简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Global Growth May Be Cooling, But Bulls Remain | Podcast

Abstract:Despite a slew of worrisome headlines to close out 2018, 2019 has come into view with a decelerating growth story that hasnt worried bulls all

Global Macro Podcast Key Takeaways:

The spread between Chinese & US Yields highlights lack of a credit-induced credit crisis

Restrained crude production from global producers supports the oil market

European growth has decelerated faster that other developed economies taking EUR lower

AUD, NZD options data shows that weakness may remain against stronger currencies like GBP

If you want more, check out the DailyFX Podcast

What a difference a month makes. It's not that the growth picture has gotten much better (it has not, despite crude up nearly 19% YTD or all major global equity indices in the green YTD, but the fear has certainly been taken out of the market.

Many of the rallies in equities that we've seen have had aggressive breadth where more than 90% of SPX500 stocks were higher on the session of December 26th and last Friday, January 18th.

In a phrase, we've seen bouts of panic buying while the volatility index or VIX has fallen toward higher support of 15.

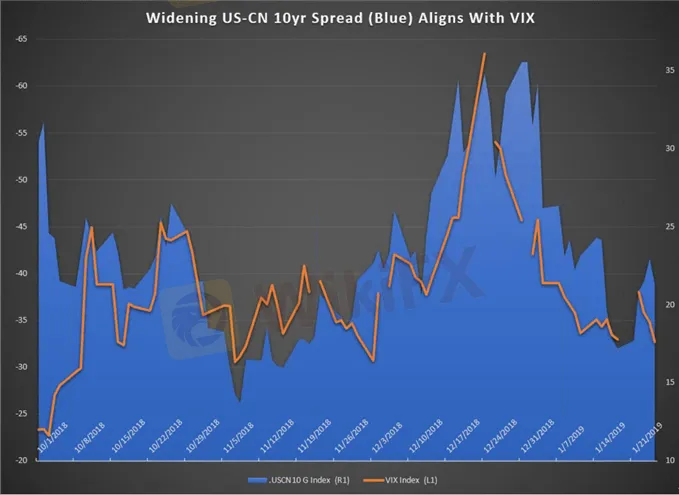

US & Chinese Yields Shed Insight on Lack of Concern of a Sovereign Credit Crisis

Source: Bloomberg

Whats going on with US & Chinese Yields?

The Chinese 10-year sovereign bond and the US spread have been narrowing. As illustrated in the graph above, the CN yield is moving towards 3% reducing the spread between US-CN spreads indicating capital inflow to Chinese bonds and less stress in the market. Stress in the market is often seen via the Volatility Index or VIX, which is overlaid on the spread of the US-CN sovereign bonds.

What does this mean?

In an emerging market, a lower yield is a positive sign, as it signals capital inflow. Such a development with a falling VIX aligning with the narrowing yield helps show that risk sentiment is improving. Investors in developed countries tend to look for investments that provide a higher yield, but this is not the case for developing or emerging countries. Lower yields in emerging markets indicate less need for concern, which is why the premium on the yield is lower.

A narrowing spread allows investors to feel more confident and less fearful about investing, thus creating more capital inflow from foreign investors. This theory is supported by the graph above as the VIX is moving in the same direction as the 10-year Chinese Sovereign bond yield indicating that lower volatility results in lower yields. This in turn suggests more stability and an inviting market.

Restrained Crude Production from Global Producers Supports Oil Price

Data Source: Bloomberg, OPEC

Whats going on with crude oil and crude oil global supply?

Crude oil prices have been at their best since 2011 with an increase by 19% year to date and with a plan to increase production cuts from OPEC and Canada. The cuts are due to the oversupply and motivation to further increase prices.

This could all change now that Venezuela has elected their new president potentially causing disruption if the country decides to increase production and revert prices down. The recent rise in US crude oil inventories to 7.97 million barrels suggests that growth is cooling down. This is further evidenced by less energy demand, so traders may need to hold a bullish view as they continue seeing production cuts from Canada & OPEC.

European Growth Has Decelerated Faster That Other Developed Economies Taking EUR Lower

Volatility has remained in EUR crosses, and this week, the Euro hit a 2019 intraday low. Such a development supports weekly lower highs and a breakbelow the 100-moving average. Traders that have turned bullish on the GBP due to Brexit developments have turned to EUR/GBP, which has moved lower at the start of 2019.

What does this mean?

Europes economic instability has had a negative effect on its currency value. Investors are more cautious when investing in the European market. The ongoing protests in France and the slowdown in the production of German cars, to name a few, are factors that continue to scare off investors resulting in a potentially further depreciated Euro.

AUD, NZD Options Data Shows That Weakness May Remain Against Stronger Currencies Like GBP

Whats going on with AUD & NZD currencies?

There are concerns regarding the AUD and NZD as option premiums are paid to protect the currencies from weakening. The premiums occur when the option is “in-the-money”, meaning that there is a good chance that the two currencies will depreciate. The increase in net-long positions further supports the strong bearish bias and suggests that prices may continue to fall.

Bottom Line: Those who thought the global economy was going to fall off a cliff in late 2018 appear to have lost confidence of their views. A look across global assets from equities, to bonds, to commodities, and finally, to FX show many of the concerns that closed 2018 may have been overblown at least when viewed through the lens of current asset prices.

WANT MORE?

Sr. Analyst, Tyler Yell, CMT covers this indicator and more in the DailyFX podcast; Trading Global Markets Decoded that you can access here.

Written by Tyler Yell, CMT, Nancy Pakbaz, CFA

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

Forex Price Trend Prediction! | Come be a New Year Price Winner!

Forex Brokers vs. Crypto Exchanges: Which Is Safer for Traders?

XTB Secures UAE and Indonesia Licenses, Expands in 2025

In Bursa Malaysia: Local Institutions Sustain Buying Streak & New Subsector Classification

Currency Calculator