behavior over the coming days as the price for bullion reverses course ahead of the 2019-low ($1277).

Gold extends the advance from earlier this week as the Federal Reserve keeps the benchmark interest rate in its current threshold of 2.25% to 2.50%, with the central bank largely endorsing a wait-and-see approach for monetary policy ‘in light of global economic and financial developments and muted inflation pressures.’

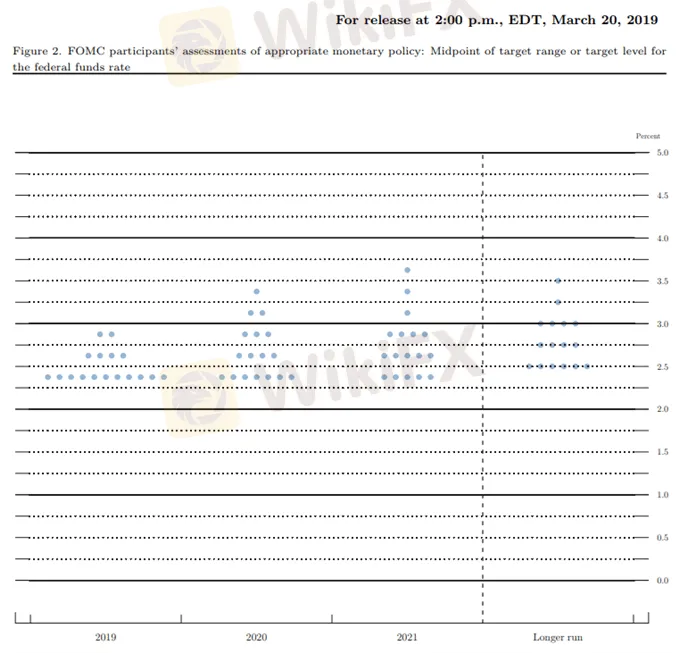

The fresh updates to the Summary of Economic Projections (SEP) suggest the FOMC will continue to change its tune over the coming months as the central bank trims its economic forecast, and Fed officials may show a greater willingness to abandon the hiking-cycle as the committee plans to wind down the $50B/month in quantitative tighten (QT) by the end of September. However, the dot-plot indicates that the FOMC may still implement a rate-hike over the policy horizon as the longer-run interest rate forecast sits between 2.50% to 2.75%, and it remains to be seen if the Fed will keep the door open to further normalize monetary policy as the central bank pledges to be ‘patient as it determines what future adjustments to the target range for the federal funds may be appropriate.’

With that said, Fed Fund Futures now shows market participants pricing a 40% probability for a rate-cut in December, and a further shift in the Feds forward-guidance may ultimately heighten the appeal of gold as it stokes fears of a policy error. In turn, the current environment may keep gold prices afloat, and the price for bullion may continue to retrace the decline from the yearly-high ($1347) as it initiates a series of higher highs & lows following the FOMC meeting.

Gold Price Daily Chart

Keep in mind, failure to snap the yearly opening range instills a constructive outlook for gold, with the price for bullion at risk of retracing the decline from the yearly-high ($1347) as it reverses course ahead of the 2019-low ($1277).

At the same time, developments in the Relative Strength Index (RSI) suggest the bearish momentum will continue to unravel as the oscillator breaks out of the downward trend carried over from the previous month.

However, need a close above the Fibonacci overlap around $1315 (23.6% retracement) to $1316 (38.2% expansion) to open up the $1328 (50% expansion) to $1329 (50% expansion) region, with the next area of interest coming in around $1340 (61.8% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator