简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 10 most complained Forex brokers in January

Abstract:At the beginning of 2019, “Exposure” of WikiFX still received many complaints against Forex Brokers, and the amount didn't decrease.

At the beginning of 2019, “Exposure” of WikiFX still received many complaints against Forex Brokers, and the amount didn't decrease.

There were still many platform problems focusing on that illegal brokers rejected investor's withdrawal application. It is advised that investors should check WikiFX APP regularly to evaluate risk in advance and make investment decision rationally.

Investors can lodge a complaint or disclosure by “Exposure” of WikiFX, encountering illegal problems.

What's “Exposure” of WikiFX?

WikiFX's “Exposure” is created to lodge a complaint or exposure by investors, who can post messages by “Exposure” to complain, confronted with brokers' problems during trading.

And they also can cancel the posts freely, when problems are solved.

The complaints this month mainly focus on:

Broker refused or delayed investor's withdrawal.

Broker had the problems of serious slippage and trade delay.

Platform customer service ignored investor's request frivolously.

Platform closed.

Position blowing up or wearing.

Heavy loss happened in a short time.

Platform was out of contact.

Heavy loss caused by analyst's trading signal.

WikiFX reminds investors should be always aware of the brokers with complaints to avoid potential risk.

Blew is the top 10 most complained Forex Brokers in January released by WikiFX to provide valuable reference for investor

Top 10 most complained Forex Brokers in January :

Edward

Ingot

GSG

PTFX

SGFX

PROFIT

Capstone

HXPM

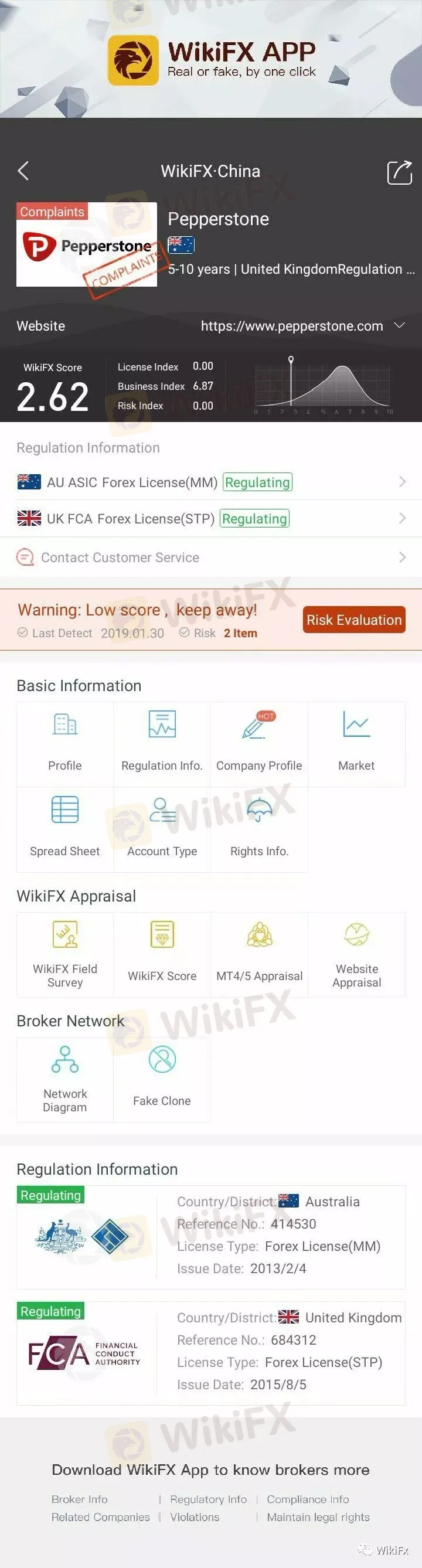

Pepperstone

GCM

Warning !

It is worth-noticing that Pepperstone was listed again this month. With risk controlling index 0.00, Pepperstonewas complained recently by lots of investors. Therefore, investors are strongly suggested to be alert to this.

Screenshot of Pepperstone interface from WikiFX

From the chart this month, Edward and Ingot has stopped business in China. WikiFX reminds investors to protect their rights promptly to avoid further loss caused.

Conclusion

Investors are strongly advised to be aware of suspected brokers with complaints in addition to check WikiFX APP regularly to avoid potential risk. And WikiFX hopes that the brokers listed this month can deal with their complaints positively.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

What Will EU Lose After Brexit?

Britain has officially left the European Union on January 31st , 2020, and will soon start negotiations with the European Union regarding bilateral relations in the future. It is believed that Brexit will cause negative impacts on the European Union in multiple aspects.

AUD’s Trend Is Affected by Macro Economy

Latest statistics show Australia’s annualized CPI from Q4, 2019 to be 1.8%, lower than the central bank’s 2%-3% long term target range, which the inflation fails to reach ever since 2017.

What Do the Economic Indicators Say About GBP

British general election at the end of 2019 was conducted against a sluggish economy. Latest statistics show that Britain’s economy growth is stagnant and the once strong labor market has weakened. In the first half of 2020, the pound will need to navigate through the domestic economy, central bank policies and the crucial March budget. In addition, the Brexit negotiation is still in its preliminary stage, whether a free trade agreement can be successfully concluded will also be critical.

CAD Will Have Less Upward Momentum in the New Year

As the G10 currency that performed the best in 2019, Canadian dollar may see a rather smooth horizontal trend this year partly because weakening domestic economy, and partly because the positive influence of easing trade tensions has been fading. CAD rose 5% against the USD in 2019, with nearly half of the increase gained in the last few weeks, benefiting as several other currencies from a reduce of risk factors at the end of 2019.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator