简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

Abstract:Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

Gold Price Analysis and Talking Points:

Gold Buying Persists, Eyes on FOMC Minute

Crucial Technical Resistance May Spark Inflection Point

See our quarterly gold forecast to learn what will drive prices throughout Q1!

Gold Buying Persists, Eyes on FOMC Minute

Since the beginning of the year, Gold prices are up over 5%, trading at its highest level since April 2018 as global central banks take a more accommodative stance. Most notably the Federal Reserve who emphasized that not only would they be patient in rate hikes, they had also opened up to the idea that the balance sheet unwind may end sooner than what the markets expects. Consequently, investors have flocked to the non-yielding precious metal. Eyes will be on tonights FOMC minutes, whereby a dovish release could see gold push towards key resistance at $1350.

However, judging by the price action observed in the USD and gold yesterday, markets may have already positioned themselves for a dovish outcome, implying a slight near-term pullback if markets perceive the minutes as less dovish than expected. Outlook continues to remain bullish as global bond yields continue to dip.

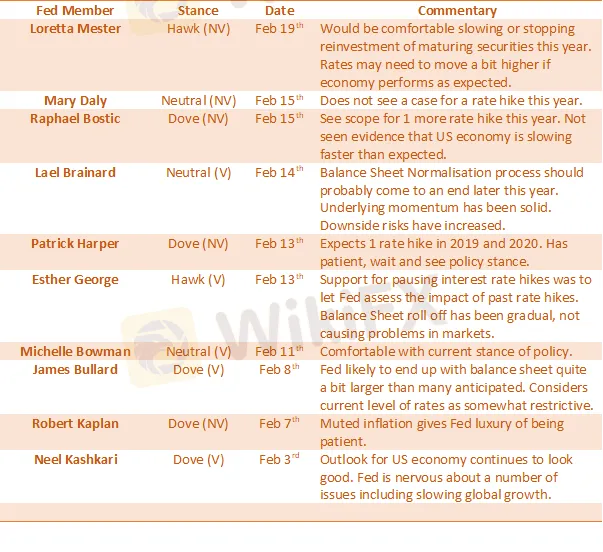

FOMC Tracker

Crucial Technical Resistance May Spark Inflection Point

With the gold uptrend firmly intact, the precious metal is now eying key resistance at $1350, which marks the descending trendline from the August 2013 peak, potentially sparking a near-term pullback. However, a closing break above increases scope for a move towards the 2018 peak at $1365-66. Elsewhere, a slight negative divergence on the RSI also raises the potential for a pullback.

GOLD PRICE CHART: Daily Time-Frame (Jun 2018-Feb 2019)

Chart by IG

GOLD PRICE CHART: Weekly Time-Frame (Aug 2010-Feb 2019)

RECOMMENDED READING

Gold Price Analysis: Fed Capitulation & Central Bank Buying Spree Maintains Bullish Outlook

What You Need to Know About the Gold Market

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Quiet Before the Storm? Markets Poised for a Relaxed Week

For June 2024, Canada's CPI rose by 2.7% year-over-year, down from 2.9% previously. This decrease in core inflation is driven by a combination of slower economic growth and moderated wage growth, even with a strong labor market. The FOMC meeting minutes from July 2024 indicated that the Federal Reserve decided to maintain the federal funds rate within the target range of 5.25% to 5.50% and revealed a shift in the Fed's focus. The latest data on U.S. Initial Jobless Claims, for the week ending...

Weekly Economic Calendar: Key Events Impacting USD, JPY, GBP, EUR, and Gold (XAU)

This week's economic calendar is packed with key events affecting USD, JPY, GBP, EUR, and Gold (XAU). In the USA, watch for Core PCE Price Index, ISM Manufacturing PMI, Initial Jobless Claims, and JOLTs Job Openings. Japan releases the Tankan Large Manufacturers Index and Services PMI. The UK focuses on Manufacturing and Construction PMI, while the Eurozone releases CPI and Services PMI data. Each event's potential impacts on currencies and gold are analyzed for market insights.

Fed Faces Inflation Heat: What's Next for FOMC?

In February, retail sales in Australia saw a slight increase, fueled by heightened spending on clothing and dining out, likely spurred by popular Taylor Swift concerts drawing crowds. The U.S private sector employment increased by 184,000 jobs in March and annual pay was up 5.1 percent year-over-year. It was the largest addition since July and higher than the expected reading of 148k new private jobs with the biggest increases for job changers were in construction, financial services and...

GEMFOREX - weekly analysis

The week ahead: Dollar awaits key US data

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

5 Advantages of Choosing a Regulated Broker

Currency Calculator