简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tomorrows NFP Report to Spur Further USDCAD, EURUSD Volatility

Abstract:Forex option traders have bid up USDCAD overnight implied volatility to its highest level since January 3 ahead of Friday's employment data release.

IMPLIED VOLATILITY – TALKING POINT

Jobs data out of the United States and Canada set for release tomorrow looks to provide a fresh take on the economy in North America and could cause USDCAD to gyrate

A persistently robust US jobs market could solidify recent EURUSD downside and even extend spot prices lower in response to further evidence of economic divergence

New to currency trading? Take a look at the Forex for Beginnersand Introduction to Forex News Trading educational guides by DailyFX to gain insight from our analyst

The last few days have been a wild ride for short-term currency traders as a barrage of global economic data releases and central banker commentary sent forex pairs swooning. In response, implied volatility has escalated throughout the week as the option market prices in higher anticipated price action.

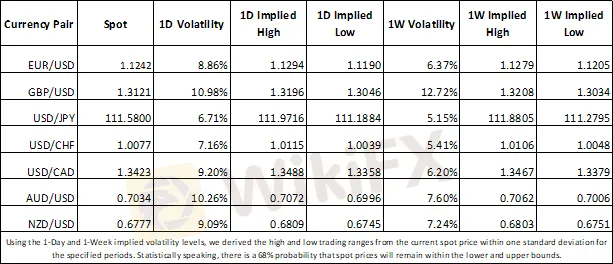

CURRENCY MARKET IMPLIED VOLATILITY AND TRADING RANGE

Job reports out of the US and Canada scheduled for 13:30 GMT tomorrow should cap off this weeks market-moving data releases. In anticipation of the upcoming data, forex option traders have bid up USDCAD overnight implied volatility to its highest level since January 3. CAD traders already saw the currency tumble nearly 1 percent as dovish remarks from the Bank of Canada yesterday pushed the Loonie lower.

Although USDCAD 1-week implied volatility has faded from recent highs as previously estimated price action became realized, the currency pair could extend gains just as easily as it could reverse lower tomorrow with employment numbers likely weighing heavily on the cables next direction.

UPCOMING FOREX ECONOMIC DATA RELEASES AND EVENT RISK

Todays EURUSD selloff in response to Mario Draghi and the European Central Bank lowering economic growth and inflation targetssent the currency pair to its lowest level since June 2017. The aftermath during tomorrows session could provide some relief from selling pressure if US data crosses the wires below expectations. Alternatively, a persistently robust American jobs market could solidify recent EURUSD downside and even extend spot prices lower in response to further divergence between the two economies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

Canadian Dollar Technical Analysis: Short-term CAD Weakness Anticipated–Setups for CAD/JPY, USD/CAD

While the BOC has turned more hawkish, other fundamental factors are working against the Canadian Dollar in the near-term. Volatility and weakness in oil prices coupled with a stretch of disappointing Canadian economic data are weighing on the Loonie. According to the IG Client Sentiment Index, USD/CAD rates have a bullish bias in the near-term.

EUR/USD Looks to US Retail Sales, Sentiment Data After ECB

EUR/USD may rise if US retail sales and sentiment data amplify growing Fed rate cut bets after the ECB failed to meet the markets ultra-dovish expectations.

Euro Sinks Ahead of ECB & Draghi, Implied Volatility Surges

Euro selling pressure builds as implied volatility measures skyrocket and dovish expectations fester while forex traders anxiously await the high-impact September ECB meeting slated for Thursday.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator