简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/SEK May Dip on Swedens Trade Data, US-China Talks, EU Peril

Abstract:The Swedish Krona may fall on January 28 as Sweden prepares to release its Trade Balance. Slower growth in the European region may continue to

SEK TALKING POINTS - SWEDEN, TRADE BALANCE, TRADE WARS

The Swedish Krona may fall on Swedens Trade Balance report

Slower domestic growth suggests it will continue broad decline

Political, economic turmoil in EU may weigh on economic data

See our free guide to learn how to use economic news in your trading strategy!

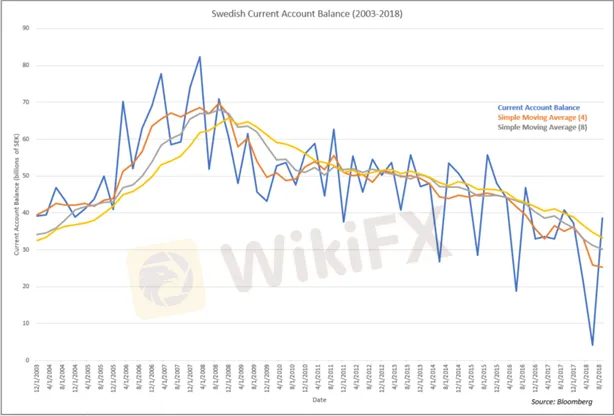

The Swedish Krona may have a small dip on January 28 as Sweden‘s Trade Balance is scheduled to be released at 08:30 GMT. For over a decade now, the Nordic country’s current account balance has been falling since approximately 2007. Despite the brief uptick October, it is not likely the data will significantly improve in 2019.

Growth in Sweden is expected to slow this year as outlined in the Riksbanks December meeting minutes. Policymakers are keeping their eye out for key domestic concerns such as high household indebtedness. The political uncertainty in Sweden is also still worrisome. They will also be closely monitoring political international economic and political forces that may influence the Swedish economy.

Some of these external risks include political turmoil in the EU with Brexit and the Italian budget crisis along with concerns of an economic slowdown. The influence of European events on the Swedish Krona is primarily attributed to the relationship the EU has with its Nordic counterparts.

As an export-driven economy, SEK is also vulnerable to trade wars and protectionism like what was seen in 2018 and may see in 2019. On that front, Chinese Vice Premier Liu He will be visiting the White House this week to further facilitate trade negotiations and attempt to reach a deal before the deadline on March 1.

The Swedish Krona in the meantime may continue its downward movement against the US Dollar. USD/SEK had a major jump last week and burst through 9.0032. Given the potential 2019 headwinds, the pair might continue to trade above this point and the key resistance at 9.0086.

USD/SEK Daily Chart

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator