简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Venezuelan assets are rallying as the world's biggest economies recognize Juan Guaidó as the country's new president

Abstract:Investors have fresh hopes for Venezuela with key bonds rallying after the US announced it would recognise Juan Guaidó as the country's head of state.

Venezuela's credit markets are rallying after President Trump announced that he would recognise Juan Guaidó as the country's legitimate head of state. Guaidó's initial legislative challenge sent the country's bonds to a five month high which has been surpassed today. Venezuela's state-owned oil company Petroleos de Venezuela's bonds also rallied sharply. Investors appear to have fresh hopes for Venezuela with two of the country's key bonds rallying after the US and other countries announced they would recognise Juan Guaidó as the country's legitimate head of state. Eight days ago Venezuela's benchmark 2027 bond reached a five-month high at 28 cents on the dollar, but has now risen higher still to 31 cents on the dollar. Similarly, state-owned oil company Petroleos de Venezuela's bonds also rallied sharply to 20 cents on the dollar Wednesday, up from 17 cents a week ago. The country‘s bonds are nearly all in default as Venezuela’s hyperinflationary economy spirals downward. Investors have generally seen few opportunities for debt restructuring under the current administration given that Maduro's government is under US sanctions.The opposition-run congress declared incumbent President Nicolas Maduro a usurper last week, and the United States and numerous Latin American governments have called the legislature the country‘s only legitimate institution. Most Latin American countries have now backed Juan Guaidó as Venezuela's leader, as have the UK and European Union.Venezuela's economy has been tanking in recent months with GDP growth coming in at negative 17% for 2018 as the country's population struggles for basic necessities and many citizens forced to take drastic measures to survive. Maduro’s government and state-owned companies owe some $8 billion in unpaid interest and principal amid the collapse of the countrys once-wealthy socialist economy.However, improving commodity prices — oil in particular — could provide a boost to the country's economy given Venezuela's huge natural resource reserves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Foreign Institutions Step Up Holdings of China Government Bonds

Data shows foreign institutions increased holdings of China’s government bonds by 70,671 million yuan in April, raising their holdings of yuan bonds for the 17th consecutive month.

Fitch list of highest-risk energy bonds, risk of 'imminent default' - Business Insider

Nearly half of Fitch's "top bonds of concern" are oil and gas companies, which have been hammered by the collapse in demand for crude oil.

Trump retweets call to fire Fauci who said US response will cost lives - Business Insider

It's not clear whether it's more than a vague threat, but Trump has fired several prominent public servants over the last few weeks.

Bad news for Trump — 60% of Americans say the surging stock market doesn't affect them - Business Insider

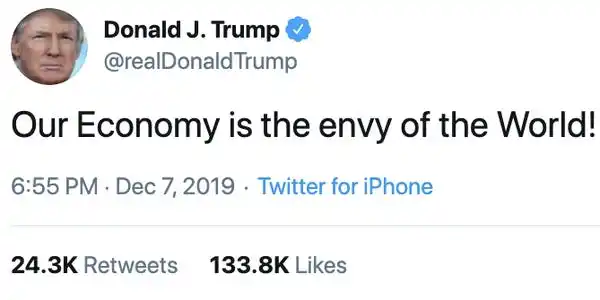

Only 40% of respondents in the Financial Times poll said that the stock market had gone up this year. The S&P 500 has soared about 26% in 2019.

WikiFX Broker

Latest News

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

How can the forex fix be manipulated?

CMC Markets and ASB Bank Form Strategic Partnership

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Currency Calculator