简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Chinese Yuan Takes Spotlight - Investors Buy as China Borrowing Jumps

Abstract:Is the narrative of global investing themes shifting from a certain bear market to possibly setting the stage for new highs in equity indices in

DailyFX Podcast Talking Points:

A patient Federal Reserve (per Fed Funds Futures) could lead to eager to buy investor

Is the Yuan a proxy for a rush back into global assets that have recently been oversold?

Key metals like Iron Ore see a premium paid on upside options likely signaling upside

Prefer to listen to market views? Check out Trading Global Markets Decoded, the DailyFX Podcast

Is the SPX in a bear market rally with 2,800 being resistance or are things fundamentally different enough to encourage investors to keep buying in views of a brighter future in the near term? That is the question the DailyFX‘s Sr. Analyst; Tyler Yell looks to answer in this week’s show with a handful of supporting points that are worth your consideration.

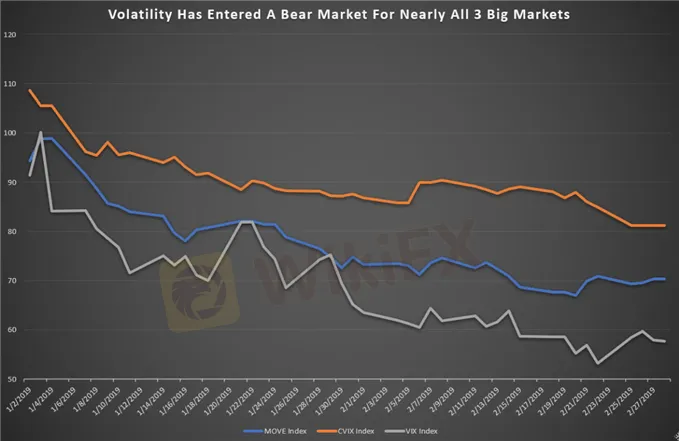

A key bear market is also underway in a market that gets too little attention. Volatility, whether you look at bonds, equities, or FX has plummeted in early 2019 that may also favor further upside albeit at a slower pace than that.

Stock, Fixed Income, & Currency Volatility YTD Factored by 100

Data source: Bloomberg

Whats Going On?

The S&P 500 continues to rally up with the help of the Fed as chairman Jerome Powell provides a positive economic outlook while communicating patience is the play in 2019.

Data source: Bloomberg

What Does This Mean?

As we see in the graph above, the bond market has been performing in the opposite direction as the equity market, which tends to be normal. In times of uncertainty and fear, the volatility index moves in the same direction as the bond market.

When looking at the 2008 crisis, the bond market outperformed the equity market, and the VIX index was at its highest. Investors tend to tilt towards less volatile investments such as government bonds in times of uncertainty and given the potential deal between China and the U.S, the Feds positive outlook and increase in market confidence; it would be no surprise if the equity market continues upwards in the short-term.

Record-Breaking New Lending MoM in China Propels CSI 300 Higher

Data Source: Bloomberg

Whats Going On?

In 2018, China witnessed one of its slowest growth as a result of the trade war. The government had set in place some stimulus programs to lessen the effect, and it seems to now be kicking in. It has been reported that new yuan loans have hit a record this month of 3.23 trillion yuan making their monthly assets equivalent to that of all the global banks combined.

What Does This Mean?

As small and medium companies take advantage of the liquidity injected by the government, we may see China‘s economy pick up especially with the potential truce between U.S and China. Although this may seem positive, the country needs to be cautious and ensure that there aren’t too many funds circulating since not only can it increase inflation, it will further increase their debt-to-GDP ratio, which is already too high.

Iron Ore Options Continue to Seek Upside Protectio

Source: Bloomberg

Whats Going On?

Iron ore premiums increase on call options as prices may continue to increase.

What Does This Mean?

With the closing of Vales mine and iron ore production declining in China, this shift in supply may push markets to drive prices higher since the demand would likely be higher than the supply. This looks to have resulted in a higher call option premium shown in blue on the chart above.

WANT MORE?

Sr. Analyst, Tyler Yell, CMT covers these topics and more in the DailyFX podcast; Trading Global Markets Decoded that you can access here.

--- Written by Nancy Pakbaz, CFA

Follow Nancy on Twitter @NancyPakbazFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator