简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Visited FP Markets, an Australian Forex Broker

Abstract:Recently, WikiFX has paid a visit to FP Markets, an Australian Forex broker. The broker, established in Australia in 2005, has operated in financial product trading for more than 10 years.

Recently, WikiFX has paid a visit to FP Markets, an Australian Forex broker. The broker, established in Australia in 2005, has operated in financial product trading for more than 10 years.

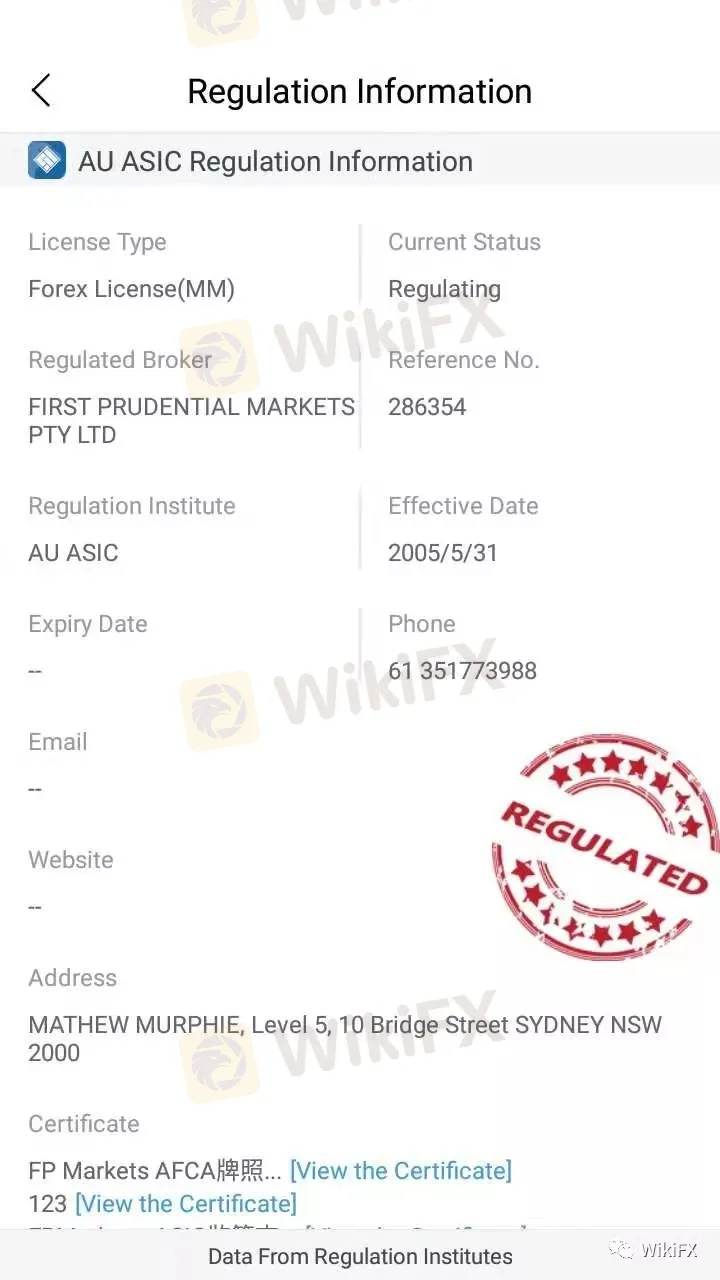

FIRST PRUDENTIAL MARKETSPTY LTD(aka FP Markets), headquartered in Sydney, holds ASIC (AUS)' s MM license.

Meanwhile, the broker, one of biggest securities company in Australia, has the full license for Stock, Futures and Margin FX trading service from ASIC(AUS) firstly in Australia. ( AFSL regulatory number: 286354)

Screenshot of FP Markets' s regulatory information

We visited FP Markets, a licensed Australian Forex broker, which is located MATHEW MURPHIE, LEVEL 5, 10 Bridge Street SYDNEY, as per the address recorded in regulatory body.

10 Bridge Street

WikiFX team came to the building located 10 Bridge Street and found FP Markets from company directory.

Photo of company directory of the building

We entered the building and saw that FP Markets is at Room 502 per company directory.

Photo of directory on Level 5

We can see the logo of FP Markets clearly at Room 502 with spacious working area. And the TV sets were still displaying Forex quotations and financial program clips.

Photo of FP Markets' s door outside

We confirm that this Australian licensed broker is truly existing with large size.

Screenshot of FP Markets interface from WikiFX

Screenshot of FP Markets interface from WikiFX

With rating 8.09, FP Markets has valid regulatory status. Per the visit, we confirm that the Australian licensed broker is really existing.

Download WikiFX APP to learn more about the visit reports of individual brokers worldwide.

Our visit service covers UK, Australia, Cyprus, Hong Kong and many others, and now over 76 Forex brokers has already been visited and filed. Stay tune and more visit reports are coming soon.

Screenshot of FXCM interface from WikiFX

Go to broker page, click the button at the bottom - “WikiFX Field Survey”, you will see the information of those brokers visited.

We will visit more brokers around the world, helping Forex investors to identify the legal and trustworthy platform to ensure the safety of their capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Watch out! PlatformsFx Robbed Me of US$76,878

A few months ago, a person from the trading solution provider company “PlatformsFx” contacted the victim for forex trading. According to the victim, the scammer and his so-called well-known gold trading platform took US$76,878 from her and put it into a presumably real forex account.

How to choose the best leverage level

Archimendes said: “Give me a fulcrum, I can lift the whole earth”. This is the earliest appearance of the concept of leverage. The word leverage dates from 1724 and was originally used to describe the action of a lever. By 1824, by which time the Industrial Revolution was fully underway, the scope of the word had expanded to include the power of a lever and therefore the obtaining of a mechanical advantage. It is simple to say that if you want to invest $10,000 in the forex market, you can to it by leverage with small investment. Leverage is a financial tool, which can magnify the result of your investment, including gain or loss at a fixed ratio.

Oil Prices Hit Fresh High on Uncertain Outlook

WikiFX News (6 Aug) - WTI crude oil embraced a steep rise in prices, up 4.5% to the high level of $43.68, compared to its low level of $41.76. It has recorded a fresh five-month high since March 6. Nevertheless, the outlook of oil remains uncertain because of the insufficient upward momentum in future oil prices resulted from the sluggish job growth in the United States.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator