简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound May Shrug as US Dollar Gains on CPI Data, Euro at Risk

Abstract:The British Pound may shrug off UK CPI while the US Dollar gains on analogous local data. The Euro may turn lower anew after yesterdays

TALKING POINTS – CPI, POUND, US DOLLAR, EURO, SPAIN, BOND AUCTIO

UK inflation data unlikely to see strong response from British Pound

US Dollar might be sent higher as CPI data brightens Fed policy bet

Euro may fall on Spain budget vote, soft IP data and bond sale result

UK CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 1.9 percent on-year, the lowest level since January 2017. A soft results impact on the British Pound may be relatively limited however considering near-term BOE rate hike chances already appear negligible ahead of the March 29 Brexit deadline.

US DOLLAR MAY RISE IF CPI DATA TOPS FORECAST

Analogous US CPI figures enters the spotlight later in the day. Here, the on-year price growth rate is seen cooling from 1.9 to 1.5 percent, marking the weakest reading since September 2016. US news-flow has palpably improved relative to forecasts recently, opening the door for an upside surprise. Leading PMI survey data bolsters the case for such an outcome.

An upbeat result might encourage priced-in Fed policy expectations to shift to a less-dovish setting. In fact, that process is already underway. Traders still lean against a rate hike in 2019 but the outlook now implied in Fed Funds futures puts the probability of one at the highest in a week. A higher CPI print may help this process along, boosting the US Dollar along the way.

EURO AT RISK ON INDUSTRIAL PRODUCTION DATA, BOND AUCTIONS, SPAI

The Euro may succumb to renewed selling pressure following yesterday‘s spirited recovery. Spain might trigger a snap election if the minority government of Prime Minister Pedro Sanchez comes up short in a budget vote due today. Meanwhile, soft Eurozone industrial production data and the results of bond auctions in Italy and Germany may sour investors’ appetite for EUR-denominated assets.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

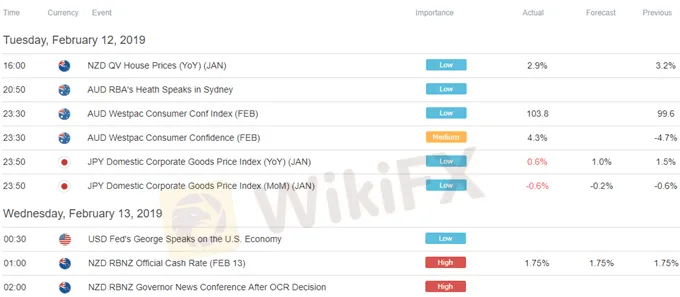

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

Global Economic and Financial Highlights: July 18, 2024

Today's news covers significant developments in global markets and politics. President Biden's campaign faces challenges due to a COVID-19 diagnosis, while China's economic strategies and tech advancements remain in focus. Key updates include the impact of US semiconductor restrictions, rising tensions in global trade, and significant shifts in corporate strategies and financial markets. The news reflects the dynamic and interconnected nature of the global economy.

Special Article: Analysis of FOMC Minutes

The FOMC minutes highlighted financial strains on low-to-moderate-income households, the Fed's data-dependent approach, and the impact of geopolitical risks. Discussions included immigration's positive impact on the labor force and modest progress toward disinflation. Potential rate cuts were mentioned if the job market deteriorates significantly. This cautious outlook emphasizes balancing inflation control and economic support.

Today's analysis: XAUUSD Faces Potential Decline Amid Fed's Rate Uncertainty

Gold (XAU/USD) is predicted to decrease due to a mix of economic factors and technical indicators. Lower-than-expected US PPI and CPI data suggest potential Fed rate cuts, initially supporting gold, but a cautious Fed outlook has pulled prices back. Technically, a bearish Head-and-Shoulders pattern suggests a trend reversal, with a break below $2,279 confirming downside targets at $2,171 and $2,106. However, a rise above $2,345 could challenge this pattern and push prices back toward $2,450.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator