简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NZDUSD Uptrend Extends, 4Q GDP Data Ebbs Near-Term Showdown Fears

Abstract:NZD/USD unexpectedly rose, closing at its highest since December on lackluster fourth quarter New Zealand GDP data which might have reduced near-term economic slowdown fears.

New Zealand 4Q GDP, NZD/USD Talking Points

NZD/USD unexpectedly gains on lackluster NZ 4Q GDP data

In line 0.6% q/q result may have ebbed near-term slowdown fears

The New Zealand Dollar may extend the uptrend from October

Trade all the major global economic data live and interactive at the DailyFX Webinars. Wed love to have you along.

In a puzzling turn of events, the New Zealand Dollar unexpectedly appreciated against its major counterparts despite a lackluster GDP report. In the fourth quarter of 2018, New Zealands economy grew only 2.3% y/y versus 2.5% expected and from 2.6% in the third quarter. This was the weakest pace of economic expansion since the fourth quarter of 2013.

Markets may have been paying more attention to the quarter-on-quarter 0.6% result. This was in line with expectations and more importantly up from 0.3% prior. That previous outcome was the softest pace of growth since Q4 2013 as well. More importantly, it was a step away from a contraction. In the current world economic environment, every major central bank has highlighted the concerns of weakening global growth.

Most recently was the Fed which just hours earlier downgraded economic projections and delivered increasingly more dovish rhetoric. While New Zealand may have also slowed to a certain extent, the q/q GDP statistics revealed that the situation could have been a lot worse. And on that surprising result, NZD/USD resumed its rally after losing upside momentum in the aftermath of the FOMC.

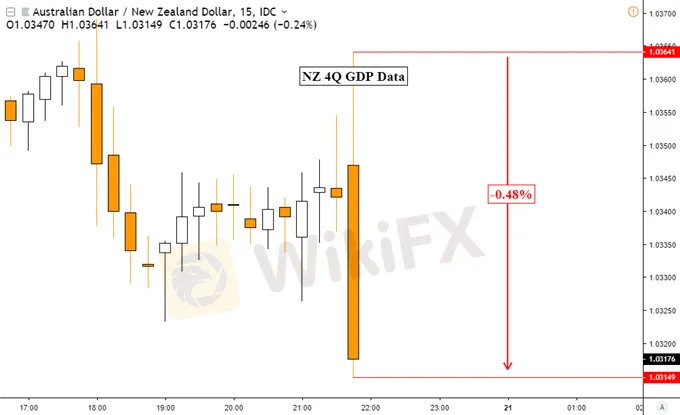

AUD/NZD15-Minute Chart Reaction to NZ GDP Data

Chart Created in TradingView

NZD/USD Technical Analysis

The surge in NZD/USD on Wednesday on the FOMC rate decision and New Zealand GDP data was the most potent since late January when using a daily basis. On the chart below, NZD/USD just barely closed at its highest since early December. However, it did not breach early February highs and it remains a robust area of resistance. Confirming another close to the upside exposes resuming the uptrend that began back in October. You may follow me on Twitter for the latest updates on NZD here at @ddubrovskyFX.

NZD/USD Daily Chart

Chart Created in TradingView

New Zealand Dollar Trading Resources

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

NFP Hammers Dollar to 4 Months Low

The aftermath of the Japanese yen's strengthening has manifested in significant dips across multiple markets, including equities, commodities, and various currencies. The yen has erased all its 2024 losses against the dollar, moving towards the 145.00 mark. The dollar index (DXY) has fallen to its lowest level since March, hovering above the $103 mark.

KVB Today's Analysis: Gold Bullion Gains Strength Amid Fed's Dovish Stance on Interest Rates

Fed officials have indicated they are prepared to cut interest rates if necessary, though there is no immediate need. This dovish stance has been viewed positively by the markets, leading to increased buying pressure on gold. Despite ongoing inflationary risks, market expectations of a rate cut in June have risen to 66.3% (up 3% since the PCE release). Lower interest rates could enhance the appeal of non-yielding gold.

Yen Resurgence! Will Next BoJ Week Sustain the Rally?

The U.S. Conference Board reported a slight decline in the US Consumer Confidence Index (CCI) for June 2024, dropping to 100.4 from 101.3 in May. The Bank of Japan (BoJ) opted to keep its key short-term interest rate steady at 0.10% for June 2024, in line with market expectations. At its June 2024 meeting, the Federal Reserve decided to keep the federal funds rate unchanged at 5.50%. In June 2024, the Bank of England (BoE) decided to keep the interest rate at 5.25% unchanged. This decision...

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Dr. Sandip Ghosh, Ex-RG Kar Principal, Involved in Multi-Crore Scam

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

Terra Founder Do Kwon Denies Fraud Allegations in U.S. Court

Currency Calculator