简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Rally Resumes as S&P 500 Looks More at Risk to Reversal

Abstract:US Dollar resumed rally as CPI report reduced dovish Fed policy bets, sapping upside potential from the S&P 500 which looks more vulnerable. Asia Pacific

Find out what retail traders equities buy and sell decisions say about the coming price trend!

3 Things to Know Before Trading APAC Market

1) US Dollar Resumes Rallying on Inflation Data

After a pause yesterday, the US Dollar resumed its uptrend from the beginning of February as it clocked in its best rise in a day since January 2 (+0.52%). A better-than-expected US headline inflation report helped contribute to this. Domestic government bond yields rallied, signaling a reduction in dovish Fed monetary policy expectations.

This may have weighed against equities to a certain extent, preventing a liftoff in the S&P 500 as it trimmed most of its gains and closed just 0.3% to the upside. This followed a rosy session in Europe where most benchmark stock indexes rallied. However, these were largely because of gaps to the upside. The Euro Stoxx 50 then proceeded to range.

2) Dismal Eurozone Industrial Productio

Gains in the Greenback weighed against the Euro which also had to contend with dismal Eurozone industrial production as expected. Output contracted by 4.2% y/y which was by the most since 2009. Economic weakness from Europe, with Italy in a technical recession and fears of a no-deal Brexit, leaves EUR/USD increasingly at risk to declines down the road.

3) Asia Pacific Market Ope

As we head into Thursdays Asia Pacific trading session, S&P 500 futures are aiming narrowly lower. This may precede a mixed to slightly underwhelming day for regional bourses. Especially if markets start feeling more concerned about Fed rate hike bets. The anti-risk Japanese Yen could thus be offered a chance to recover on some losses while the pro-risk Australian and New Zealand Dollars fall.

JPY showed a minimal reaction to the preliminary Q4 GDP report (see calendar below) given that economic data out of the country tends to have a minimal impact on BoJ policy bets. Meanwhile, at an unspecified time today, China is expected to release January‘s trade data. Fears of growth slowing there and data tending to underperform relative to economists’ expectations may result in a soft outcome.

S&P 500 Technical Analysi

The pullback in the S&P 500 on Wednesday as it trimmed most of its gains resulted in the formation of a shooting star candlestick. This is typically seen as a sign of indecision. Closes to the downside thereafter may lead to a bearish reversal. On top of this, negative RSI divergence warns that upside momentum is fading. Fundamentally, the index seems to be running out of reasons to rally.

S&P 500 Daily Chart

Chart Created In TradingView

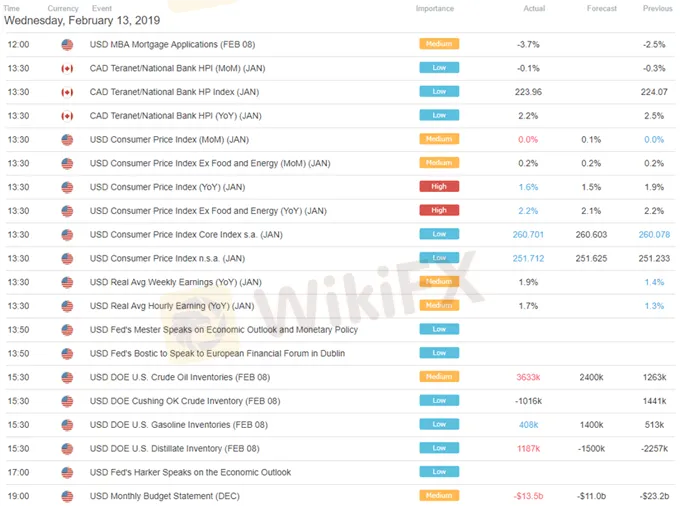

US Trading Session Economic Event

Asia Pacific Trading Session Economic Event

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

Type of Accounts Offered by Giraffe Markets

Each type of account is tailored to meet the diverse needs and preferences of traders, ensuring that there's an option suitable for every level of expertise and trading style with Giraffe Markets.

Commodity Trading for Beginners: A Comprehensive Guide

At Giraffe Markets, we provide the tools and resources to help you confidently navigate the commodity markets. Whether you're interested in trading gold, oil, or agricultural products, our platform offers a seamless experience for new and experienced traders.

OnEquity Unveils New Website: Simplified CFD & FX Trading for Global Markets

Unlock Global Markets with Simplified CFD & FX Trading at OnEquity. Our new website offers a powerful platform, competitive spreads & commissions, and 24/7 multilingual support. Trade CFDs on currencies, stocks, indices & more. Join our thriving trading community today!

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator